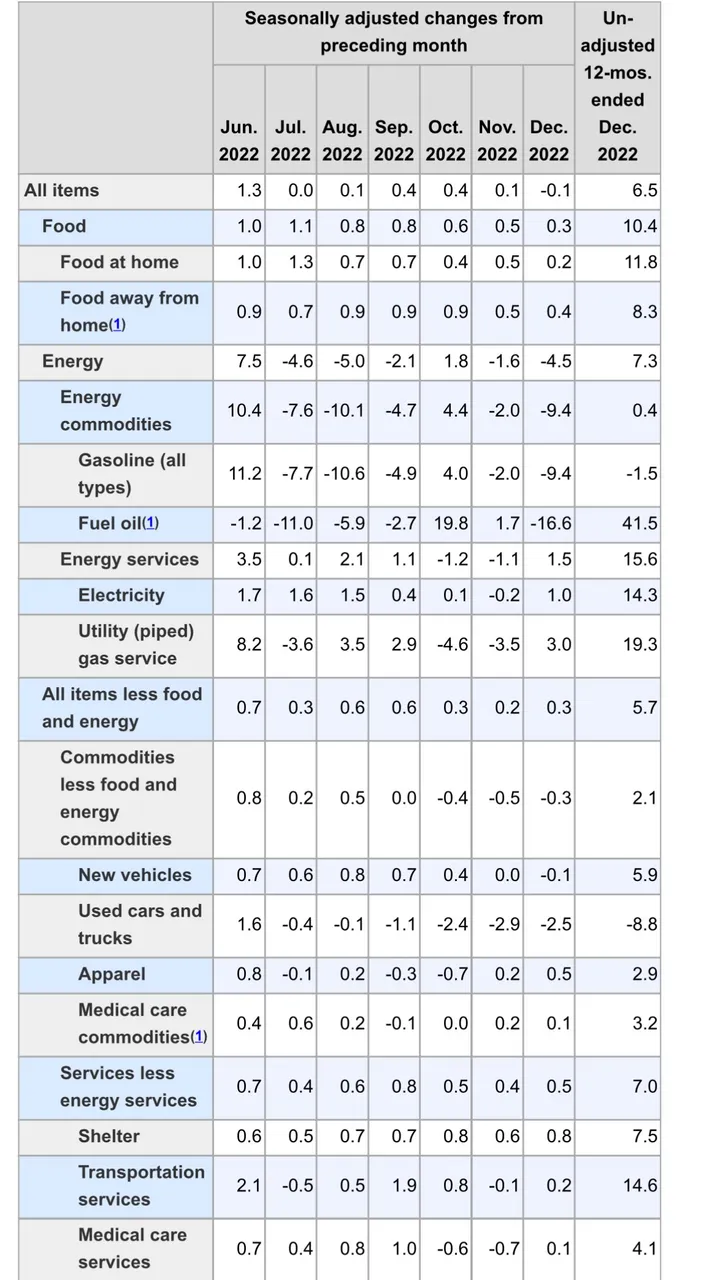

What a couple of days are we having, with the CPI coming in on expectations and showing us the inflation is coming down.

Now about the CPI report if we watch carefully we can see that the slowing came because there was a downward prices in energy

Fuel oil was down 16%

Gas was down 9.4%

Energy commodities down 9.4%

And if we watch the other metrics everything was up . Housing up , food up. Not a really health drop.

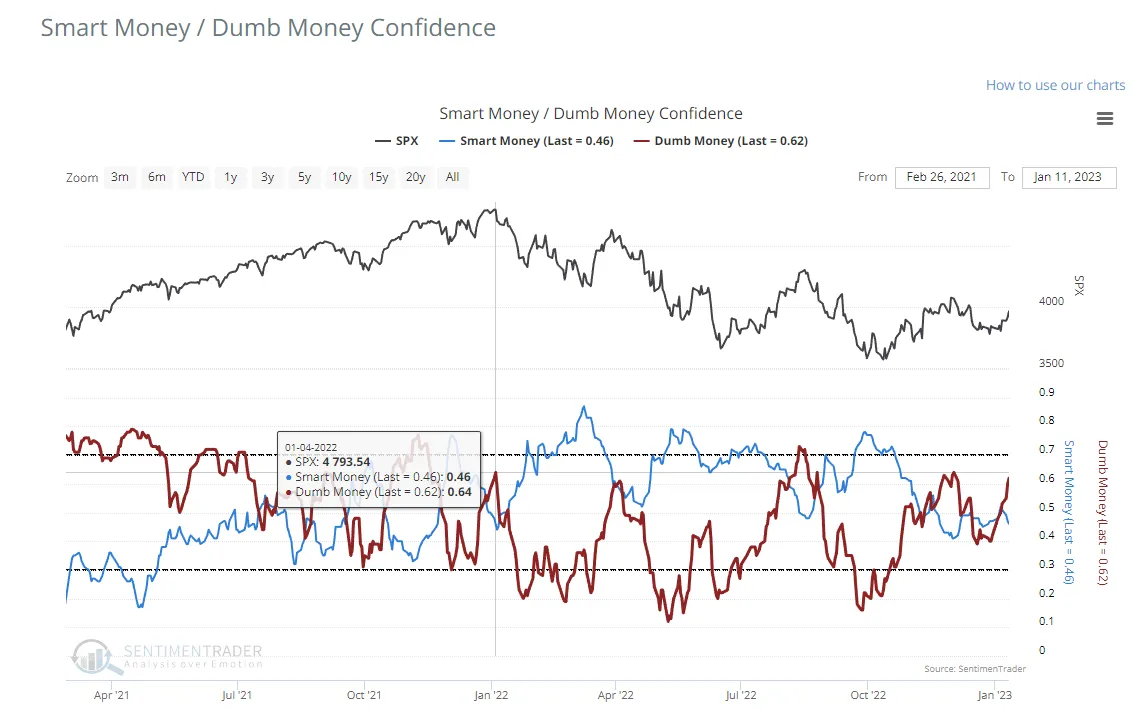

Euphoria is the dominant feeling in the market with expectations being that the next FOMC will increase the rates by 0.25. The prediction for 0.5 was 20% and now has fallen to 7%

Now when the energy and fuels are dropping like this That’s great but if that’s all the is dropping and at the same time USD also dropping the anything trading with the dollar will rise. That includes oil , wheat etc so when that rise gets printed in the next CPI report we will see an increase. So other things in the report has to come down , food is the priority.

One more indicator that I am closely watching the past year and a half is the smart vs dump money buys. Whales vs shrimps kind of thing. And we have reached levels that when reached we are seeing dumping

So until the macro data changes more favourably the this pump is probably unsustainable and will end eventually, I don’t think that the bull market is back.

But seeing that we are alive is a good feeling and eventually we will skyrocket again .

https://www.bls.gov/news.release/cpi.nr0.htm

What a nice photo they have in their Twitter

https://twitter.com/federalreserve?s=21&t=g7Ht9EKvFJhDufxzR9kNCQ