Hey guys

I recently watched a really well made video about the economy of Japan. In that video the creator is analysing how the Japan crisis in the 90s is similar to out own and that Japan is something of like seeing the economy in 10 years.

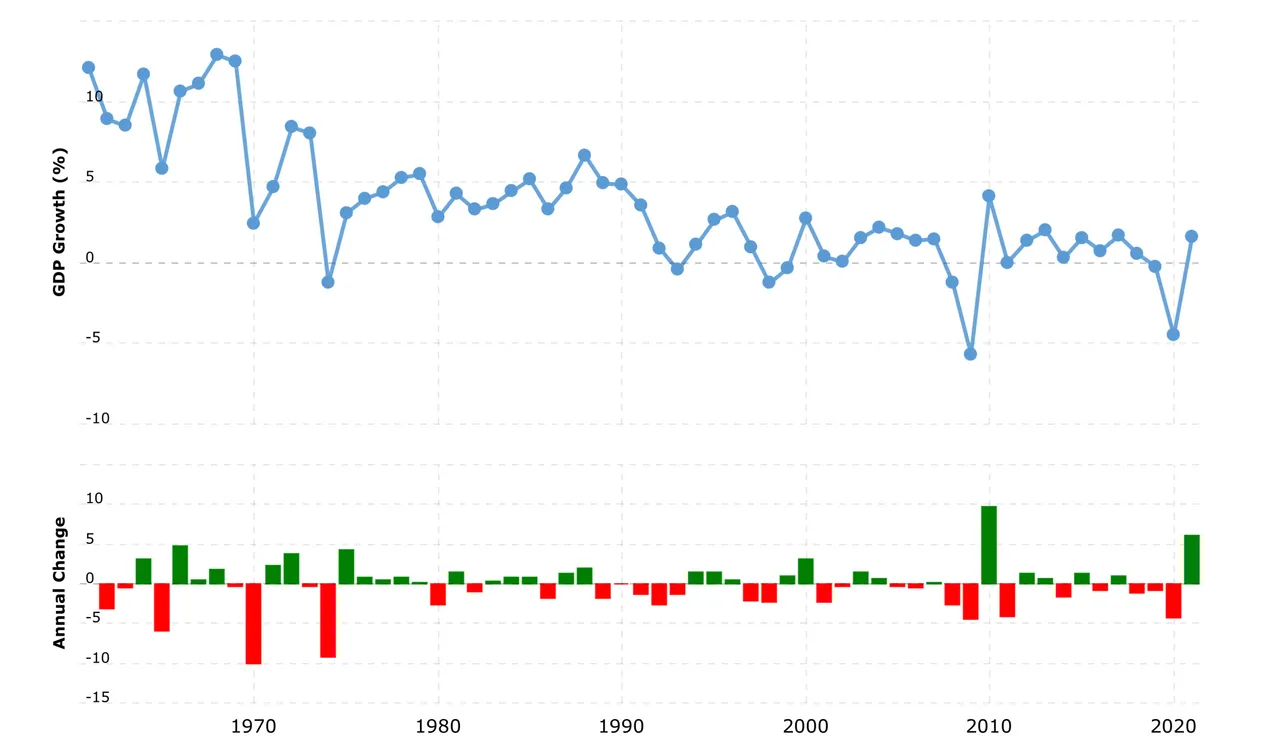

Japan is the the third largest economy in the worlds by GDP and once was in the way to surpass the US but for the last three decades it’s almost at a zero % growing

To try and combat this Japan took some of the most innovative and unheard at the time measures

- quantitative easing

- negative interest rates

- consistent deficit spending

We see this things for the last decade almost everywhere and the years since Covid we saw this measures used in an overwhelmingly high intensity.

Now all of the above measures after 30 years of implementation have worked in a different way or is that where we are headed too?

Japans central bank started buying everything it could government bonds , corporate bonds , stocks etc making it the biggest stock owner they did that because they wanted to put the money directly to the sellers to the government in order to build more roads , parks or more welfare programs , companies to invest in factories and job creating and to the consumers directly in order to spend more.

Well it did not worked 😂 as inflation wasn’t rising

So Japan is in a stagflation for almost 30 years. Maybe the reason why all of the above measures worked they way it did was because it became a regular thing and consumers had a lot of time to get prepared unlike us were we saw a stunning amount being printed in such a small amount of time. But maybe Japan is the country of the future and that is where we are headed ?

For more in-depth watch the video

And for those wanting a better understanding on the Japanese economy