The UK tax authorities, HM Revenue & Customs (HMRC), is closing the net on UK crypto investors and Airbnb hosts...

Coinbase customers targeted

HMRC has issued a formal demand for the personal details of registered customers of Coinbase who had transactions of more than £5,000 in the 2019/20 tax year. This carve-out for customers with transactions of less than £5,000 is a result of negotiations by Coinbase, as HMRC had originally requested details of all UK customers.

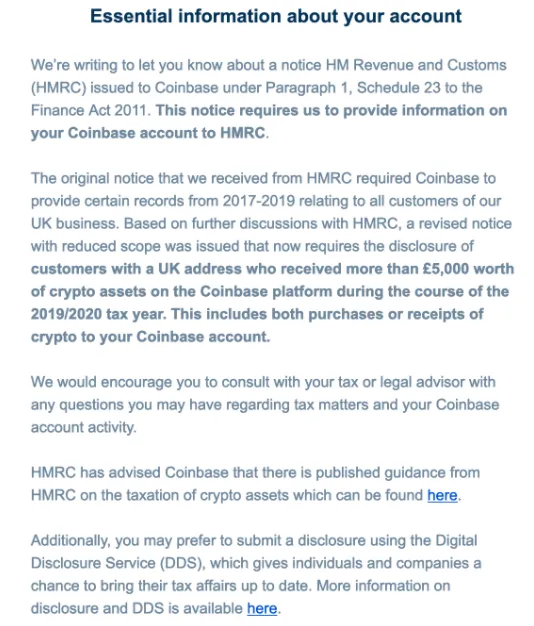

Those affected may have received an email from Coinbase as follows:

It is interesting that HMRC not only settled on a £5k limit but also, having requested details covering 2017-2019, that the tax year 2019/20 only (i.e. 6 April 2019 to 5 April 2020) was selected - as I suspect that many returns will show losses for this period, whereas the tax years 2017-18 might have shown a different and more profitable picture for some, following the end of 2017 bull market tops...

Regardless, HMRC can go back in time if they find that crypto taxes have been missed in earlier tax years so you need to make sure that everything is up-to-date for all years.

Tax returns for the year 2019/20 are not due until 31 January 2021 so many will yet to have prepared and filed for that year. This gives crypto-folk time to get things sorted and declared, as HMRC is clearly lying in wait.

Airbnb hosts targeted too

And this stealthy approach from HMRC is not limited to crypto investors, as news has recently emerged that they have successfully demanded details of the earnings of hosts via Airbnb too.

So Airbnb have been formally requested to hand over data related to those hosts (who let out property) via its UK platform in the years 2017/18 and 2018/19.

In certain specific circumstances, certain hosts/landlords might be protected by the 'Rent-A-Room' relief but there are certain conditions that must be satisfied for this relief to apply. Also, the £1,000 miscellaneous income relief might come to the rescue of some smaller-scale Airbnb hosts.

HMRC's enquiry window for the tax year 2018/19 is open until 31 Jan 2021 so there is time for them to challenge undisclosed rental earnings. They also have the power to go back in time.

If any of this applies, then you may need to seek professional advice (especiallly if you are a crypto-investing Airbnb host!), especially as the current global economic climate looks like it'll have little in the way of tolerance for unpaid dues...