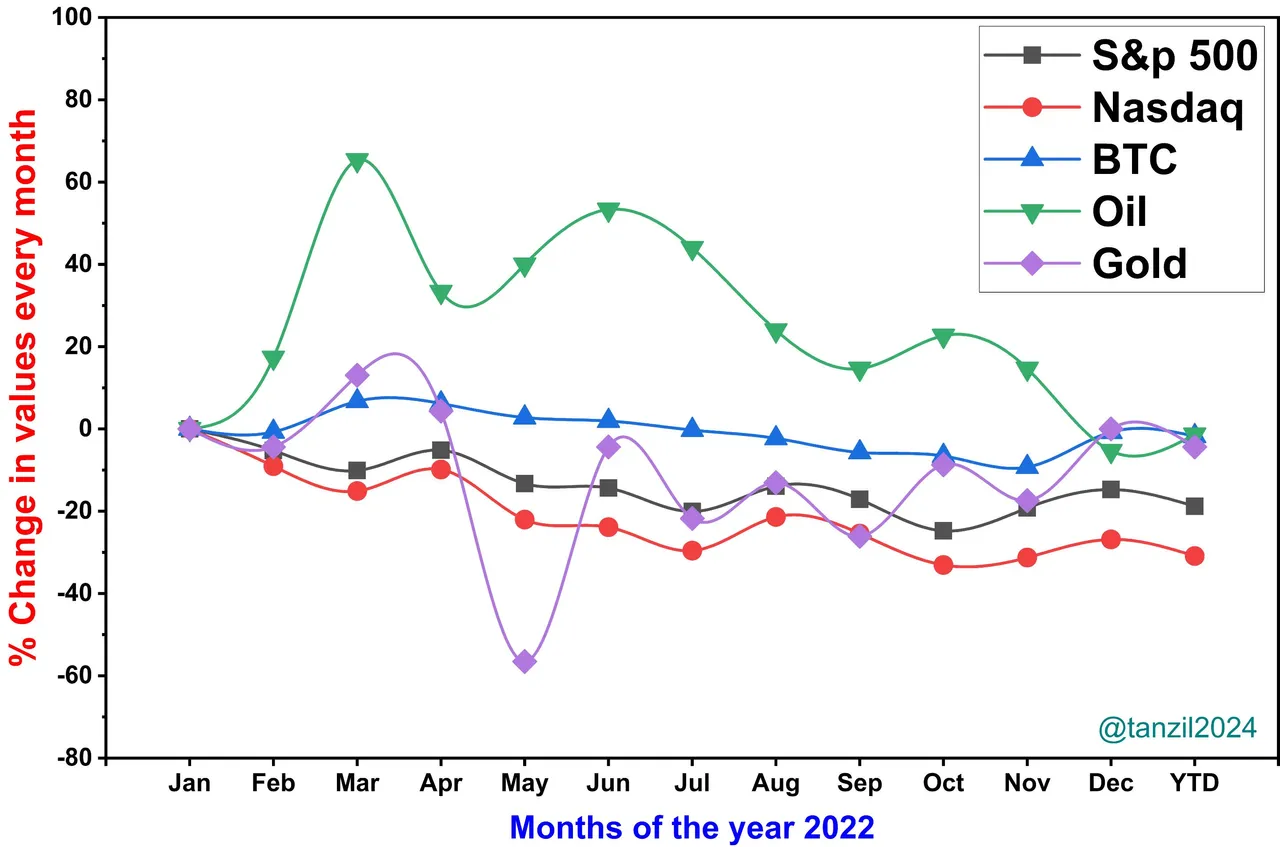

We are almost at the end of the year and now it's time to include our whole year's gains and losses to start a new plan for the upcoming year with a revised and more effective strategy to overcome the losses of the passing year. One of our main goals in life is economic freedom which is the top most important thing to make sure to be stable for the security of the future! Traditional assets like stocks and precious metals have been already leading the sector to store your assets which are the proven ones. And recent digital assets such as Bitcoins, and NFTs are gaining popularity though are stored in the blockchain and are often more convenient and more easier to transfer and get liquid cash instead of extreme volatility in the sector. Both sectors have ups and downs but 2022 was really a unique and difficult year for all kinds of assets and the market is still not recovered from the Global Covid-19 Pandemic and the Ukrainian War! Still, many nations are suffering from extreme inflation with the fear of an upcoming recession. Though the end of the year seems to be positive uncertainty is still dominating everywhere! What about the performance in the year 2022 by the top stocks S&P500, Nasdaq, top cryptocurrency BTC, top metal GOLD, and the driving liquid of the earth CRUDE OIL? Let's explore it.

From the graph, it is clear that OIL is the king in the year 2022 as it soared up to 70% increase in march and still is the top gainer among all of the assets. The record-breaking fall in Oil prices of 2021 has now filled up the losses and now it has gained its true position!

Bitcoin has proved its strength again as the most stable asset in 2022 though it has significantly lost its value from the all-time high of 2021 in 2022 it is performing well in the crypto winter which period is considered to be the dark moment of the cryptocurrencies!

Gold has seen an unusual drop in 2022 as being a stable asset throughout history but after the drop, it is consistently rising to gain its prior level in value.

Unfortunately, the stock's performances are affected bitterly as can be seen in the graph, both of these stocks are in a downtrend for the whole year. the Nasdaq has lost more in value which is still lower than the 20% level from the beginning of the year which is really a painful phenomenon for the shareholders!

The evolution of assets

A majority of investment plans are evolving based on the asset classes which continue to dominate the sector but how have these assets are being changed over time? And what kind of asset will look like going forward in the future? According to the concept, an asset is a resource of economic value that can be controlled by the owner of that asset. Though the traditional definition hasn’t been changed the ‘resource’ that constitutes an asset has changed greatly in recent years. Today, there are countless categories of assets such as gold which is an ancient asset; fiat currencies; some are very recently being rapidly adopted, such as NFTs and different cryptocurrencies. Traditional assets are the vast portion of currently stored value in the world. Gold, Silver are the most adopted ones in this category. Besides, there are more popular assets like Equities, bonds, property, foreign currency, and commodities that are still the dominant players in the area and are holding a significant store of value than other classes. This is because they are the safest houses with all requirements as highly regulated by the government and fixed procedures of exchange, ownership, and taxation.

In recent years, the concepts of an asset have evolved even further. Cryptocurrencies and digital assets like NFTs stored on blockchains are growing in popularity among the young generation. They are increasingly becoming a part of established portfolios, as well as attracting a new market of retail investors into the space as it is very easier to enter into this area and these assets offer some amazing facilities like easily transferable and security with anonymity! Though cryptocurrencies were considered a risky bet but increased regulatory scrutiny in established jurisdictions is being imposed by the government like in El Salvador, India, and many countries which lead to the flow of institutional capital moving into the sector. In the future, technological advancement will reform the sector without any doubt. No one thought a decade before that some lines of codes will be sold at a price as now the tokenized businesses are on the verge of the way to enter! Blockchain technology has changed the concept of the assets in the real world. The metaverse and augmented reality will bring more virtual assets which will be traded for value in the upcoming future.

Conclusion

The concept of asset is fixed at the storing value but the storing technology is evolving day by day with technological advancement and it will further bring the concept to a new horizon in coming years. This year was a tough year for all due to the Pandemic and the war which are diminishing day by day. Actually, it is very important to manage our funds accordingly as the collapse of LUNA and FTX has made a tremendous loss for thousands of people but we can learn and make ourselves aware of such things to avoid underlying risks.

It is very tough to predict the future but one thing can be concluded undoubtedly digital asset managements are easier and all the real values can be tokenized through blockchains under the supervision of the authority can be a company or the government. And thus digital assets will be more popular in the future!

What is your storing value for your asset management strategy, let us know in the comments. And thank you a lot for your time and attention in reading my post. I will catch you at the next.

Have a great weekend!