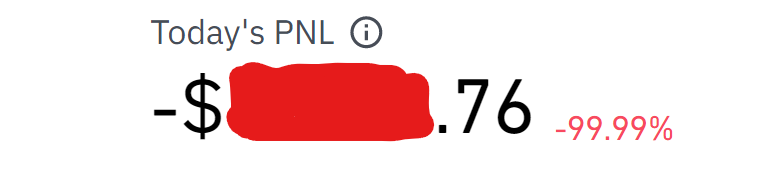

Binance has a handy profit and loss metric, here is mine for the last 24 hours:

That is not a good result and I feel like a fool. For the last few weeks while Bitcoin has been pumping and then the GameStop pump, I have read articles from the mass media and the constant warnings that said "you can lose everything" - I thought it was FUD. I should have listened.

But looking at that loss it is painfully obvious where all of my value went.

To the 0.01 percenters....

Ok, in reality, it is a glitch on Binance and it will be corrected soon enough. I don't care much about this metric overall, as what I focus on is my crypto holdings, not the equivalent in Fiat.

The other day, a friend at work was commenting on how he didn't get why people would put their money into Bitcoin or crypto, as it is nothing at all, just some zeroes and ones. Putting it in the bank is much safer as it is something real.

Fiat money is a currency established as money, often by government regulation, that does not have intrinsic value. Fiat money does not have use value, and has value only because a government maintains its value, or because parties engaging in exchange agree on its value.

wikipedia

Seems safe to me, no room for abuse in there.

It is interesting to listen to how confident some people are about their view on the world, without actually ever having thought much about it at all. Most of what we learn comes culturally and we never really review or question it, because it seems natural, because it is familiar. It is no different to being indoctrinated into a cult of some kinds from birth, where no matter how much of a mess it is, it feels normal. It is only when there is a wakeup call that there is the chance to have a slightly more objective look at what is actually going on.

What I think is slowly happening is that like the reading on my account, the 99.99% are starting to awaken and realize how heavily in the the red they are. Generation after generation is having their value bled out of them, to the benefit to the benefit of the 0.01%.

But it isn't their fault, it is ours.

We have created a system where money buys power and with that power it is possible to change the rules of the game. A company that reduces its tax burden through loopholes isn't doing anything wrong, they are playing the game as it has been designed. A billionaire who donates to political parties to get favors is playing the game too. This is a game that we support, because even though there are options, we stay dormant, so the transfer of value keeps happening.

In a comment I got the other day, someone said that people want to invest into LEO because it is profitable, they are thinking long term.

No, they are thinking mid-term, because they are looking at it from a profit perspective, meaning that they are actually looking to sell what they have and likely move into something else. Long-term thinking isn't selling, it is building conditions where value can be generated as an owner.

This is something that might be culturally learned as well, where people think that someone has "made it" when they are rich, but I think someone has made it when what they have created is able to keep generating value indefinitely. Yet, we are very quick to sellout, given the opportunity.

I wonder how many offers Bezos turned down for ownership of Amazon over the years. What would have been a fair price - A million, a hundred million, a billion? I wonder at what point he would have sold in 2000, or 2008. However, selling is far easier than taking the risks of the markets and facing ruin. Most people take the bird in the hand approach to life - sell now, as tomorrow the opportunity might be gone.

But, for those interested in building over profit, it isn't a good enough deal to take market value while in the build phase, especially if one believes in the product. For most of the real builders, they have taken many risks to get to where they are, sometimes it is close to all or nothing to make it through, to cover debts. Yet, they roll the dice. Why?

It is hard to say for each individual, but I think it comes down to personal hierarchy of what is considered important. Yes, I am sure they enjoy making the money, but that tends to be a buy product or tool for their real purpose, whether it be a love of competition, the desire for status or, the belief that what they offer the world is valuable and too valuable to sell away and entrust to others. There are likely many reasons, but it seems that the money itself is not one of them, otherwise they would be hoarding all of that beautiful fiat that they make... but they don't.

I think that the media has positioned the "rich", poorly in the psyche of the masses, as they talk about wealth from the perspective of money. A few days ago, Elon Musk and Jeff Bezos were dueling it out for the title of richest in the world, each with around 182 billion dollars to their name...

No.

Neither of them have anywhere near that amount, what they have is wealth, the ownership of products currently worth 182 billion dollars, with most coming in the form of shares. If either of them needed that 182B today, they couldn't get it and even if they tried to sell their stocks, they would collapse the value of their own stock heavily - as they are the largest fish in the pool and when whales dump, everyone gets dumped.

While this seems obvious to most, what many do not consider is that the wealth they have is not in dollars at all, it is in what they own and what maintains that wealth is their ability to keep what they own generating value. Bezos with Amazon keeps building market share and reducing costs anyway he can, Musk keeps building innovative products and being a cheeky bugger on Twitter to keep the hype rolling. But, they have to deliver - because when they don't, the sentiment in the market turns against them and they can lose their value quickly.

Though, neither of them will ever go hungry, because they own more than stock. They have diversified their portfolios in the same way that the profits a bank makes from selling access to customer funds and charging for the privilege, get used to invest into other profit making ventures.

Think about that scam for a minute - give the bank money, they make money off that money and use that money to buy for example into a business, then convince you to use more of your money to invest into the business that they have just taken some ownership of, charging fees for the management, as well as taking the benefits of having value stack on top of their own. Before it winds down, they will be able to exit their ownership, while leaving you to hold the bag.

But, what it is all about is ownership. It doesn't really matter what is owned, as long as it either maintains value and grows at or higher than the real rates of inflation, or will grow as an investment that generates an increasing amount of wealth, like the ground floor of a successful startup. A bank doesn't invest any money with the intention to lose it, and it invests everything it can, with far better data than most other investors, because they give loans to people who don't have money and know what that money is going to purchase.

I wonder, when they were lending the money to buy the houses that led to the global financial crisis, how much did they have invested into the goods and service industries that went into the building and maintenance of the houses. I would be very surprised if they were only planning on getting the stream of value from the loans themselves.

because we have been programmed into believing that wealth means money, we tend to give up the potential of our value in order to chase and even hold fiat. Not only this, while the investment firms are investing 100% of what they can into what they believe will make money, we are encouraged to spend as much as we can on goods and services (that they have invested into) that only lose money.

You want to buy the latest iPhone on Amazon?

Largest Amazon Shareholders

Humans:

Jeff Bezos - 55.5 million shares, representing 11.1%

Andrew Jassy - 94,797 shares of the company, representing 0.02%

Jeffery Blackburn - 48,967 shares of Amazon, representing0.01%

Institutions:

Advisor Group - owns 35.4 million shares of Amazon stock, representing 7.1%

Vanguard Group - owns 33.0 million shares of Amazon, representing 6.6%

BlackRock Inc. - owns 27.0 million shares of Amazon, representing 5.4%

Largest Apple Shareholders

Humans:

Arthur Levinson - 1,13M shares of Apple stock, representing 0.03%

Tim Cook - 847,969 shares of Apple stock, representing 0.02%

Al Gore - 113,585 shares of Apple stock, representing less than 0.01%

Institutions:

Vanguard Group - owns 336.7 million shares of Apple, representing 7.8%

BlackRock - owns 274.7 million shares of Apple, representing 6.3%

Berkshire Hathaway - owns 245.2 million shares of Apple, representing 5.7%

Who are you really buying from?

This is the value of ownership, this is looking long-term on investing. While we are thinking about profits so that we can buy a better life, they are building empires that will extract value from all of the sources we consume from and they know where that is, because they track everything we do -

Largest Facebook Shareholders

Mark Zuckerberg - 400M shares (about 57% of the total)

Vanguard Group Inc - 184M shares (about 25% of the total)

BlackRock Inc - 158M shares (about 20% of the total)

Largest Alphabet (Google) Shareholders

Larry Page - 40M

Sergey Brin - 39M

Vanguard Group, Inc. - 22.6M

BlackRock, Inc. - 20M

Do you understand yet? Is it starting to click?

It doesn't matter where you consume from, it is going to benefit a very small handful of companies that are going to use every bit of the enormous volume of data to which they have access, to extract all they can and then use that extracted resource to broaden and deepen their ownership reach. They aren't in it to find an exit, they are in it to have conduits of value extraction pouring through, endlessly. There is no beating them at this game.

The game has to change and the only way to do so is,

to own what we create to replace what we use, but do not own.

I hope you are starting to understand what looking long means.

Taraz

[ Gen1: Hive ]