A week or two back whilst writing about interest rates and how much some people's loan repayments have changed, I was asked about my own, which is collared. A loan collar costs slightly more percentage-wise as the lower ceiling is above the current interest rate at time of taking the loan, but it put an upper ceiling on how high the reference rate can climb.

I was adamant that we would have a collar when we took the loan, something that some people laughed at, because "why pay more". My reasoning, which is sound, is that even the "more" was incredibly low, as interest rates were the lowest they had ever been - and that means, there really is only one way they can go. We took the loan just as Covid was becoming a thing at the start of 2020.

However...

Just after my stroke, we found out that the loans manager hadn't collared our loan after all and the interest rates were already starting to climb. We (my wife as I was out of it) had to fight hard to get them to reinstate the collar, but we had to pay a higher rate and reference, but it was still low. The benefit is, it started the 10 years again.

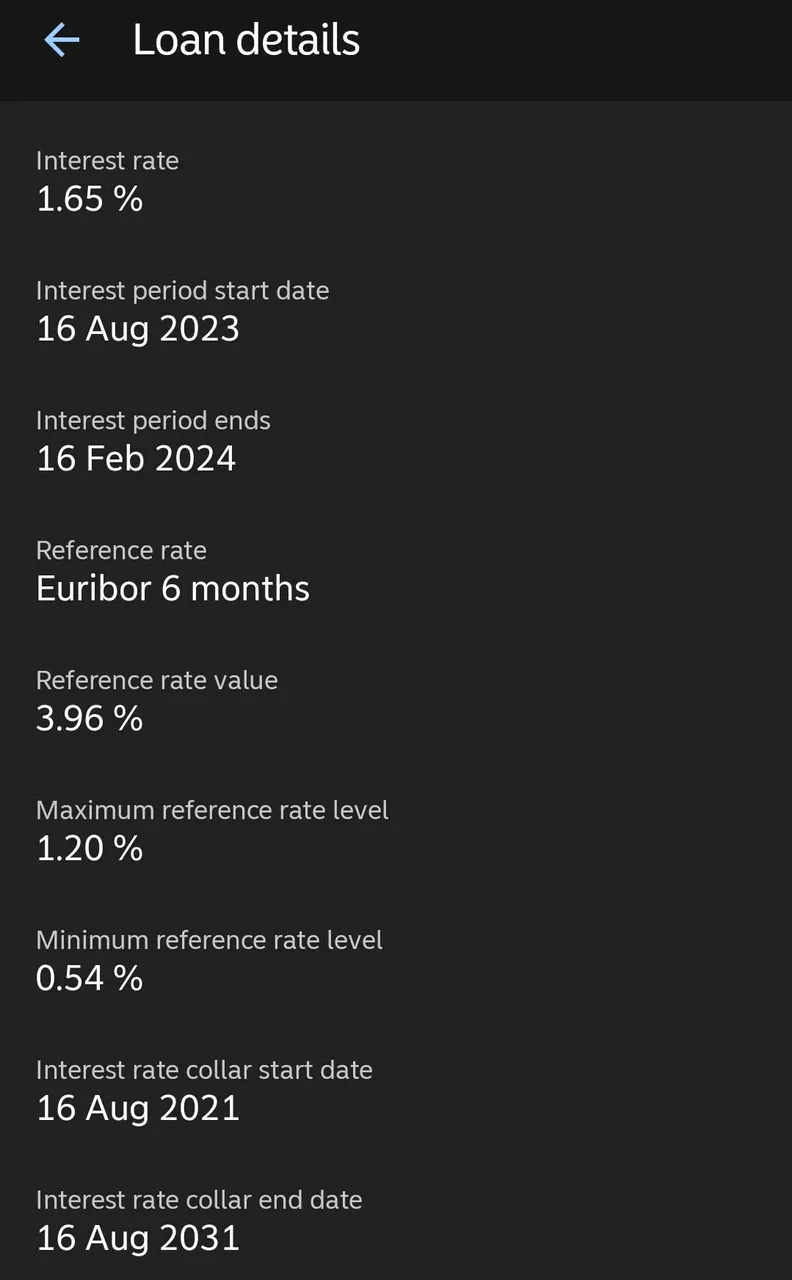

So far, our loan repayment looks like this:

Still a ways to go.

We had to have a deposit of course and this is actually only one of our loans, as the other is a much smaller renovation loan.

This is the basic loan terms, which I will explain below.

Interest Rate

The top number (1.65%) is what we are paying on our loan - which might make some people jealous, because it is very low considering the times.

Reference Rate

The "Euribor" is the basic rate of interest in lending between banks on the EU interbank market. This is used by banks for reference and it is calculated daily.

Reference Rate Value

The loan is using the "Euribor 6 months" value, which at the time of this invoice, was 3.96%.

Maximum Reference Rate Level

This is the most that the reference rate will ever be on the ten year collar.

Minimum Reference Rate Level

This is the lowest it can be. This is where you "pay more" for the collar, because when we took the loan, the reference rate was around 0.32%, so we were paying 0.54% instead.

And what isn't listed here is the margin the bank charges for the loan, which you can calculate very easily now, because we are paying the maximum 1.2% reference, so the margin is 0.45% for the total interest rate of 1.65%.

So what?

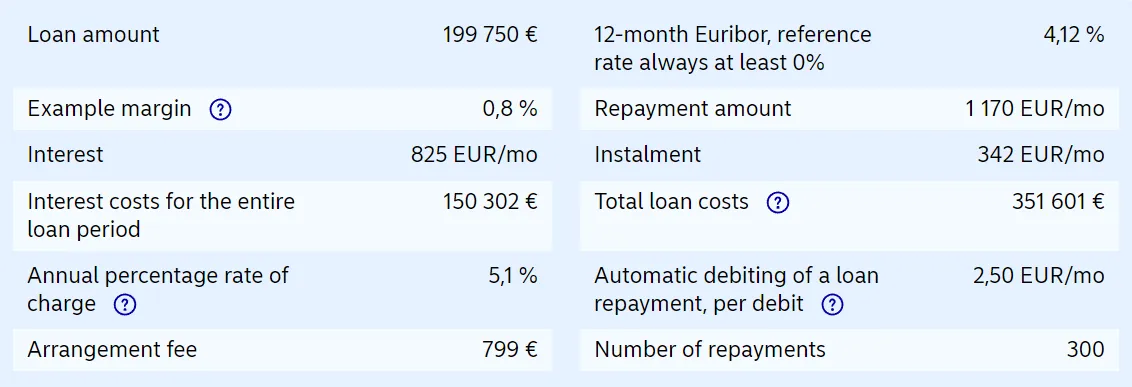

So, let's have a look at the impact that this makes using a loans calculator. Unfortunately, I can plug in all the numbers, so I will use a baseline one where the bank margin is 0.8% on top of the reference. I wanted to get an evenish number, but also had to factor in the deposit, so it is €199,750 loan. If this was a house, it would be a €235,000 home. The loan period is 25 years (300 payment periods) for all, so we can look at what kinds of differences this makes to the repayments and the interest portions.

The first one is their current calculation.

Interest Rate: 4.92%

So you can see that the monthly repayment amount is €1170, with 825 going toward paying the interest, 342 goes to bring down the principle - which means the interest payments are about 2.5 times the principle reduction. What you can also see is that the total cost of the loan is €351,000, meaning 150,000 is purely interest.

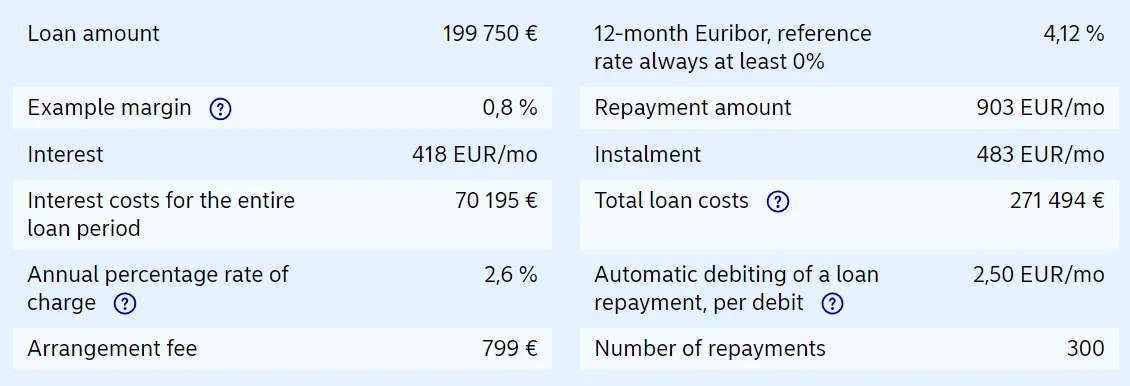

Let's half the rate.

Interest Rate: 2.5%

This would currently be an incredible loan deal to get, but it is impossible. Firstly, the 12 month Euribor reference rate is far higher than this, as it sits at 4.12 in the calculator. But, if someone was able to collar their loan at a 1.7% ceiling with the 0.8% margin, their monthly installments would decrease from the first example by €267. And, if you look at the installment and interest payments, a little more is coming off the principle than is being paid in interest.

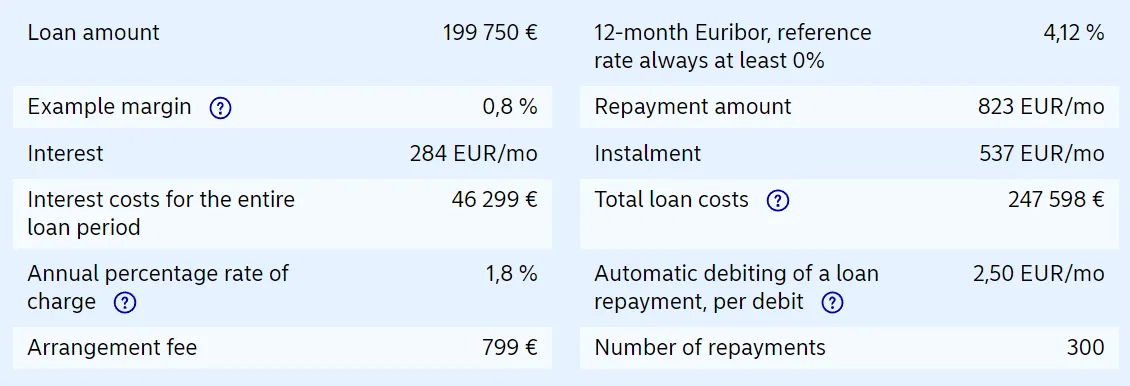

Interest Rate: 1.7%

This is around about where mine is currently.

There is quite a dramatic difference between this and the first example, isn't there? Or is there? Well, the repayments are only €347 less per month, but the total costs of the loan are less than a third of the price at 47,000, instead of 151,000. This means that after 25 years, the difference in total cost of the house is about €100,000 less. And the interest is half that of what is

coming off the principle.

And it is in here that lays opportunity.

For instance, that 100,000 difference in total cost could be used to regularly invest, top up superannuation and retirement funds, or perhaps go on a few holidays.

But, we have a collar until 2031 and no one knows what the interest rate will be at that time. If we do nothing and just pay the suggested monthly amount, the last 15 years of our loan will mean we are in the exact same position as people without the collar. Yes, we would have had an easier ten years, but when the collar expires, we might be in for some pain.

However, if we didn't have a collar we would be paying that top example, meaning €300 more a month out of our pocket now. But, any money extra we put in on top of the loan will have a larger affect on the principle in relation to all other loans, because the interest rate is set. For instance, if rather than paying 823 a month we paid 1000 a month, the extra 177 would come straight off the principle, because the interest is already covered.

This might not sound like a lot, but over the space of years, it will reduce the principle faster and therefore also reduce the interest rate accordingly. This means that keeping the same 1000 payments, bit by bit, the portion that goes to reducing the principle increases, as the interest repayment decreases. If significant reduction can be made, when the collar comes off and we are paying market rates, the principle we are paying it on, are significantly less.

And of course, in that time inflation is also going to happen and hopefully my salary will increase, so because we have the collar, we can "supercharge" our repayments on our home without having to actually pay that much more per month. And essentially, we should be able to pay up to what we would have to without the collar anyway, because if we can't we would have lost our home under the current conditions.

With the renovations over the last years and the challenges with health, my wife and I haven't been paying any extra into our loan, but this month we are going to start in earnest. My wife is unsure about this, because of the extra costs per month, but I believe she doesn't fully comprehend the impact in the future of paying a little more now. But similarly, most of my friends who thought me a fool for maying a little more each month, didn't comprehend the impact that raising interest rates would have on their monthly mortgage repayments either. The difference at the time was something like 17€ more a month in interest to have the collar. Money well spent.

People do not understand compound interest intuitively.

The global economy is a mess at the moment and I was reading how Finland is dragging well behind the curve in terms of wage increases in relation to inflation. This means that our salaries are worth less and less, so any way to overpower the value we do have, the better. What I have decided to do is that at least half of my bonus money (if I make bonus) will go into the house loan, and the other half will be used as a bonus, having a little fun and perhaps investing a percentage. These amounts aren't much, but if put into the right place, they can make a difference on our financial future.

Was this an interesting article?

Maybe my wife should have a read too :)

Taraz

[ Gen1: Hive ]