Oh look, the HBD Stabilizer initiative is working!

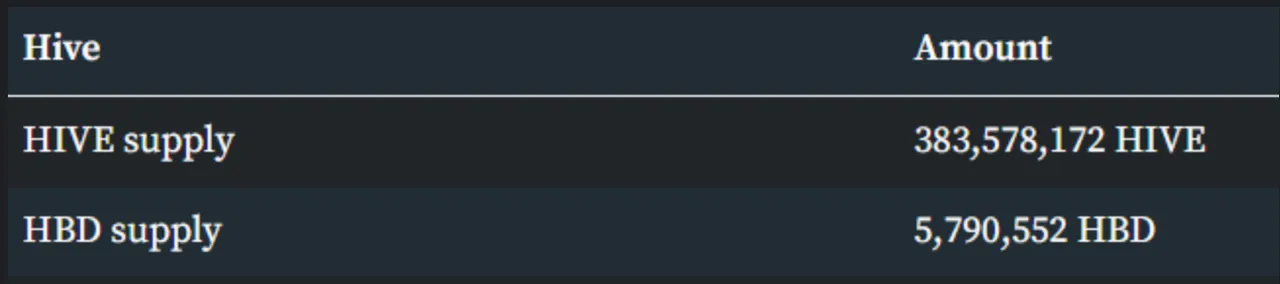

Well, I don't think that is the reason for the drop in HBD today of course, but it is likely having an effect on suppressing HBD price as in a little over 6 weeks, the supply of HBD has increased by four million, making it much less scarce. I think it will take some time for the speculators to realize what is going on however, so we should take advantage of it while we can.

Because the more important aspect (in my opinion) of this at the moment is that in those six weeks, the HIVE supply has reduced by 2.4 million Hive and has topped the DAO up by about the same I think. That is a pretty good result and if it keeps it up at this rate to the approximate hardfork date in a month from now, it will have removed around 1.5% of the total HIVE supply in three months, which is a massive amount of deflationary pressure that benefits everyone and, no HIVE was harmed in the process.

Come the hardfork, new mechanisms for stabilization will go into affect as well as a slew of other alterations to voting mechanics. I am hoping it will work and HBD will stabilize, which is why I have been selling any HBD I have for HIVE daily, as right now it is "overvalued" so I can get a bit more HIVE than I would otherwise. There are probably some people still holding HBD in the hope that it keeps getting pumped by Korean speculators also.

If the idea to add significant interest to the HBD savings wallet goes into affect, I think I will use some of the HIVE I have bought to buy back HBD and stake it into the wallet, but I am not sure about that yet, so will have to see how it plays out. It would be nice to earn some stable coin though.

I have been converting my yield gains into BNB mostly and along with the rest of the market, it has taken a massive dump. Today was the largest single monetary technical loss I have taken in my life. The amounts are eyewateringly large and the decline over the last days has been massive. While I do feel the nerves a little, it doesn't change much in me these days, other than me running through the woulda, coulda, shoulda options of it. But, I played a pretty good game and while down today on last week, I am up on 3 months ago and well up on a year ago. It is best to look long and not have a short memory.

So, instead of lamenting lost opportunity, I took the opportunity to get out of the dust for an hour and grab a coffee before I picked up my daughter. Being quite early, there weren't many people there, but look at them blissfully unaware of the crypto carnage that was taking place.

But they are likely no-coiners - so what they are also unaware of is the opportunity that was happening while they sit there and sip their café lattes. Bitcoin hit a low of around 30,000 and then bounced back to 40,000 a couple hours later. A no-coiner could have got in and turned around a 33% gain in that time, if they had been watching the market. How many were?

For me, I did what I could but had no stables without loss on it (in liquidity pools) and get paid tomorrow. At the end of the month, I don't have a lot of cash laying around available, especially with everything going on with the house. It is payday tomorrow though and we aren't out of the woods yet in terms of the downturn. We also have a long way to go for this bull year.

However, if this was the end, I am content to wait another three or four years for the next bite at the run apple, while participating for that time in the development that is to take place. There is a lot to come.

Now, you don't have to believe that any of the projects like Hive or Cub are going to last 10 years, but the thing is, the people who do have to act their belief in order to be true to themselves. If you want to build a business that lasts, you have to behave in a way that supports the business lasting - you have to be committed. In crypto, the supporters of projects are rarely committed for long and they definitely aren't loyal, but that can't be echoed by the founders. You want to build something great, you have to actually build it and that rarely happens fast, nor smoothly.

However, 5 or 10 years down the track, people look back and say it was inevitable, even though it wasn't and, they think it was easy for those who got in early, even though it wasn't. When people look back at the early adopters, they don't acknowledge the days and weeks like today, or the years of bear market. They don't see the stress or the loss - all they credit is the current value and when that value is high, they don't think about the road to get to that point, they just think of all the opportunity a person has with those resources now and often feel, that they themselves are entitled to some of it.

Pay it forward.

"Pay" is to give what is due for goods and services - it isn't charity.

Everyone wants the gains, but they don't want to have to do any of the work to have them, they don't want to commit, lock up their investment, endure the hard times and cutback in order to stay invested. Upside with no downside, ownership with no obligation. It is highly unlikely and even though there is risk and work and it is still uncertain, the people who will end up building value and sustainable business models, are those who are also willing to do what it takes for the opportunity, even if there is personal discomfort and cost.

When it comes to having skin in the game, there is more to it than money. There are up days and down days, green days and red. But at the end of the day, it is best to go to bed knowing that whatever kind of day it was today, tomorrow will bring new opportunities. Both gain and loss are always possible.

Taraz

[ Gen1: Hive ]