Over the last couple days, I have been asked a couple questions about ZING delegation APR (Annual Percentage Rate) fluctuations, as the percentage has changed significantly. This is affected by a couple things, so I thought I would clear it up (as best I can) for those who are delegating to @zingtoken, as I am.

Firstly, just a reminder that the percentage is going to change on a couple of metrics, which is how much of the delegation "pool" is held, the price of ZING and the price of HIVE, because that is what it is referenced against. The percentage of the pool with a lien on it changes as more people enter into the delegation, or remove their delegation.

So for instance, there are 200K ZING tokens issued per day to delegators. if a person owns 1% of the delegation pool, they will receive 2000 ZING per day. If there are only 2 delegators who each delegate 100 HIVE, they will each get 100K ZING. If another 2 delegators each add 100 HIVE, they will all get 50K ZING each. If then one delegator doubles their delegation to 200 HIVE, that person will own 2/5th of the reward pool, which is 40 percent and will therefore get 80,000 ZING, whilst the other three delegators will receive 1/5th share, 40K ZING each.

Now, the APR is also informed by the conversion value of that ZING. So the value of the delegation is based on the current blockchain price of HIVE (lets say 35 cents). So, 100 delegation is worth 35 dollars. If that is able to attract 100 ZING a day (as an example), then the value of ZING comes into play. Lets say that Zing is worth 1 cent, so 1 dollars a day. That means that all things remaining equal, the 35 dollar delegation will attract 365 dollars a year, which is an APR of about 1050%, as it is essentially 10.5 times the value of the delegation amount.

Which brings us to the price of ZING, which is a bit misleading on the website, because it references the price of ZING on Hive-Engine, the value of the last sale. This means that if someone sells a fraction of ZING at 20% below the last sale (assuming 1 cent), the total market cap of ZING will reduce by 20%, as if a large dump happened, even though it didn't. Similarly, if someone buys at a higher price, the entire market cap increases. This is one of the problems with not having a lot of "referencing" exchanges. Bitcoin for instance doesn't fluctuate like this, because there are so many trades across so many exchanges simultaneously stabilizing the price.

However, H-E isn't the only way to trade ZING, because there are also the swaps on TribalDex and BeeSwap, and because of the much deeper liquidity there, there isn't the same kind of fluctuations in the value. So, while the price of ZING on Hive-Engine has been fluctuating on small amounts where 1000 Zing = 27/30/33 HIVE tricking the market cap, on TribalDex, it has been a relatively stable 1000=35 HIVE.

What is the real market cap?

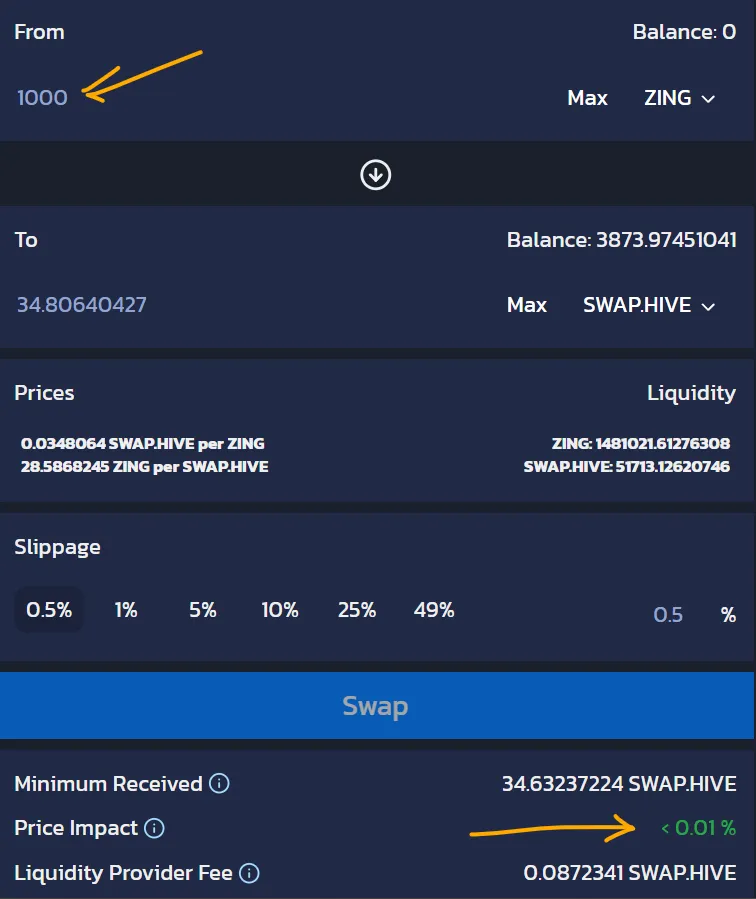

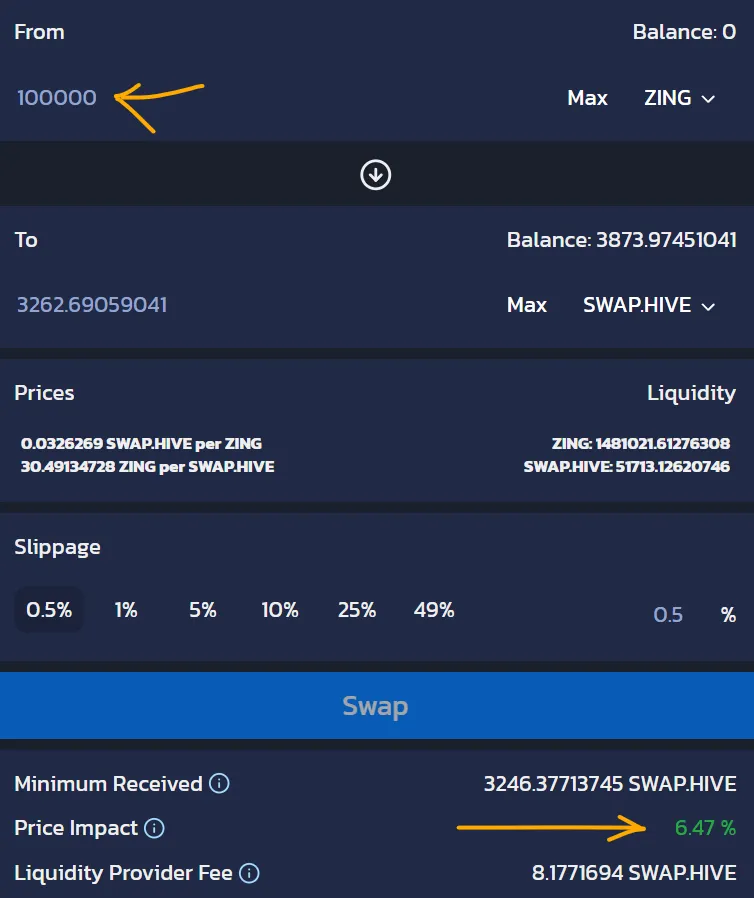

Last sale is not a good indicator, because it doesn't account for trade volume. The more liquidity in the pool however, the more stable it becomes, because larger trades have less of a price impact on the total value. To illustrate:

There is currently about $33,000 worth of liquidity in the pool. Swapping 1000 ZING makes almost zero impact on the value of the swap price, however, swapping 100K ZING will see the price of ZING drop by 6.5%. This is because it is a "ZING dump" effectively adding more ZING into the pool and taking out the equivalent value in SWAP.HIVE. 100K ZING is worth about 1300 dollars, so that comes out of the pool, reducing the "total value" of the pool by that amount. Remember that both sides of the pool have to balance, so once the SWAP.HIVE comes out, there is more ZING in the pool, less SWAPHIVE, some of the zing gets "converted" into HIVE to make it balance again at the lower total price.

Also, if you do the math, if someone was swapping 1000 ZING, they would get 34.80 SWAP.HIVE for it, but that doesn't add up if they were to swap 100K, as they will get 3246 SWAP.HIVE, 234 less that the 100* multiple. This is slippage, which is incurred when the trade makes a significant impact on the value of the pool. If the trade is too large, it won't be possible to swap, as it is impossible to swap for more than the pool is worth.

I am actually a little bit "worried" as the price of ZING has held up much longer than I had expected, which means my plan of buying back more cheaply, might go awry. The close it gets to release of packs and the game itself, the greater the risk gets that I will end up buying it bak at a premium. However, I have also been leaving some staked along the way, so I won't be left completely dry.

Hopefully though, this article will give people a little insight into some of the mechanisms in play that make up the value of ZING and possibilities to trade it. What isn't known is how development is going to progress, or if the tokenomics will change after the release of packs, or how excited people will get over the game, especially if it happens to coincide with a bullish crypto market. There are always risks involved with these things, so do your own research and own your decisions and consequences.

Taraz

[ Gen1: Hive ]