We all heard how Elon Musk seeks to make Twitter the "Everything App". He is seeking to expand the capabilities of this platform by venturing into different markets. It is no secret that Elon seeks to build the largest financial institution in the world.

While many will scoff at this notion, yet it overlooks how powerful fintech truly is. Applications were disrupting the banks for decades now. Wall Street has embraced technology. That said, there are many aspects, such as mortgage origination, that is now dominated by non-banks.

Basically, Elon grasps the merging of finance and social media. He seeks to put Twitter at the forefront of this. It mirrors a plan he outlined in the early PayPal days.

Web 3.0 comes at things from a different angle. With this new technology, there is the ability to expand into segments which were previously untapped.

Personally, it looks like Hive is at the center of this.

##Everything Protocol

Hive is the everything protocol.

This is an extension of the idea Musk is using. Here we see the difference from Web 2.0. In that arena, everything is siloed. Each platform is individual, tied to the corporate entity that owns it.

Web 3.0 is open. The base layer is permissionless, meaning nobody controls the data. Here we see decentralized databases forming that developer can access. The most basic feature is the account management system. Since each account comes with a wallet, this give one not only ownership over the account but also all assets.

It is easy to see Hive's social media offerings.

Here is a short list:

- Leothreads

- DBuzz

- Liketu

- Veews

- Medium Style blogging (peakd, hive.blog, ecency)

- 3Speak

Web 3.0 needs social media. Here is where Hive stands out. There is a simple reason why it is likely that Hive only expands the lead: transaction fees in social media are a non-starter.

In other words, any application that charges a transaction fee to engage in social media activities is not going to succeed. To provide this service, we are looking at a blockchain that has no direct fees.

This is what Hive provides.

Blockchain Is Financial

All blockchains have the financial aspect by default. This is, after all, distributed ledger technology (DLT) that is utilized. The ledger, i.e. accounting, of all transactions is housed on multiple servers around the world. What is important is whether those are uncorrelated or are they under the control of a single individual (or group)?

Elon wants to incorporate financial services into Twitter. This is something that could be done. To accomplish this, it will require licensing from different government entities along with likely buying out a few firms to get into the industry. To me, there is a clear path for him to achieve this end.

That said, make no mistake: Elon does not care about decentralization, Web 3.0, or regulation. He is all on on the present system.

That means, in my mind, Hive is the anti-thesis of Elon. We want to use him as a model for what is being built yet do so in a decentralized and distributed manner.

With Hive, no single application has to perform it all. This is where the protocols enter. Through the base layer, features can be accessed that enable developers to build upon. This gets expanded when sidechains are added such as what is being done with VSC and SpkNetwork.

From here, with smart contract capability, we are going to see the ability to start created diverse decentralized finance (DeFi) applications. This is the point that we can see finance on Hive being placed on steroids.

Largest Financial Institution

When trying to determine what this means, we can take a couple different approaches.

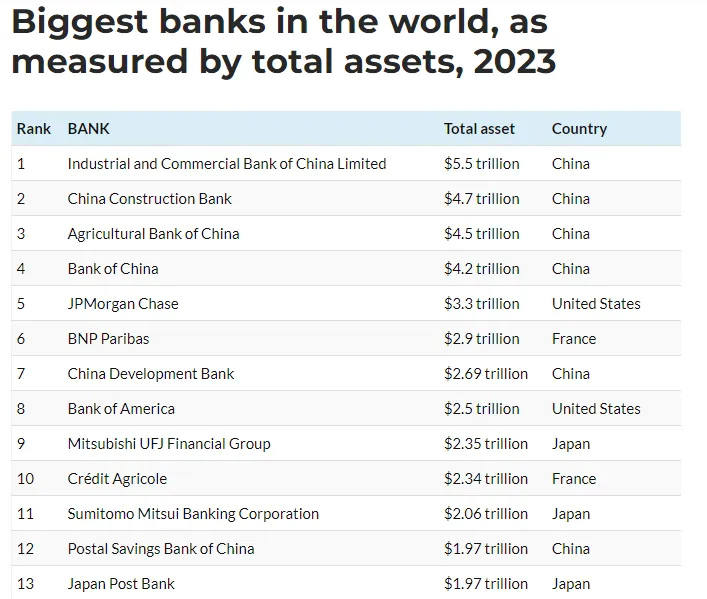

What is the largest financial institution in the world? This can be looked at either through market capitalization or assets. If we start with the latter, the list looks like this:

If we go by market capitalization, we get this:

Notice the difference between the two tables. One of the keys here is to understand the value of liquidity. Even though JPMorgan is 4th in total assets, it has the highest market cap. Much of this is due to the liquidity the comes with trading on American exchanges.

To achieve the goal of largest financial institution, we are looking at assets totaling trillions with a market cap into the hundreds of billions.

The point here is to emphasize the sheer magnitude of this market. When people say that Hive could not achieve a market cap of hundreds of billions, I simply shake my head. Look at the numbers. We are going to see quadrillions in tokenization. There is no reason why Hive will not have a piece of that.

Another key factor is no single project team or group is responsible for this. Since we are dealing with protocols, many developers can tap in and utilize the resources. This means a multitude of applications tied to smart contracts that can offer the full spectrum of financial services.

This is where things can grow at a rapid pace. Funding initiatives through value that is already present within the ecosystem means more aggressive advancement. It is an option once lending platforms are built.

These are just a few variables that we are dealing with. Reverting back to the main premise, much of this either starts, or is enhanced, by the social media features available on Hive. The merging of the two cannot be overlooked. This expands when we include the idea of gaming into the equation.

Hopefully we can see how this all can come together. The potential to build this is here. Not many blockchains are going to be able to offer serious social media solutions simply due to transactions fees.

Hive already has this solved.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z