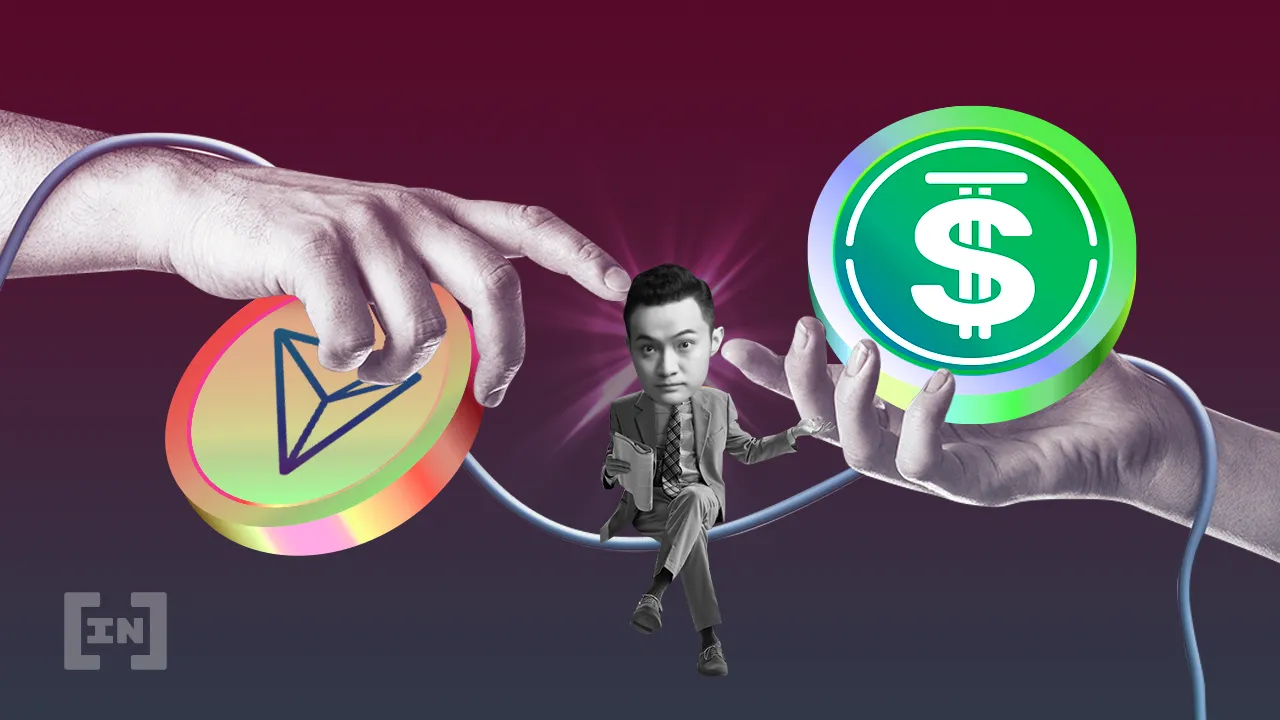

The headlines are screaming about USDD, the stablecoin Justin Sun built on Tron, losing its peg. This is not something that is suppose to happen. After all, according to the USDD website:

The USDD protocol aims to provide the blockchain industry with the most stable, decentralized, tamper-proof, and freeze-free stablecoin system, a perpetual system independent from any centralized entity.

Sadly, this seems to not be the case. Of course, it could only be a minor blip and, in fairness, there are only 725 million USDD circulating. When it comes to a currency, this is not nearly enough. There is going to be volatility, especially when the market cap is low. To contrast, there are roughly $2.5 trillion in USD banknotes, a number that does not include the "digital dollars".

Nevertheless, we know Justin Sun's tactic. He introduced USDD with many bold promises. Like most of cryptocurrency, little focus was given to what makes a currency viable and how to establish value.

In comparison, HBD is taking a different approach. While it is an algorithmic stablecoin, steps are being taken to expand the ecosystem surrounding it. If we are going to be legitimate player in this market, we have to pursue the path that ensures success. Trying to monkey with tokenomics or taking other shortcuts will not work.

Pegs Never Hold

This is a fact people are overlooking.

No matter what the asset, when it is pegged to something else, it will never hold. This is true in the currency markets as well. If we look at FOREX, we are continually seeing currencies move up and down against each other. Freely floating rates are a necessity for global activity. Hence, no matter what is done, a peg will break.

The result of this leads many to the idea of asset backing. This has some validity although there are challenges. It start with the fact that many assets that are held in reserve, are also freely floating. This means that they can gain or loss value. Volatility in an asset acting as a backing agent is not a good thing.

Another issue is all value is derived from the backing agent. While this is not the worst idea in the world, it does effectively make the stablecoin a derivative. Certainly, this is a starting point but few appear to be moving beyond this. Ultimately, this will end up with the asset being a cheap replica instead of an innovative currency that can used as part of new financial system.

Ironically, it is this situation that causes pegs to break. If attention is placed upon establishing the value of the currency itself, this would reduce volatility while enabling it to remain strong against other assets.

Instead, most opt for the path of least resistance.

HBD Will Be Valuable

What makes HBD different?

The answer to this question lies in the potential. At the moment, it suffers from the same issues as most other stablecoins. USDD has 750 million coins in circulation, HBD has less than 10 million. Hence, the idea of it being strong is nonsense at this point.

That said, there are things beginning to take place which are going to enhance the value of HBD itself. This has nothing to do with the banking agent, in this case $HIVE. Here is where there is a stark contrast to all other stablecoin projects.

HBD going to derive value as a standalone currency. The ability to convert it to the backing coin will be an added bonus. In fact, if done properly, this will be something very few consider.

At this point, we are treading upon topics that we discussed extensively. To reiterate them all here would not be prudent. However, for those who are unfamiliar with this subject, we will highlight a few important points.

For a currency to a force globally it requires:

- liquidity

- depth

- infrastructure

- sophistication

The magnitude of this is astronomical. When we consider the EURO, which is nothing more than a regional currency, it lags far behind the USD in all these areas. Certainly, the liquidity is far beyond anything in cryptocurrency yet, to be a major global player, it requires a lot more.

Another factor is use case. Most simply think in terms of being able to spend the currency but that is only the tip of the iceberg.

Basically a currency use cases need to include:

- payment system

- lending/collateralization

- funding and investment

- derivatives

These are some major areas to cover. The buildout required is monumental. It is why none of this happens very quickly.

Fortunately, there are some projects on Hive that are seeking to expand upon these ideas and indulge in the different areas. For now, infrastructure is the prime focus because nothing can really be built until that a foundation is laid.

Nevertheless, it is activity like this that will give HBD value over time.

Hive Is For Builders

When it comes to this subject, the peg is really not relevant in the long run. The key is whether the backing agent can produce what is promised. For this reason, Hive took steps to implement precautions to ensure HBD is redeemable for $1 worth of $HIVE.

An important point to note is that Hive is also doing things that others do not appear to be doing. Look at the two lists and tell me how many stablecoin projects are embarking in even two of these areas. Do you see Justin Sun working on the sophistication of the token he created? Is there any word of the robust financial system being constructed to provide value to it?

The answer is no. Instead, we hear about the reserves being used, the USD (and cash equivalents) being acquired, and how audits are needed.

Of course, it is easy to make the case this is a major advantage for Hive. Since nobody else is focusing upon this, by even excelling in a few different areas, HBD can stand out against all other stablecoins.

It is not enough to concentrate on one area. USDC is positioning itself as for payments. This is a good approach yet it going to reach a limit, especially if different networks create their own coins. This gives them little resiliency against other projects.

The key is to keep "layering" the coin with derivatives, providing different financial use cases. As this takes place, value is continually driven to the stablecoins since we end up with network effects that far outpace the ability to back.

Hive's conversion mechanism will remain in place. However, with the evolution of this system, we will see it becoming less important in terms of the value of HBD.

A robust economy that offers commercial and financial applications built around HBD will achieve this end. At that point, not only is the backing agent less relevant, but the peg is also. Suddenly, people are pricing things in HBD instead of the equivalent in USD.

Ironically, it is at that point, where the peg is of little concern, that it actually holds much better.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z