Bitcoin opened up a completely new world of finance for one simple reason. Instantly, the role of creating currency was opened up to anyone. Whereas it was almost exclusively in the hands of governments through central banks, with the introduction of Bitcoin, people realized others were able to the same thing.

Today, we see more than 6,000 tokens listed on data aggregation sites and the number is growing.

While decentralized, non-government controlled currencies are making new, this does not mean that governments are not going to get into the game. Obviously, we see a lot of discussion about CBDCs, which to many, is just another form of economic abyss.

However, if we drill down a bit further, we see how the creation of one's own currency can really enhance a local population. By moving further away from the centralized system, we can see added benefits.

The challenge with present stimulus is very little of it ends up in the hands of everyday people. Instead, the central banking system uses the commercial banks to distribute new money. This ends up enriching those very close to the central bank while the rest end up falling further behind.

Source

Direct stimulus has a much different impact. One Spanish community realized that and is taking measures. With economic calamity due to the COVID-19 lockdowns, this town is seeking to help jumpstart its economy.

The city council of Lebrija has created a virtual currency, elio, that can only be used for payments made to small and medium-sized businesses, according to a report by Diario de Sevilla.

Here we see the creation done at a level much further away from the central bank, in this case the ECB. It is not even the Spanish government doing it. Instead, we see a local city council adopting a virtual currency in an effort to stimulate things locally.

In the age of globalization, this is a radical shift in thinking.

One Elio is equivalent to one euro and almost 600 families will receive between €20 (US$24.50) and €200 ($244.96), which can only be spent in local businesses using an app.

Certainly, nobody is getting rich off these numbers. However, it could be enough to stimulate things locally while shifting enough demand to local businesses. In times like these, for many people, even a few thousand EUROS can make a difference.

It is vital to understand one of the basics of money: it is a tool for collaboration. The more money that is circulating, the more collaborating, i.e. economic activity, potentially takes place.

The problem is when money is distributed via debt and most of it does not get circulating in the economy. Then you get the reverse situation where less collaboration takes place.

In short, the economy gets squeezed as debt servicing takes on a much larger role. Also, we end up with a large portion of economic activity that is done by rent seekers, who extract from the overall pie.

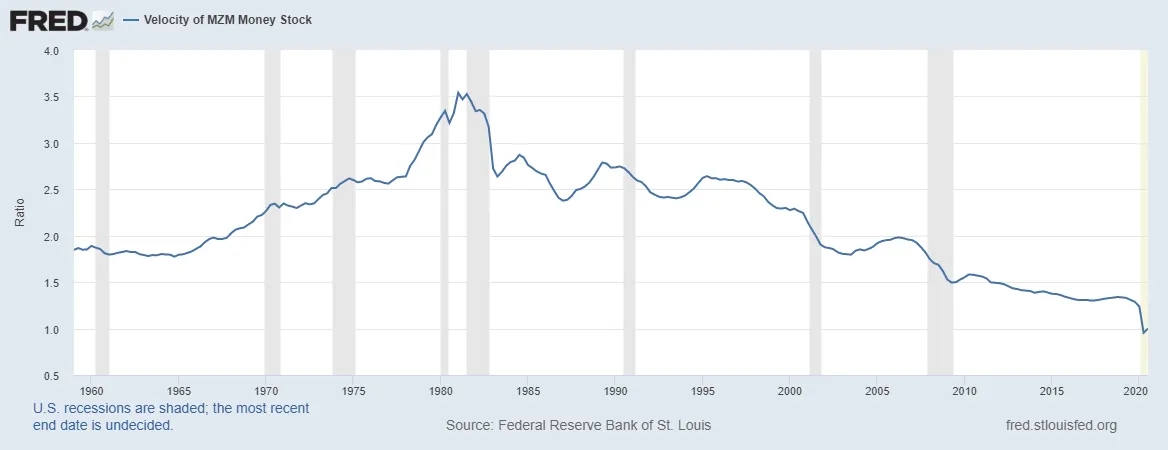

The last 40 years in the United States shows exactly how this played out. In the USD, the velocity of money has slowed to almost a dead stop. It is barely hanging above 1. The other major currencies are actually all reading below 1 on this scale.

This ultimately puts the long-term growth trend below the historical norm. It is another reason why we saw the global economy slowed even before COVID-19. Each passing decade leads to slowing economic activity as debt rises.

Once again, we see cryptocurrency as a way out of this. Have you ever noticed that when people talk about the insane values of Bitcoin, they never mention how it will lead to greater inflation? After all, if BTC hits a $10 trillion market cap, up from the present $500 billion, that is a lot of extra money floating around in the system.

How come the inflation hawks do not believe the same about Bitcoin? Of course, we would them likely see Ethereum worth a couple trillion. In fact, if we add in all the cryptocurrencies, we could see tens of trillions in money circulating.

The reason this is the case is two-fold. To start, money is distributed, for the most part, to individuals, not banks. Thus, all new money is a grassroots stimulus.

At the same time, cryptocurrency is issued without rent extractors tied to it. Since it is not debt when formed, there is no interest to pay back. This will allow an economy to flourish in spite of the increase that is on the market.

As a tool for collaboration, people can be incentivized to do many things. At present, it is mostly done in accordance to governance protocols or providing incentive to do an activity such as walked.

Nevertheless, we are going to see a time when tokens are used to incentivize the design of rockets or doing cancer research. We will see solar, wind, or geothermal systems established using cryptocurrency. Whatever is lacking, crypto will be the tool that can provide for it.

In the United States, it takes an act of Congress (literally) to get direct stimulus in people's hands. With a blockchain such as HIVE, just wait a few seconds and more is issued into the wallets of people. The same is true for many blockchains.

With the economic situation looking bleak for many, cryptocurrency is the shining knight that can save the day. The central bankers and politicians repeatedly proved how inept they are at providing solutions. In fact, a strong case could be made that they cause more damage then they solve.

With all the attention given to Bitcoin over the price run, it is actually the utility of cryptocurrency that is going to provide the foundation for the new financial system.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z