There is a lot of turmoil taking place in the world. Of course, it could be stated this was always the case. The difference with today is we are more aware of things due to instant communication. Whatever happens is posted on social media within a few minutes.

That said, regardless of what is (or projected) taking place, there is one underlying situation that is not going away. This is the pace of compute.

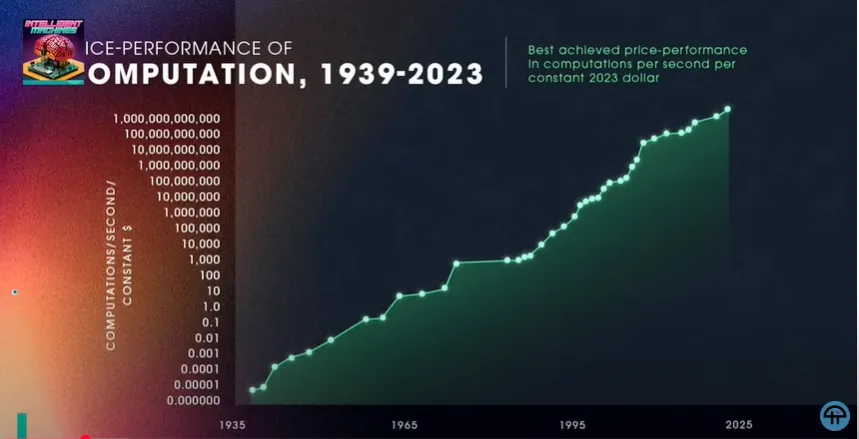

The following is a screenshot covering the cost of compute since 1939.

Since this chart is logarithmic, an flat, upward sloping (45 degree angle) is actually exponential growth. Based upon this, from 1939, we have see a quadrillion fold increase. This means, $1 today gets us a quadrillion more times the compute than it did in 1939.

There is another important factor. When it comes to software enhancement, we are looking at a million quadrillion increase.

In a world that is being driven even more by the digital realm, this is crucial. Each new generation means a radical jump in capabilities. That is why the language models of 4 years ago seem rather crappy compared to the ones we have now.

The industry is doing a remarkable job of keeping pace. Some question whether it can continue.

In this article we will show how it will and some of the implication.

You Have Roughly 5 Years Before The World Completely Changes

We discussed the potential ramifications to the economy on a number of occasions. Therefore, we will not touch upon that Instead, we will focus upon what one can do.

Before diving into that, we need to look at what is taking place. With compute, we have to go no further than Nvidia. This is one of the companies that is driving the entire industry.

Recently, the company started to roll out its Blackwell series of chips. There were some manufacturing hiccups, causing a delay in the scaling. In spite of that, the chips are being shipped to customers, with ramping continuing throughout 2025.

This line of semiconductors was far more advanced than the previous generation, Hopper. As more are put into service, we should see a significant impact.

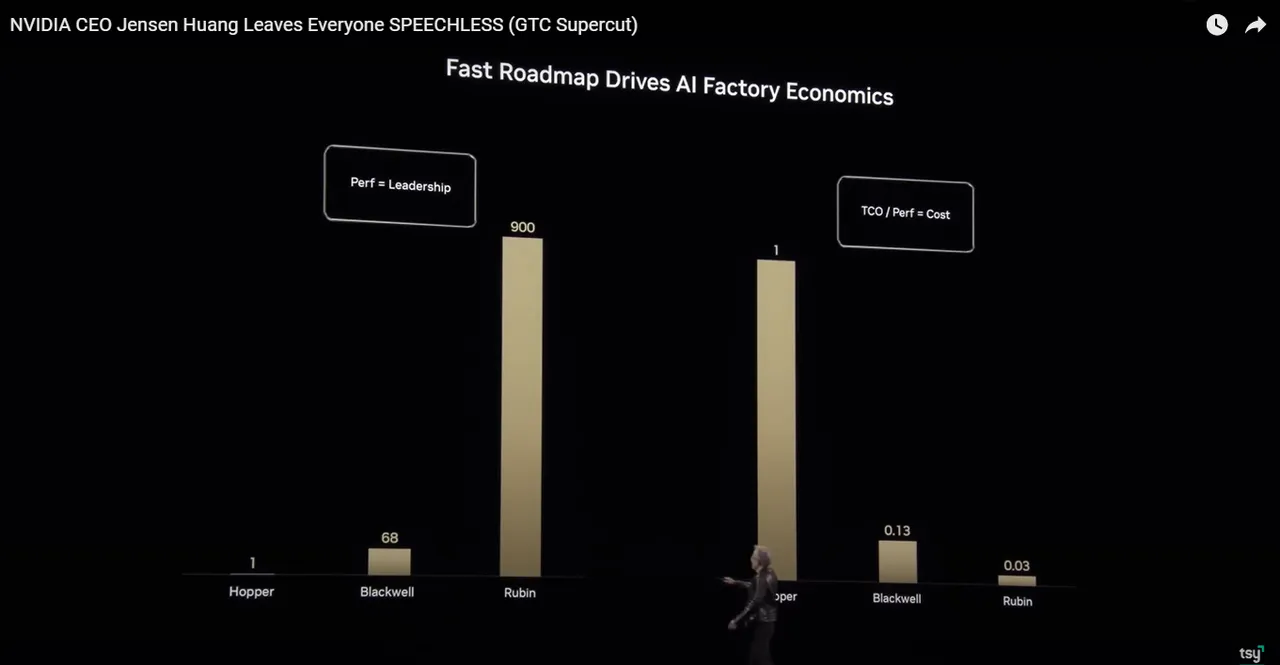

Jensen Huang, the CEO of Nvidia, recently gave a talk about what the company is doing. The next image is a screenshot from that presentation.

This explains why AI costs are dropping like a stone. According to this, it is only going to accelerate.

We will start with the left side, the bars associated with performance. These measure FLOPs. From the chart, Blackwell came in at an impressive 68x that of Hopper. This will be dwarfed with the introduction of Rubin, which is a 900x increase in performance over Hopper.

The right hand side shows the important lesson of technology: if it deflationary.

When we look at cost/performance, we see Blackwell coming in at 13 cents on the dollar. Rubin takes this even further, pushing the cost down to 3 cents. Keep in mind that Hopper was the only GPU available from Nvidia early last year.

It is likely we start to see Rubin start shipping at some point in 2027.

That means that, in roughly 4 years, 97% of the cost associated with AI computing will be eliminated. This is, naturally, only focusing upon the hardware side of the equation. Software engineers are busy gaining efficiency at the different levels of the stack, including bringing out robust algorithms.

As a comparison, this is like going from a golf cart to a Ferrari to one outfitted with a rocket engine.

So what does this all mean?

Capital Means Assets

The majority of the world is still focused upon income. We have generations of people looking for a paycheck.

We see this with our politicians and business news. Things such as unemployment statistics are used as a measure of the economy. Politicians discuss creating jobs in their areas. Individuals are looking for pay increases, with unions fighting for job security.

Once again, what is this, 1925? Does anyone in power realize the true impact of what we are talking about here?

A major talking point that should be taking place if the fact that labor is being replaced by capital. This is one of the fundamental economic changes we are facing. In the past, to increase output meant hiring more people. As we see here, this is no longer going to be the case.

With AI producing units of cognitive ability and robotics getting ready to attack physical labor, we can see how this could create a problem. Some have mentioned it in passing with few solutions. In fact, it really doesn't get much attention. The tendency is to deny it is even happening.

If we are rapidly heading to a world without labor (or substantially reduced), what does this mean for the average person. Here is where a basic flip in the old economic model is required.

As I read the situation, if capital is driving the ship, that is what is required. People will need to own assets. What these are is up to individuals but depending upon income flow from labor might be obsolete.

That means income will be based upon capital. How that looks is what many are speculating upon. However, crypto seems to hold, at least in part, a viable answer. We see a great deal of discussion about staking, even from the likes of Blackrock. This is going to be something that, in my view, accelerates over the next year.

Deflation disproportionately affects the working class.

We can see how we are dealing major deflationary pressures at the foundation. Compute is driving everything and it continues to plummet. This means the impact is going to be felt somewhere.

Here is where we are going to see a major economic transition. Are people ready? Not in the least.

For those reading these words, my suggestion is to start amassing assets in some manner. Keep a portion of what you can in things that can appreciate. If they can be utilized to generate yield, even better.

My guess is, due to the pace of what we are seeing, there is roughly 5 years before things get hairy. Since we are not sure how they will look exactly, there is a lot of uncertainty. It is best to prepare the best we can.

We will dive more into this in future articles.

Images from YouTube videos