If you thought that 2020 was heavy in quantitative easing, we haven't seen anything yet. Next year is shaping up to require even more money from central banks around the world, making 2020 looks rather tame.

In fact, the Fed will have to double its monthly QE just to keep pace with 2020.

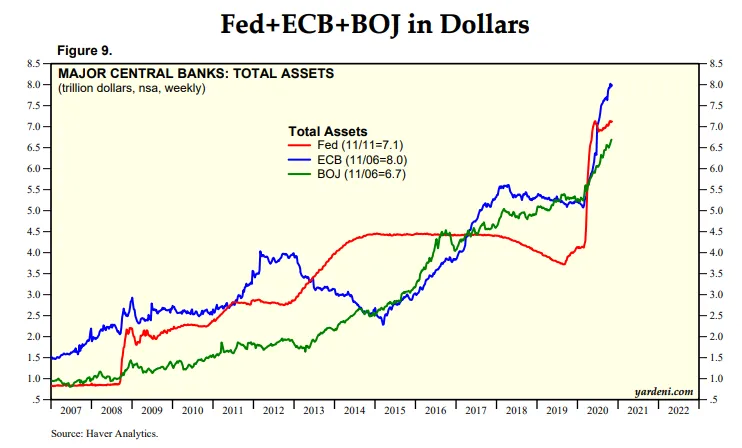

This is not a situation that applies only to the Fed. We see the RBA, ECB, and BOE all monetizing 100% of the net issuance from its Treasuries. How long until the Fed follows suit?

It is likely that the Fed gets little help from Congress, meaning there is no fiscal policy forthcoming in any meaningful way. Of course, with employment in such bad shape, this is going to silence the MMT advocates.

Unfortunately, with things collapsing all over the place, central banks find themselves in a no-win position. This is a situation that was brewing for a long time yet the banks are not aware of why.

Simply put, this is the new reality. Regardless of what happens with COVID and these lockdowns, the central premise remains that downward pressure due to technology is inescapable.

COVID only hastened this process since corporations all over the world are pushing forward to automate as much as they can. Human employees are now viewed as enemies. This adds another element to the equation: even more downward pressure on wages.

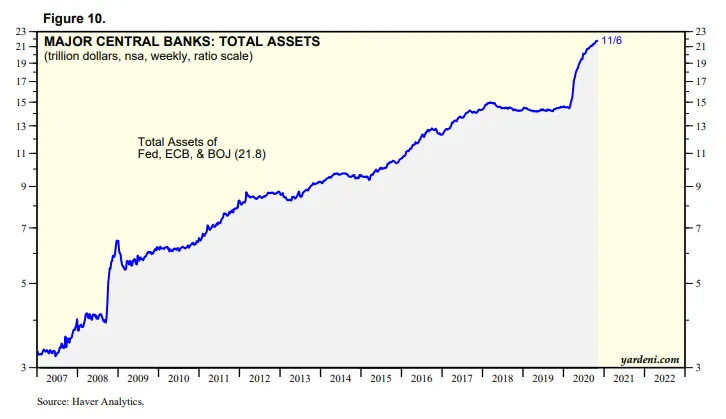

The 2020s are going to require more than $100 trillion in stimulus. This is only the start. The pandemic only provided cover for an economy that was woefully underfunded for more than a decade. We saw more then $23 trillion unleashed by central banks in the 2010s. This was a mere drop in the bucket.

Sadly, all of this still saw the Nominal GDP drop to around 4%, far below the 7% that should be mandated as a minimum to the economy. At the same time, the velocity of money is falling off a cliff, topping off a 4 decade run where it consistently dropped from the peak in the early 1980s.

Of course, the biggest problem is the central banks still insist on "stimulating" through the banking system. With this as a distribution system, the impact is much less. Here we clearly see why the statistics over the past 4 decades is so poor. The trend is clear and the central banks are at the core of it.

Their policies, sadly, favor the few who are near it. Hence Wall Street makes out like bandits while Main Street is left out of work.

Another problem with this approach is that it is government debt, i.e. starts to take money away from the private sector. While this is the idea of MMT advocates, even they believe it should be done during time of low unemployment. We are a long way from that situation.

Ultimately, the cost of servicing the debt will strangle the private sector as too many of those resources are required, removing it from those who innovate and develop. In other words, the engines of economic growth get strangled.

The best hope is that someone wakes up somewhere around the middle of the decade and stops the insanity of running this as a debt based operation. At some point the Central Banks need to change course and offer direct stimulus. Anything short of that will be cutting off any chance of economic growth since more resources will go to servicing this debt.

Maybe when NGDP gets near 2%, maybe they will wake up.

If you found this article informative, please give an upvote and rehive.

gif by @doze