It might have been beneficial if I started a disruption series. There is so much that is being obliterated before our eyes.

Most of the world realizes newspapers are done. Outside the oldest Baby Boomers, who still reads the physical paper? We also know that radio is a dying industry as podcasts are taking the ears away.

Then there is a topic we covered at length, cable television. Between the cable news channels and the streaming train wreck, this is going to end very bad.

Now we are going to add commercial real estate to the list.

No Tenants

We start this discussion with what is taking place right now.

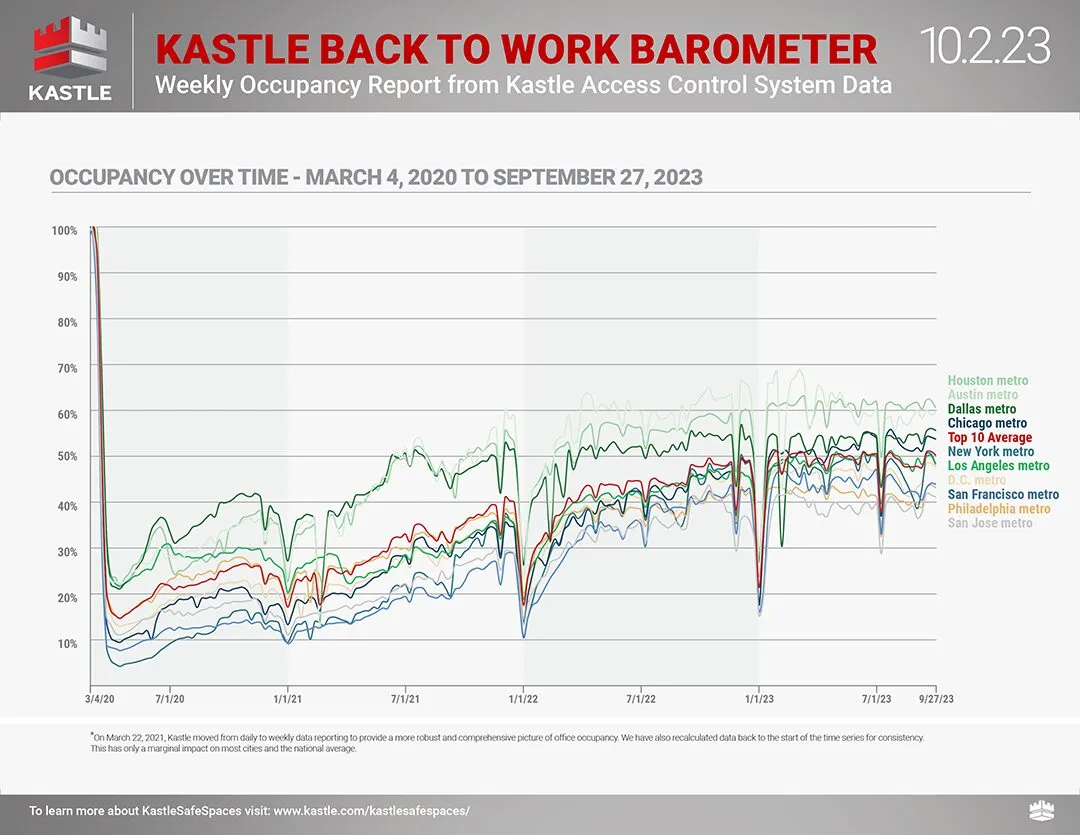

Our good friends at Kastle are kind enough to produce their Back To Work Barometer. This is a charting of the commercial real estate occupancy rates of the top 10 U.S. cities.

We can see that before COVID, the rate was up there. As that kicked off, it was a rapid drop. This was expected as the work-from-home routine took hold.

The challenge is what happened afterwards. Here is where the wake up call should be.

It is easy to see how the numbers are awful. Most markets are barely back to half of the occupancy rate it saw before. In simple terms, these places are half empty.

Now, how do you think a company can pay its mortgage with a building that is only 50% full? This could be feasible for a while but, ultimately, it is impossible.

Why hasn't it all collapsed yet? The answer likely lies in the fact banks are going to withhold pressuring these companies. While a lot of the loans were packaged and sold into CMBS (the commercial version of mortgage backed securities), there are still loans banks are holding.

For this reason, delay tactics are the best option. Perhaps, just maybe, a Hail Mary will emerge.

Technology Rears Its Head

Unfortunately, technology is going to crush this idea.

We are in the most technologically advanced age in human history. Believing that things will remain the same is just asinine.

Let us look at Jamie Dimon, a proponent of pushing people back to the office.

But the advance of technology is also something societies have grappled with before, Dimon pointed out, adding that with AI and large language models there are also huge opportunities to improve living standards.

“People have to take a deep breath,” Dimon said. “Technology has always replaced jobs. Your children are going to live to 100 and not have cancer because of technology, and literally they’ll probably be working three and a half days a week.”

We can leave the longevity aspect of things aside since that is outside the scope of this article. However, we cannot overlook the fact the CEO of one of the largest investment banks in the world publicly stated the next generation is going to work 3.5 days per week.

Then we get this:

Employees could scale back on their working hours, thanks to the technology being used to automate some of their activities, McKinsey found in a report published in June.

Naturally, these forecasts could be wrong. After all, it was predicted 100 years ago that we would see the 15 hour workweek in a few decades. Obviously, that never materialized.

What we can conclude is that more jobs will be done by machines. The advancement of artificial intelligence is going to put a beating on knowledge workers. This much is known.

By extension, this is going to affect commercial real estate in a huge way. We can see how it is suffering already. What happens when jobs are replaced, at least to some degree? Many companies are going to consolidate their real estate outlays even more.

All of this will lead to collapse. The commercial real estate market is going to face things it never saw before. In short, it will get crushed. Office space, in particular is vulnerable. Of course, we already covered how shopping malls and retail is doing.

The one area that continues to do well is industrial. This is because companies like Walmart and Target are closing stores in many areas yet still want to service these areas. They just will not tolerate the laws and expense associated with retail spaces in many cities.

This means Internet shopping. Target and Walmart will deliver to you, no problem. Hence why industrial real estate is being bid up.

Outside of that, office space is poised to drop even more.