Headlines are meant to mislead. You will never get the reality of what is taking place simply by listening to what the talking heads on television say. They are their to either increase ratings or promote some kind of agenda.

For this reason, we try to delve into the numbers to get to the bottom of what is taking place. Also, we discount what "mainstream economics" says because they tend to live in the world of theory, ignoring the fact that what they espouse is wrong. Fortunately for them, they have no feedback system telling them they are wrong like traders do. Hence they can maintain a "wrong position" for decades, losing other people money.

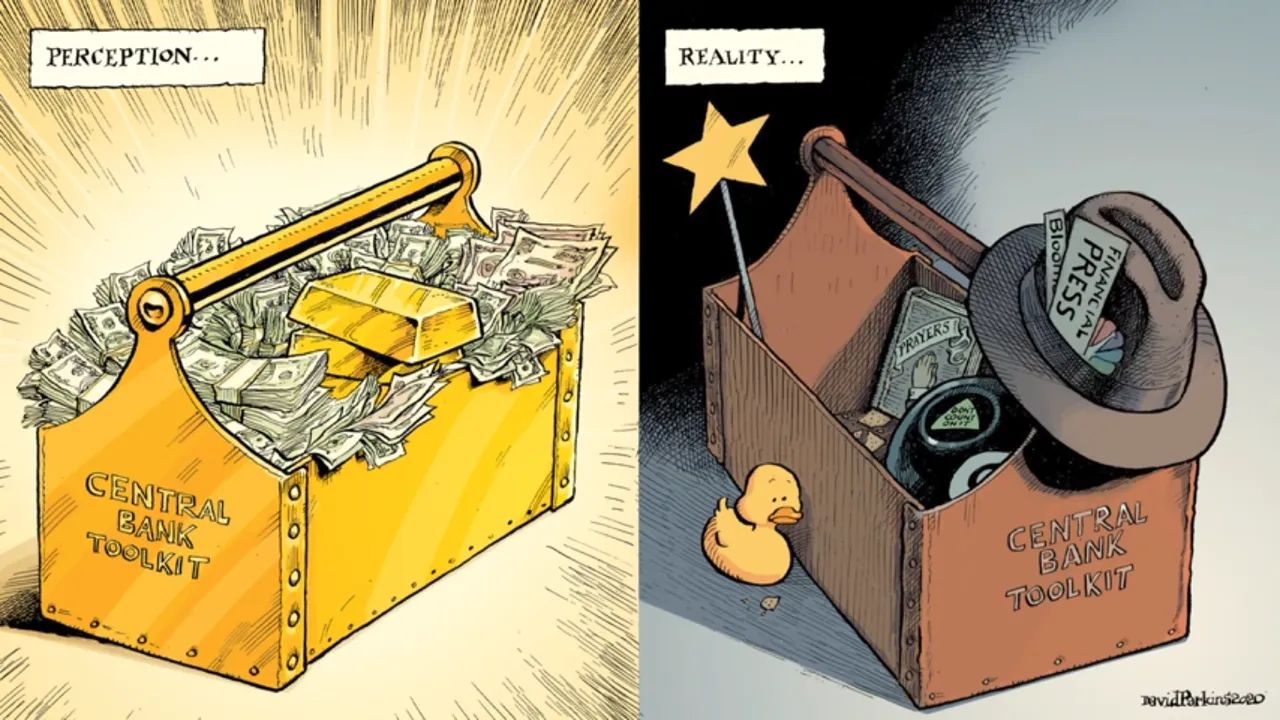

This all leads to the perception that the Fed actually has some power. The reality is the Fed does nothing more than try to manipulate the perception people have.

Source

Therefore, it is best not to fall for the Fed's bullcrap or believe that they have any chance to fix what is ailing us. It is all a con job.

The Fed Miracle

Most people look at economic situations completely backwards. They do not understand simply topics such as rising interest rates are a good thing for they show economic strength. When interest rates are down, it shows economic weakness is at hand. For more than 20 years interest rates were falling, a fact that mirrors the growth rates across the developed world.

The economy is sick and has been that way for some time.

Therefore, do not buy into this interest rate hike fixing anything.

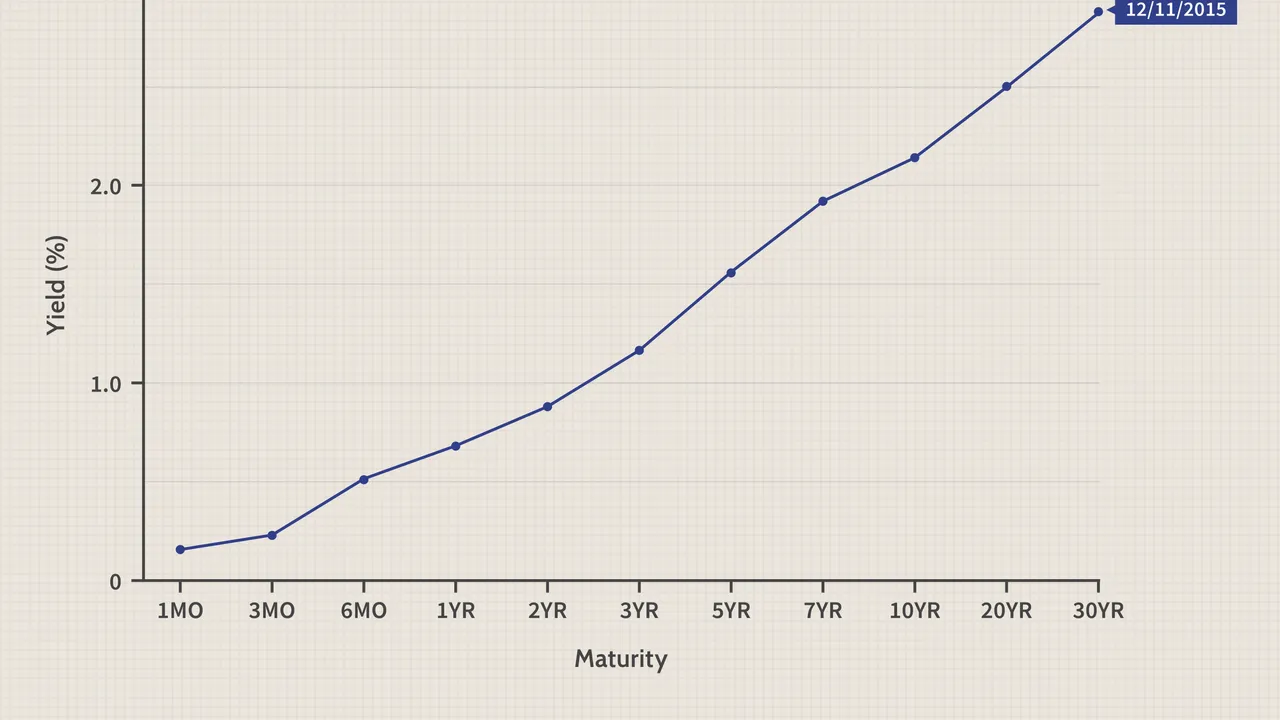

Here is what a strong yield curve looks like.

The reason it is strong is the longer duration rates are higher than the shorter term ones. This means the bond market is optimistic about economic grow rate and inflation. In other words, it is a forecast of expansion.

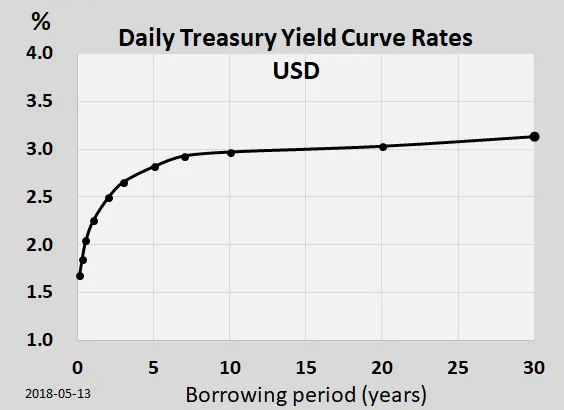

Now let us look at what a "sick" yield curve looks like. This is what is meant when people say the yield curve is flattening.

Source

Of course, the next step is when the yield curve actually inverts meaning the longer term rates fall below the short term rates.

So the Fed is going to pull off a miracle by raising rates to combat a problem they did not create. Hence, they are powerless to fix it but they will take credit for it if this works.

The bond market is screaming "Warning Will Robinson".

Bonds Inverting

Let us look at some of the bond rates.

These are from CNBC. The first is comparing the 30Y to the 20Y. Obviously, the 30Y should have a higher rate.

This is a problem. The 20Y is .0059 higher than the 30Y.

Hence inversion.

Again we see the short term with a higher rate than the longer term.

The key to remember is that when prices go down, prices go up (and vice versa).

Trend

Like anything else, we have to look at the broader picture to determine where things are going.

The thing with yield curve is how it warns us of potential issues. This means the longer that it is in a "sick state", the greater the likelihood that something negative is brewing.

When the bond market, which is roughly $130 trillion by some estimates, is telling us it is not buying the economic growth/inflation story, it is best to listen. This is especially true since things started to flatten out and go negative in December. Touching this state is one thing; living here completely another.

Therefore, it is best to listen to the yield curve. Many scoff at the bond market yet it holds valuable information. Also, this is not only true with the US Treasury curve but we are getting the same warning from the LIBOR yield curve also.

Global growth is not in the cards according to both these markets. In fact, they are screaming troubled waters ahead.

And once again, the Fed is positioning itself to look like the hero. Rates are telling us that long term moves are not there.

This also is mirroring that actions of the Fed both in 2013 and 2018. Each time rates went up for a while before returning to their long term trends. The overriding direction is down and the Fed claiming to move the Fed Funds rate a couple points (if they get there) is not going to change anything.

Even the Fed's own research admits they do not have any impact upon the long end of the yield curve (10Y and out).

It seems like all those shorting bonds might be in for a major short-squeeze.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z