Have you seen some of the outrageous forecasts regarding commodities?

There are people out there predicting insane levels. Behind all of this is the idea that commodities are going to enter a major supercycle. This is where we will see the price levels orders of magnitude higher than today.

Anyone who follows this market](@leoglossary/leoglossary-market) knows it is highly cyclical. And, when it comes to bulls, they can often take things to levels that blow people away.

However, this is not going to happen.

For a commodity supercycle to occur, we need demand. This is going to be a problem going forward.

Many Emerging Markets Screwed

There is a challenge for many developing nations. What they lack in technology and education they often make up for in their natural resources. This is why they can be emerging players on the global stage.

The problem for them is they need a steady flow of consumers for their resources. Without that, they have little to fall back upon.

Here is the harsh reality: there are no saviors when it comes to commodities. While we are in a bullish cycle now, it will be short lived. When the bull runs out of steam, whether it is in the next 6 month or 2 years, that it is for a while.

Countries such as Australia that forged powerful alliances based upon increasing growth rates will have to adapt. Their new reality is that demand is going to be much less than it was before.

Why is this the case?

The Biggest Consumer Just Left The Building

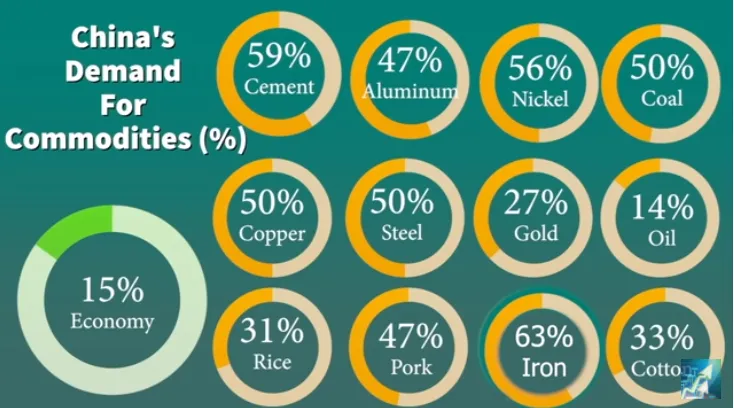

China was the largest consumer of commodities over the last couple decades. It was a situation where nobody was even close to them. Whoever occupied the second position was light years behind the world's largest population and leading manufacturer.

Look at the graphic above and you see how much of the world's resources that single country consumed.

The challenge is the growth spurt is over. After more than 40 years, it is time to say goodbye.

We saw this over the past weekend. Everyone expected Xi to come forth with a plan to kickstart slowing growth rates. It did not take place. This is in keeping with his actions (and statements) over the last few years. Since 2019, the CCP was turning the ship to a "China First" policy. No longer was growth the primary driver.

In short, the CCP is writing a new social contract with the people of China. The days of capitalistic pursuits are over. This is clear based upon the actions towards the technology sector and real estate developers. Both are being given a major haircut by the government.

The party leaders (well leader) are pointing to the fact they are taking the billionaires down. No longer are they going to tolerate extreme inequality. This is the new contract that is being designed.

Of course, if the CCP is not interested in growth, guess what will happen: no growth.

Again, this is evident in the numbers. Since 2019 (no coincidence), bank lending has retracted. Banks are not being forced to lend. In fact, they are being cautioned against it. The CCP realized that the growth rates came with the instability of massive debt. They are going to put an end to this.

China is not going to disappear like some claim. It is, however, entering a new phase. Since it was the world's largest consumer of commodities, by far, it is now going to cause a major reduction in demand.

This is why there will not be a commodity supercycle. No matter how frothy the markets might get in the short term, they cannot sustain long term runs without demand. Since China is going to be reducing the amount it it sucking off the market, suppliers are going to be left with little choice but to cut back.

Look for this bull market in commodities to be the last for a while. Whenever it peters out, things will slide down and stay that way for the rest of the decade (and likely into the next one).

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z