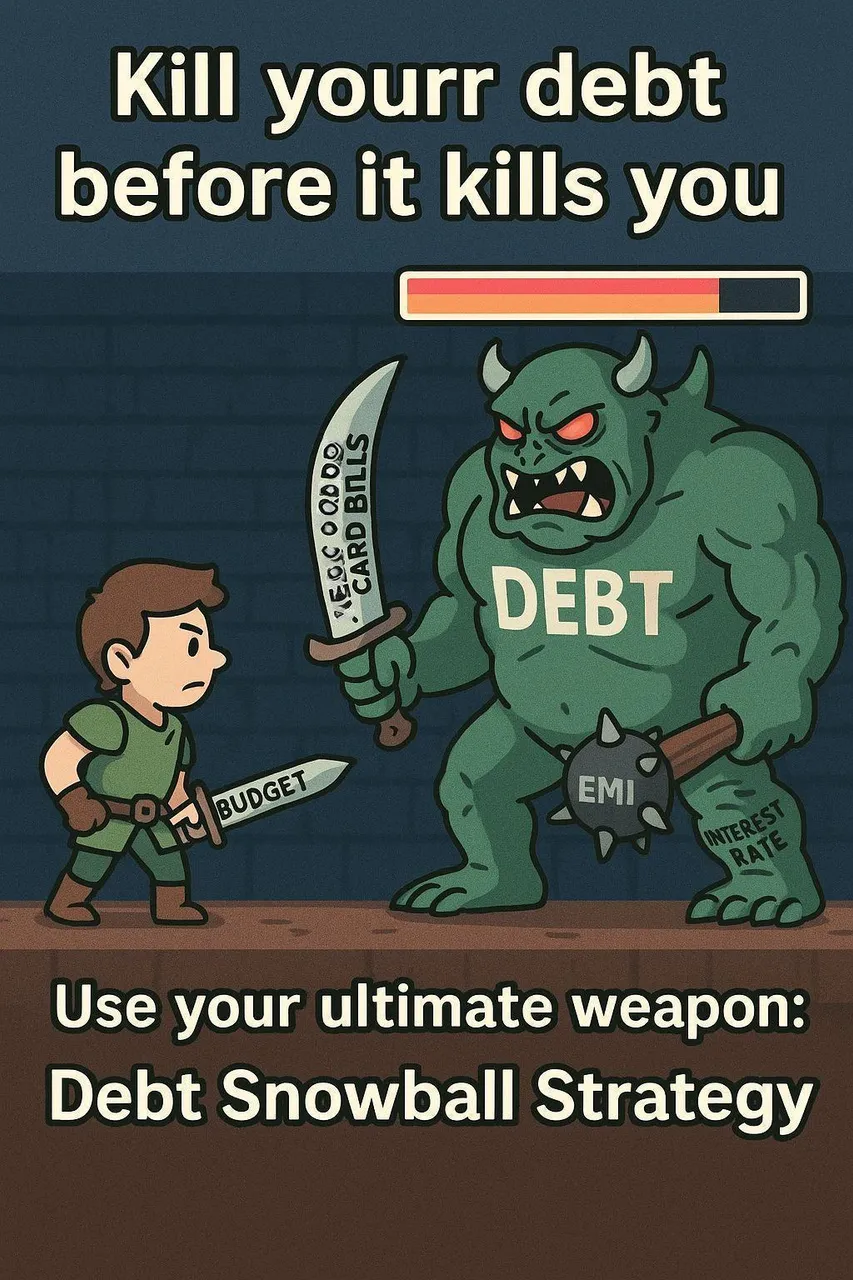

Debt can kill you

No guys this is not a clickbait. Look around there are so many people shortening their life spans due to financial stresses and unpaid debts go a long way in accelerating this financial stress.

Debt can be lethal

Perhaps it does not make front page news however as you read this there could be someone contemplating ending his or her life because of unpaid and spiraling up debt.

Avoid the debt trap like the plague

Debt is easy to get into and very difficult to get out of

One big reason for that is that most of us live from paycheck to paycheck. There is little scope to mess with our finances.

You have to walk the tight rope and make sure that your payments are made as soon as you get your paycheck.

Any unexpected expenditure may lead to creating a situation where you may have to take a loan.

This could be a difficult situation to get into.

Often we fall for the wrong type of loan

One of the easiest traps to fall into is the personal loan trap or the credit card debt trap.

This happens because most of the time there is someone from the bank calling you and offering you an easy loan.

What they do not tell you is how hard it can become to pay back the loan.

If you are having a fixed income and having to live on a tight financial budget then it can be tricky as to from where you would get the money to pay back the loan.

Taking another loan to pay the first loan

This is when things begin to get even more complicated.

A common culprit in this situation is the credit card.

Often you may be tempted to pay the minimum due amount and let the rest of the due amount of the monthly payment roll onto the subsequent month or months.

Well this is exactly what the credit card companies want you to do.

This is their bread and butter money as you end up paying as much as 50% interest on the unpaid credit card bills on the amount you roll over to a date past the monthly due date.

Multiple credit cards can further complicate things

Another culprit is having multiple credit cards and partially paid card bills that you intentionally roll over to the next month.

Can it get worse?

Yes it can, especially if you do the blunder of withdrawing cash using your credit card. These is a hefty fee and huge interest to be paid for using this facility which you may or may not know.

What is the way out?

If you run multiple debts then the first thing to do is make sure you keep paying the minimum due to avoid defaults and penalties.

Now comes the damage control

Do damage control with the snowball method

In this method make a list of all the debts you have to pay.

Start from the smallest to the biggest.

Say you have to pay a debt of $50, $500 and $175

so your list should look like

$50, $175, $500

The idea is to arrange the debt from the lower to the top one.

Next clear the first debt which is the smallest amount first. I know there can be some pain in clearing this debt, however once you have fully paid this one you have one less debt to clear.

Next aim for the next bigger debt amount. Plan to clear it completely and move to the next one.

This is the only way to exit this debt spiral.

People who keep paying the minimum dues on the cards or multiple loans need to adopt this strategy and walk out of a debt ridden financial situation as soon as possible.

Once you are out of all these debts you would experience a much lesser financial stress in life.

Have a diversified portfolio

Have some funds allocated to asset classes that are emerging or doing well. No financial advice however some people invest in good quality cryptos like BTC

Happy #LPUD guys

Today is the 15th or the day the inleo.io community celebrates the leo power up day.

Make sure you power up as many leo tokens as you can.

Stack and make your leo portfolio grow

Main image created with AI