Good day Hiveians!

Join me in analyzing the crypto markets!

There have been quite a few headlines in the past several months in regards to this connection

Is the crypto market (i.e. Bitcoin with ~40% dominance) increasingly getting tied into the legacy markets (i.e. S&P, DJI etc.)? If so, the problem would be that cryptos could then largely not be considered to be a hedge against them.

Here are some of the headlines and link to the articles:

Bitcoin’s Correlation With Stocks Grows as Risk Appetite Drops

Crypto and Stocks Look Increasingly Correlated. That Has Raised Risk Fears.

There is no question that crypto has seen and is still seeing large scale institutional adoption and it is reasonable to assume that this will still grow in the future. Although there will definitely be some set backs with nation states trying to regulate and control cryptos at large (e.g., Russias latest crypto "ban"). With this adoption much of the money from the legacy markets is flowing into cryptos and with it a similar logic that has dominated those markets: namely fear and greed. What I mean by this is that traders and investors will probably apply their same way of thinking to cryptos by trying to extract as much "value" from them as possible and not seeing the different potential paradigm associated with them which is nothing less than a complete shift in how economic and social markets could operate.

Correlation to assets getting stronger?

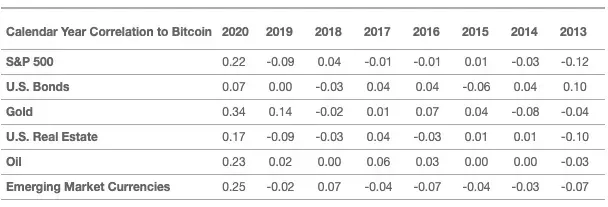

The following is an interesting table showing the correlation of Bitcoin to some assets. We can see that there is a weak trend for a more positive correlation over the years to the S&P 500, oil, the emerging market currencies, but also to gold which itself is seen more like a hedge against the stock market as well. The table shows that things are a bit more complex as the correlations are not one sided or are necessarily growing in strength.

https://decrypt.co/63468/is-bitcoin-price-correlated-to-stock-market

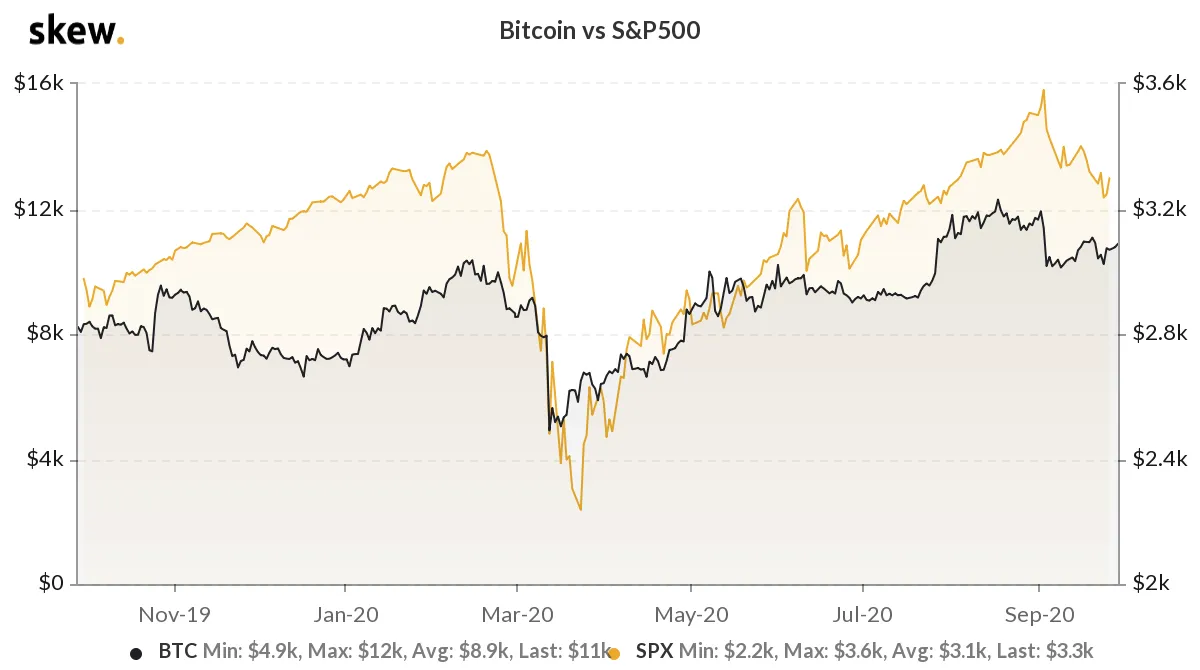

Although 2020 saw a very positive correlation to the S&P 500 and the DJI as seen in the following chart. There is obviously a connection. Again, I believe this is getting potentially stronger as Bitcoin is flowing more and more into the hands of larger institutions which will trade more similarly to "old logic" thereby reinforcing the correlation (like the Corona pandemic which was the main reason for the drop in this chart). I would therefore argue that the spectrum of people holding BTC (and cryptos) has been changing over the last years.

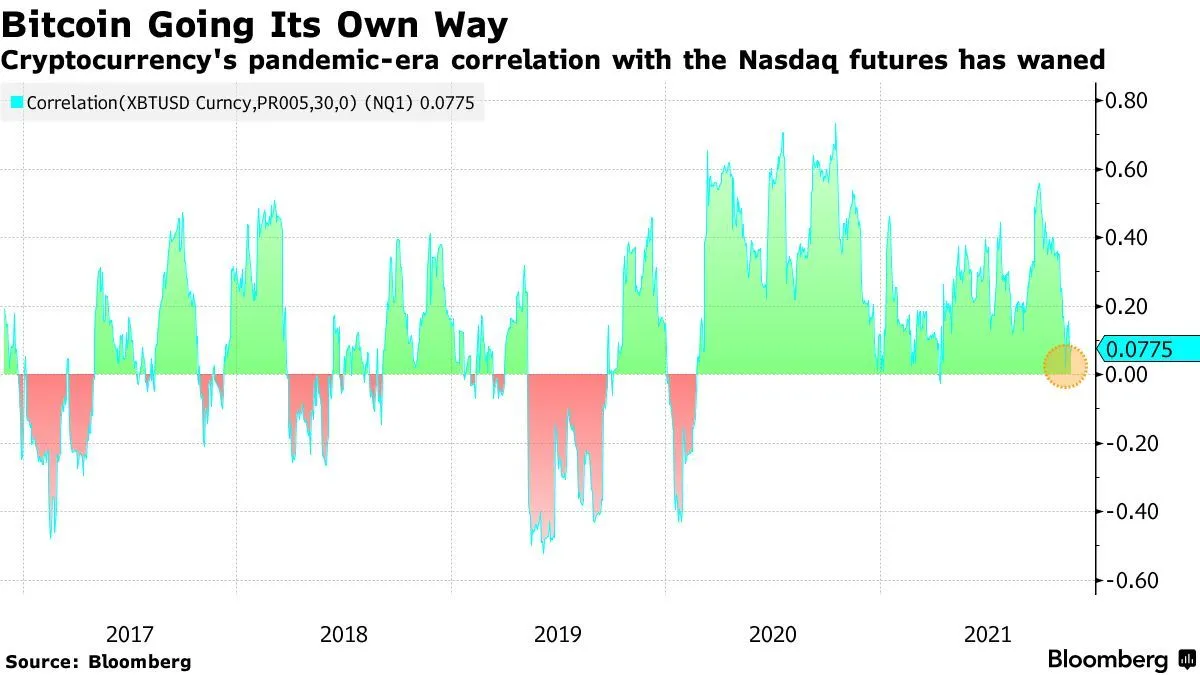

Here is an even better chart showing the correlation with the Nasdaq futures (which are by themselves also correlated with the S&P 500 and the DJI). Whereas the correlation was more bidirectional and weaker in the past, since 2020 the correlation has actually been positive and quite high. But the chart also shows that the correlation has been getting weaker in the last months.

Bloomberg argues here that "Bitcoin is going its own way", meaning that it is once again decoupling from the legacy markets. We will have to wait and see how this will actually play out. Personally, I think that a decoupling is "healthier" for the crypto industry as stronger ties with the legacy market might obscure the goals first laid out by this technology: e.g., decentralization and an independent p2p means of making transactions among many other things.

As a general reminder: Please keep in mind that none of this is official investment advice! Crypto trading entails a great deal of risk; never spend money that you can't afford to lose!

Check out the Love The Clouds Community if you share the love for clouds!