First of all, tell you that this post must be totally related to the following post, which I will publish in a few days and which deals with the “Definition of the total amount to invest in a trade”.

In any case, I thought that dividing it into two posts could give more emphasis to what I am going to tell you now:

Never start a trade without knowing your objectives.

By objectives, I mean knowing where to end up in both losses and profits, regardless of what happens next.

Yes, my dears, surely there are those who like to gamble with the price action and simply enter the trade the first time they see an opportunity.

For example, clearly seeing the break of a certain pattern that “Almost always” returns a juicy profit… and entering a “market order” as is…

Gentlemen, this is precisely what we have to avoid.

A PRACTICAL EXAMPLE

I assume that you are familiar with the acronym FOMO (Fear Of Missing-Out).

These acronyms designate an effect that occurs in all markets when they are about to explode, normally in a BULL-MARKET, but if you “play” in futures, you also can experience it in BEAR MARKET by precipitating massive sales, which denote compulsive behavior of buyers (in bull market) or sellers (in Bear market) that leads the price to move in a very reactive manner.

Well...you have to try not to be canyon fodder during these events since, easily, those famous bullish or bearish breakouts can be perfectly programmed by the big players in the market simply to screw up your trading account if you are a little careless.

What we should try to do as good traders is to be as least compulsive as possible and therefore always ask ourselves “where and when we are going to exit the trade” before entering it.

What to do then?

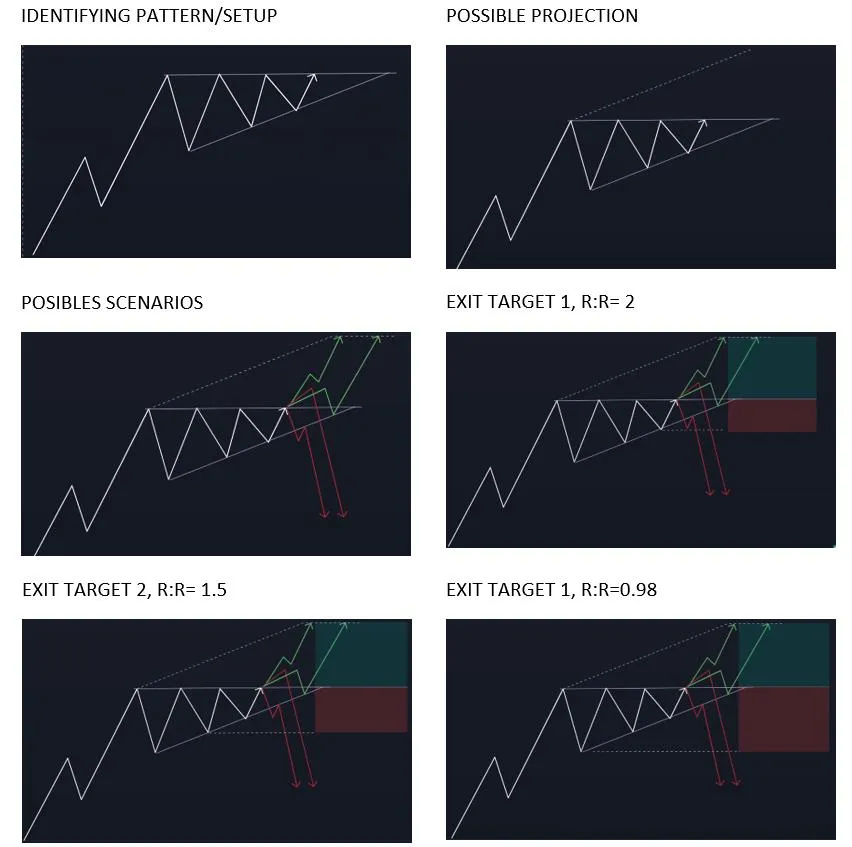

For the example, I am going to use the typical Ascending Triangle pattern in a bull market, but the process should be carried out in whatever your setup is, following your own rules for its identification.

Breaking the top line of this triangle usually has a success rate greater than 60% of the time...not bad, right? which means that 40% of the time it is usually FALSE.

If we want to avoid being compulsive and therefore reduce the FOMO that makes us rush, we have to be quick to identify what the achievable goal is, in the case of an ascending triangle it is marked by the height of the triangle itself, and what the levels of invalidity of the pattern, in the case of an ascending triangle it would be marked by the lower ascending line.

I put the process below:

As you can see, I assume that there is a single profit-taking objective and 3 possible levels in which we could evaluate exiting the trade if things turn against us.

The Risk and Reward ratio is obviously better in the first case, for the same amount of purchase, but it gives us very little margin to hold the position with respect to the other two.

The selection of one of the 3 scenarios is totally something that depends on each person, his psychology, and his aversion to risk but, in my case, I do not usually enter trades that do not have a minimum R:R of 1.5. I think it is a fairly balanced value taking into account my historical success rate according to my way of trading.

However, there are very successful traders whose selected R:R is very low but their hit rate is simply very high, that is, they are winners many times, although each time they win little. For example, their hit rate is 80% and the value they lose when they lose is usually more than when they win, but in the long run THEY ARE WINNERS.

The important thing, however, is that you always play with good protection of your portfolio and for this, you must always know where and when your setup is invalidated and how much money you should invest in the trade that does not put your portfolio at risk if it is you lose.

As I mentioned at the beginning, this post should be complemented by reading the next one which will be about calculating the amount of money to invest in each trade and that I will publish in a few days.

This post is the third in "My Trading Guide" saga, if you liked this one take a look at the previous ones as they will guide you in the topics that, perhaps, interest you the most.

Enjoy!