This post is dedicated to all those people who have tried to be profitable in trading and have not succeeded, even when they have tried repeatedly and with all the conviction and security in the world.

Many of these people have left the market or the world of trading with the typical excuse that if they don't win it is because the bank always does, as if this profession were a casino.

Let me tell you that it is not like that.

Trading has nothing to do with what happens in a casino.

In a casino, the probabilities always put a long-term advantage for the “banker” and in trading the probabilities are at least 50%/50%, unless you behave like a damn gambler, which is what happens to the 99% of people, consciously or unconsciously.

If you are not able to admit that you have behaved like a true “gambler”, it is most likely that your main mistake is a mixture of lack of emotional control, poor risk management, and, derived from the above, poor choice of risk amount invested in each trade.

If you are a person whose emotional self-control is commendable, risk management may very well be your Achilles heel.

Why do I say that in trading the chances of winning should be at least 50%?

Well, understand me, there are strategies that show that these probabilities can be much higher and there are even very successful traders who are winners by maintaining strategies below 50%, even close to 30%...

And how is this possible?

Well, it all depends on your psychology and your personal aversion to risk and how you manage all this.

Personally, my strategies usually have a WIN RATE greater than 60%...in theory or simulation...in practice and trading with real capital, any of them move around 50% of the win rate.

How can I be profitable then?

Very easy to answer, I cut losses quickly and try to win more on my profitable trades than I lose on losing trades.

And it all starts with the choice or definition of the amount you should invest in each trade.

Doing a quick survey of the documentation, information, existing books, YouTube and other sources from which to obtain knowledge, they all seem to “shuffle” 1% of your Trading Budget should be a good amount to risk on each trade.

The most risky and still profitable people can scale this value towards 2% although, personally, I think it is too risky to do so for my trading style (Day-trading and Scalping).

Are you Evaluating or Operating?

I am of the opinion that, while you are “evaluating” a strategy, it is best to risk less than 1%, with 0.5% being the ideal value since what we need is to collect as much data as possible on its efficiency, that is, evaluate the WIN RATE and the Profit RATIO that said strategy has and, to do this, you need a sufficiently significant sample.

If you are a day-trader, a significant sample could need a “population” of more than 1000 trades to give you time to “rehearse” the strategy in any market situation, bearish, bullish or sideways…

Furthermore, the objective is also to “know yourself” to know “how you behave in the face of the on-going trade”.

Your emotions play a very important role in your results that you should also value.

For this, 0.5% is the value that seems least risky to me.

Once you have passed the “test” and have validated the strategy in its entirety, you could raise your risk level to 1% in my opinion, but always taking care to adapt your behavior in this regard.

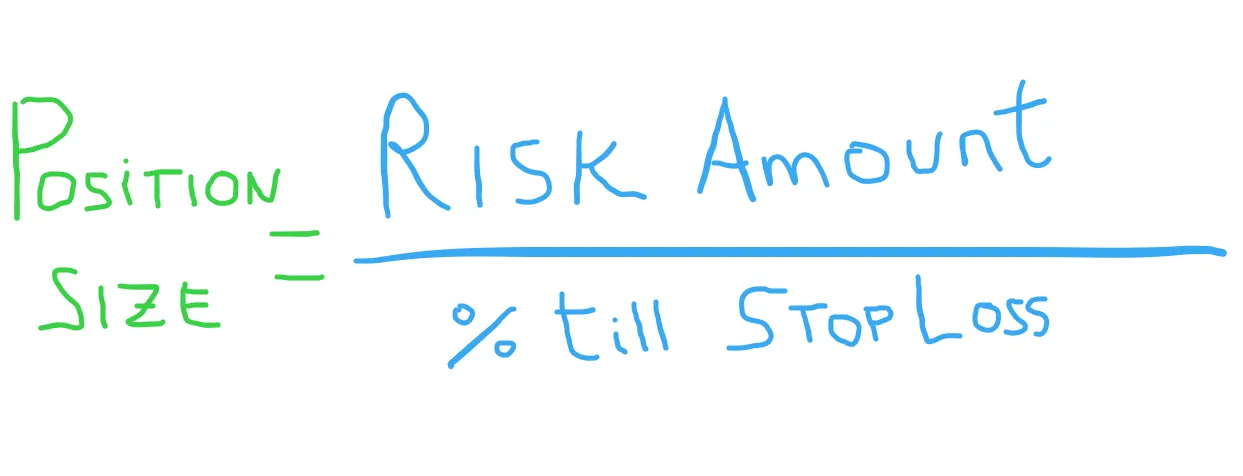

The magic formula to calculate the Position Size or amount to invest in a particular trade is the following:

If you still don't know how to calculate the amount you should invest in each trade, I leave you an example, LONG, about a theoretical BITCON/USDT “set-up”:

- Description: Triangle Pattern Broken up

- R/R ratio 2:1

- Distance (in %) till SL: 2.83%

- Trading Budget: $1000

- Risk per trade: 0.5%

- Amount to Risk: $5

We calculate using the formula in the image above:

$5/2.83%

The maximum we can invest in the image position should not exceed $176.52, including leverage.

The leverage is INDEPENDENT of the position size.

LEVERAGE is only a tool to not DECAPITALIZE yourself too much in trading. Thus, for example with a budget of $1000 you could enter into several operations at the same time without depleting your account.

In the previous example, if you do not use leverage, you could perform up to 5 operations in parallel.

If, on the other hand, you wanted to use leverage, for example, 10x, the amount to invest per trade in this particular case would be $176.52 divided by 10, that is, $17.65.

Have you caught it?

Until here today's post.

Please leave me comments if you have them, I will try to resolve them.

Additionally, if you want to test your strategy with a good Exchange without KYC and even with “fictitious” money to do your simulations, I think BINGX is a good place.

This post is the 4th in "My Trading Guide" saga, if you liked this one take a look at the previous ones as they will guide you in the topics that, perhaps, interest you the most.

Enjoy!