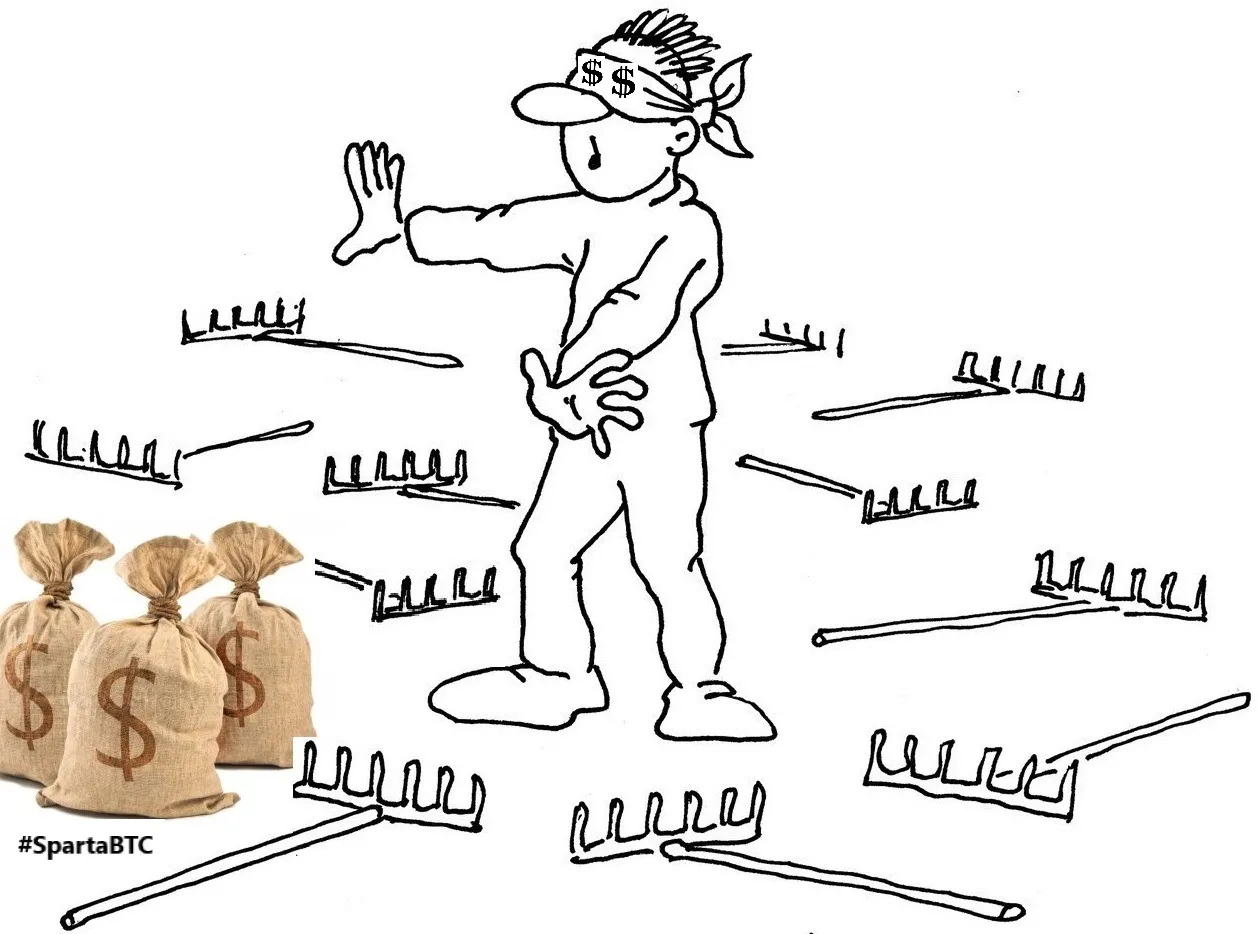

Give a fool any amount, no matter how big or small, he will quickly nullify it with his desire to have even more.

CONTENT:

Newbie trading mistakes.

Methods for solving mistakes in trading for a beginner.

This material is a translation of the original article in Russian. Links to the author and the original article can be found at the bottom of the page. The structure of the article is preserved, the photos are presented as links and are taken from the original article as is.

Mistake - 15

Mistake - Not tracking the price after entering a position.

Solution - The solution is simple, take trading more seriously. Have a clear plan of work. If there is no possibility to control the trade - use Stop-Loss.

You can buy some kind of "technological scam of faith" and after a while the project will close, the asset will not just depreciate, but just disappear, you will be left with only the program code of an unfulfilled hope.

You have to control, but at the same time, you should not jump from one extreme to another and constantly look at the charts, everything has its limits. It is worth noting that when you enter a position, you should have a clear plan of action and potential price movements and risks. If you don't have one, it's better to forget about trading.

There must be a strategy and a plan. At the same time, your strategy and plan should be malleable from market situations.

Mistake - 16

Mistake - Ignoring risk in trading. Not using Stop Loss when necessary.

Solution - Correct entry point. Risk/Profit ratio should be at least 1:3. Using Stop Loss when needed.

Strive to increase your profits, but don't forget to cut your losses! Reduced losses will double your profits!

Mistake - 17

Mistake - Greed. Not selling most of the position in an uptrend or short-term plunge, hoping to make even more money.

Solution - No to Greed! Greed breeds poverty, depression and hamster stress baldness.

Don't expect super profits, you'll earn more if you take a profit of +10-30% than if you wait for pumps of hundreds of percent. As a rule, they are not expected. Remember that 99.9% are created just to collect real money from fools under the blockchain technology hype. Some "projects" live until the first bump, some have a life span of 1-2-3 years, but the end result is a complete death and oblivion of the new technology "that will save the world".

Be less greedy for others, as a consequence you will be much richer for others. Greed begets poverty.

Mistake - 18

Mistake - Work in Va-Bank with all the depo in the hope of a quick big profit.

Solution - Study the knowledge base on money management. Select for yourself an acceptable method of money management.

In your trading strategy, no matter how effective it is, do not work with a large part of the deposit ever! Remember not only about the potential profit, but also about the risks!

Those people who came to the market to get rich quick get poor quick.

Mistake - 19

Mistake - work without basic knowledge of trading in margin trading. Working with a large part of the deposit without appropriate collateral. Not using Stop Loss in margin trading. Margin Call.

Solution - If you are new to trading you should not use margin trading!

More than 80% of the crowd do not know how to trade and lose on the spot market, where it seems physically impossible. To give such fools and in addition super greedy - the opportunity to trade on margin and a wide range of leverage - nullification of the deposit in the near future.

Many exchanges, which have margin trading, for example Binance, have a lot of tricks that do not give a hamster a chance to survive. Most exchanges are hunting for large deposits for margin trading, but recently many exchanges do not disdain penny "hamster" deposits.

Due to the large number of users with small deposits they make big money out of thin air. Although I want to note that over the past half year, this exchange is very tightened in functionality compared to other top exchanges.

Remember once and for all - margin trading is not for beginners! The problem is not so much in knowledge and experience, as in psychology and desires! Telling a hamster how to work on margin will mean giving him a grenade with the ring pulled out.

Mistake - 20

Mistake - the desire to earn a very large sum of money from pennies. Use in margin trading inadequate leverage X10-100. Margin Call.

Solution - if you are new to trading you should not use margin trading!

If a hamster is given several leverage options to choose from when trading on margin, he will naturally choose the largest one! 10x 50x 100x! Because he needs a lot of money in a short period of time! Naturally, he would not place a Stop-Loss, because several times he has placed it before the price movement. It is worth noting that such characters work with the whole available amount of their deposits, otherwise there is no way, they need a lot and a lot of money in a moment! Naturally, a margin call at the slightest movement against him.

Less risk - less profit! More risk - more profit! Excessive risk - nullification of the deposit!

An example of the situation described above is a comment under one of my trading ideas about BTC/USD, which surprised me a lot, and initially I could not understand what the problem was. After all, it was not physically possible. The man lost 80% of his depo on the mini price movement on the breakdown of the triangle! (he allowed me to publish a screenshot of his comment). -- available in the original Russian.

Dialogue:

- (unknown) -80% of deposit, failed to short ((

- (author) -80% of the deposit? What casino do you play in? What is your deposit and risk management. If on margin, where are your stops and what % of the deposit have you been working with and what kind of inadequate leverage? They are crazy, I don't understand it.

- ( unknown) x10 margin leverage, I listened to one trader, that's what I lost. without a stop. I closed my position at 9400 and it went up, that is the result. My loss for two days, BTC and another coin.

- (author) 10x )))))), If a trader gives a signal with 10x - THIS IS NO TRADER, but a hamster. I am sure it is some telegram signalman, you only need to listen to yourself. I would advise you to step away from trading for 1-2 weeks. Then devote time to studying and understanding the market, without working with money. There is a base for trading on the internet - for free, it takes 30 minutes to a few hours to find it for studying, depending on your intellectual ability.

End of dialogue.

Well and this man's explanation of this very unpleasant situation for him:

"10X listened to a trader and he went down in losses. Without a stop! I shorted from 9400 and it flew up by several hundred dollars at night, this is the result of a margin call on an empty spot.

Reasons for Margin Call:

Signal "trader" (those who don't make money from trading as they don't know how, but make money from selling information!)

Margin trading and 10X leverage!

Trading without Stop-Loss.

Working with all or a big part of the deposit.

The more stupid a person is, the more he wants to get more money from pennies in short lines, without knowledge or effort. He thinks he is special. The special 80% of the market is special.

Thanks to the "special" the market makes super profits. This desire of such people and, as a consequence, predictable behavior on the market is used in margin trading to collect their pennies in the "common fund" for everyday needs of exchange owners.

Mistake - 21

The mistake is to buy "at the bottom" cheaply and re-buy at the next "bottom" at even sweeter prices, without really understanding what is happening with the asset in question.

The solution - no to dead coins! Don't buy crypto coins because "they're cheap". Only buy when a trend reverses into an uptrend is confirmed.

Don't go into a large amount of dead very cheap coins in the hope of making super profits. Do not freeze your money forever! If a coin has lost a large % of its value, it does not guarantee a return to its previous value. Don't catch falling knives, sometimes they hurt the hand that catches them. If an asset loses value tens or even hundreds of times, it means that it was purely a speculative tool, which traders and defrauded investors lost interest in.

The less you believe in the reality of the legends of crypto projects, the higher your real earnings in the market. After all, your thinking is free from the illusions of liars.

Mistake - 22

It is a mistake to join a cult of believers in one of the thousands of scams. Believing in the air. Entering various 'promising' ICOs. "Hold a prospective scam".

Solution - don't participate in various ICO's - moneybags for fools if you don't have enough information about the project and the people who make it (not internet information "for everyone")!

Don't keep promising bullshit in your wallets that the stupid crowd believes in! Keep real money and cryptocurrencies behind the states! In 99.9% of cases from 2017 to 2019 most of the top 100 "promising projects" for which the ICO was originally conducted have depreciated by a factor of 10 - 100 or more! Many disappeared altogether! But, I don't think it makes much difference whether a "promising project for fools" disappeared or depreciated by a factor of 100!

If you are like everyone else, then the result will be like everyone else, or rather nothing at all.

Mistake - 23

It is a mistake to give money to an "internet trading guru" for trust management (TM).

The solution is not to give it to anyone in a trust. Work with your own money, or leave trading.

On the anonymous internet, only two options are taken into trust (TA):

open fraudsters, after transferring the money will evaporate along with the $, changing the identity of the legend.

sham traders who only lose money, and survive in the market (pay out the interest to investors), only thanks to a new infusion of money (kickback in trust), or by pure chance when the trend reverses, and they present it as their skill. In all other cases they are unprofitable at a distance, and as a consequence you lose money.

If you give a fool any amount, no matter how big or small, he will zero it quickly.

No matter how many virtual coins you earn in the cryptocurrency market, until those profits are materialised into tangible goods and services, they are zero.

Making money (a resource) in the market is prevented by banal greed. Everyone is almost sick with this disease. Consequently, your freedom from greed gives you unimaginable superiority over the patients of the "devil".

To be continued...

The author of the original article - Spartacus of Macedon

Communication with the author (telegram) - @SpartakMakedonskiu

Link to original article - https://telegra.ph/Oshibki-trejderov-nachalnogo-urovnya-CHast-2-Odni-iz-glavnyh-prichin-poteri-deneg-na-rynke-kriptovalyut-Metody-resheniya-oshibok-08-19

Link to the author's telegram channel - https://t.me/SpartaBTC777

Article translated by https://www.deepl.com/translator