There's nothing much to see in the daily time-frame today as all it did was trying to create a reversal but wasn't able to do so as it was broken from the current candle crossing it's newly created resistance before pulling back. So there isn't visible price action to analyze in this daily candle, except to wait for a break out to enter a trade because it could break either way right now as the market has cleared volumes from both sides already which means there are no more or very little volumes left in the market and volumes that are left could very well be profitable position waiting for the charts to break out to either take profit or to stop loss at break even. So the next thing to do is to lower down the time-frame.

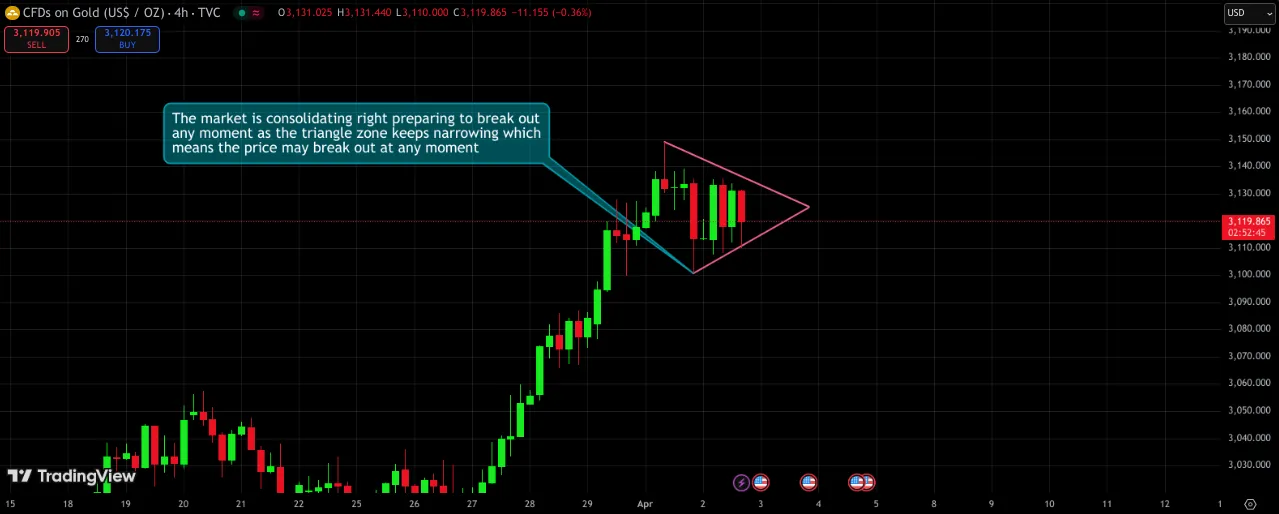

The 4 hour timeframe shows the price consolidating after dropping down clear buy volumes and rising up clearing sell volumes from market, and at the side time luring retail traders into buying and selling at break out and then pulling back sweeping stop loss each time causing quite a number of losses for retail traders. While also creating lower resistance and higher support which means the consolidation zone is narrowing in, pressuring position holders to close off their position whether profiting or losing. The only way to enter a position right now is to wait for a break out to either side and enter against it because it may be luring and accumulating break out orders before going in the opposite direction. So if it breaks above, we sell, and if it breaks below, we buy. And then close that position if it is able to successfully break that support or resistance because it'll continue going rising or dropping further.