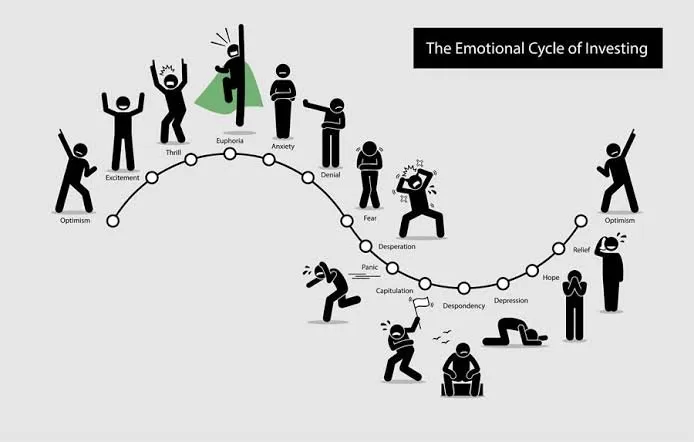

Emotions is one of the factor that can easily affect or take over the investors especially the new investors that are investing in crypto currency space for the first time. Since the crypto currency is volatile in nature, in which the market price can swing anytime, then it is normal for one to be emotionally based on whether the swing favour or affect us.

For instance, as we're still much in to the crypto bear market, those that are just investing in to the crypto currency space for the first time will not be happy seeing their portfolio chart on the declining order and in the process of being a first time crypto investors, it may leads to emotionally breakdown.

The best way to prevent swing of emotion is by having an investment scheme and cling in to it.

Diversification is also one of the factor that helps us to curb our emotions especially when investing. Diversification simply means that one invest in different projects instead of one to put all his assets on a single project so that incase of any unforseen circumstances, them one will be at a safe side. If at all, there is problem with one portfolio then the others will be safe,so this will cut out our losses and prevent us from emotionally breakdown.

When investing, we can't do away from being emotionally as it is easier said than done, but nevertheless there are some crucial factors that can help or prevent the investors from pursuing pointless rewards or overselling in nervousness

The second thing to take note of acknowledge individuals risk forbearance and the risks of ones expenditures can be a vital foundation for reasonable resolutions. Dynamic comprehension of the markets and what strengths are propelling bearish and bullish tendency is also important.

Thanks for visiting my blog and have a wonderful day

I really appreciate your upvote and support

@twicejoy cares ♥️♥️♥️