I still haven't given up entirely on the rebase token projects, and the main reason might be Hector Finance, and also OlympusDAO. These are two projects that I really believe in, even though they have seen some terrible days, especially cruel were the days in the middle of January 2022 in which all rebase tokens just dumped giantly.

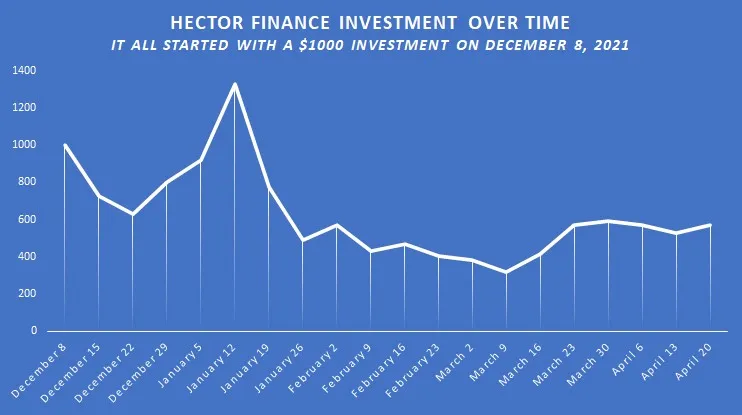

Above you can see a chart that presents how our initial investment of $1000 in Hector Finance in December 2021 has developed since then. At that time, they had rebase rewards (APY) above 100,000%. But, as we saw with all the other rebase token projects, it eventually had to dump and that came giantly to Hector Finance, OlympusDAO, Wonderland, KlimaDAI, and all the others... especially in the aftermath of the Daniele Sesta and Wonderland crisis in January in which SIFU (the second leader of Wonderland turned out to be one of the main persons from QuadrigaCX exchange in Canada that made users lose millions of Dollars after the leader showed up dead and nobody had access to the keys in order to reach those funds). This heavily impacted the entire industry, not only Wonderland.

Hector Finance is stabilizing...

As you can see from the chart above, Hector Finance has had some ups and downs, but their most recent positive trend started early in March and they have kept this going since then. The price of $HEC has since then been stabilizing around $20, and the question is now for how long it will remain there, and whether they can manage to create a demand for the token that will make the price increase even more? They are for sure working hard on the protocol, but is it truly a needed protocol? They have a DEX and they have a stable coin... they have lowered the APY, and they are working with NFTs and more. Where will this take us?

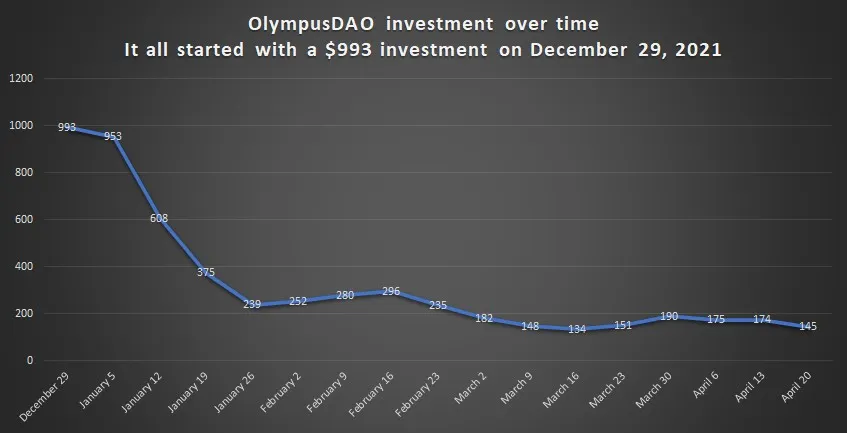

OlympusDAO also seems to stabilize, but they haven't had that great push that I can see with Hector Finance. But, if they can manage to at least keep stable between $30 and $40, then this still has potential. They are making quite a lot of revenue with their protocol and they have a big treasury, meaning that as a business, OlympusDAO is working well. But, unless they are satisfying their investors, things might get hard even so.

Do you want to check all the data from the rebase token experiment last week?? Click the link!

Would you rather like to understand more about OlympusDAO, their treasury, and why this has potential as a business, and possibly also as a token? Take a look at this article.

What do you think about all of this? Are you paying attention to Hector Finance or OlympusDAO? Are you bullish or bearish?