Hey leos! I read the challenge of writing a blog in the leofinance by @leogrowth, I know I am a newcomer but I am going to accept that challenge and writing in this vast community. So my other fellows if you want to join this challenge then you can easily read the below post and get motivation to join.

We know that nowadays everyone is Joining the awesome world of crypto and they do trading of these crypto currencies. Apparently the trading of these crypto currencies looks easy that we can buy them when they are in the dip and then we can sell them when they are up, but it is not easy as it looks. Some people see the candles and guess that now this candle is down the other moment it will be up. But it is not an easy task.

And the traders use different tricks to save their portfolio and to increase their portfolio. I am also a beginner trader but I also use a technique of Crypto Assets Diversification (CAD), So in my first blog in the Leofinance I will write about the Crypto Assets Diversification.

What is Crypto Assets Diversification (CAD)

Crypto Assets Diversification is a simple but profitable technique or you can say tricks that are used in the trading ecosystem to keep the portfolio green and safe. In this technique your investment is divided into different parts, and then these parts of investment are invested in different crypto coins. The short name of Crypto Assets Diversification is CAD.

Let me explain it a little more. So we have an investment of $1000 and we want to invest in the crypto and want to do trading with this amount. I am going to make two categories to explain this Crypto Assets Diversification (CAD).

Category-I

As mentioned earlier, we have the same investment of $1000 and in the first category a person A invests all the money in one crypto coin, thinking that it will go up and then he will take profit from that one coin. But due to the volatility of the market that coin does not go up according to his desires and goes down 25% more from his entry so he is facing a loss of $250 on the spot.Category-II

There is another person B who uses the technique of Crypto Assets Diversification. So he divided all his investment into two equal parts. And then he invested in two different coins. So after the investment both the coins show different behaviour. One coin goes 10% down but the other goes 20% up. In these coins investment is the same and now calculate the profit or loss. After calculation it is clear that in this strategy we have gained 10% profit that is $100.So it is known as Crypto Assets Diversification (CAD) it is an amazing technique which is simple and easy to use.

My Experience in Crypto Assets Diversification (CAD)

As I have mentioned earlier, I am also a small trader but I still use this technique of Crypto Assets Diversification and often apply this technique to my investment. Now I am going to tell you my experience about this trick.

I had $500 and I was new to the trading and I didn't know about these nice techniques and I saw a coin that was in dip. And I suddenly invested my all investment in that coin. It was SLP (Smooth Love Potion) coin, which was in dip.

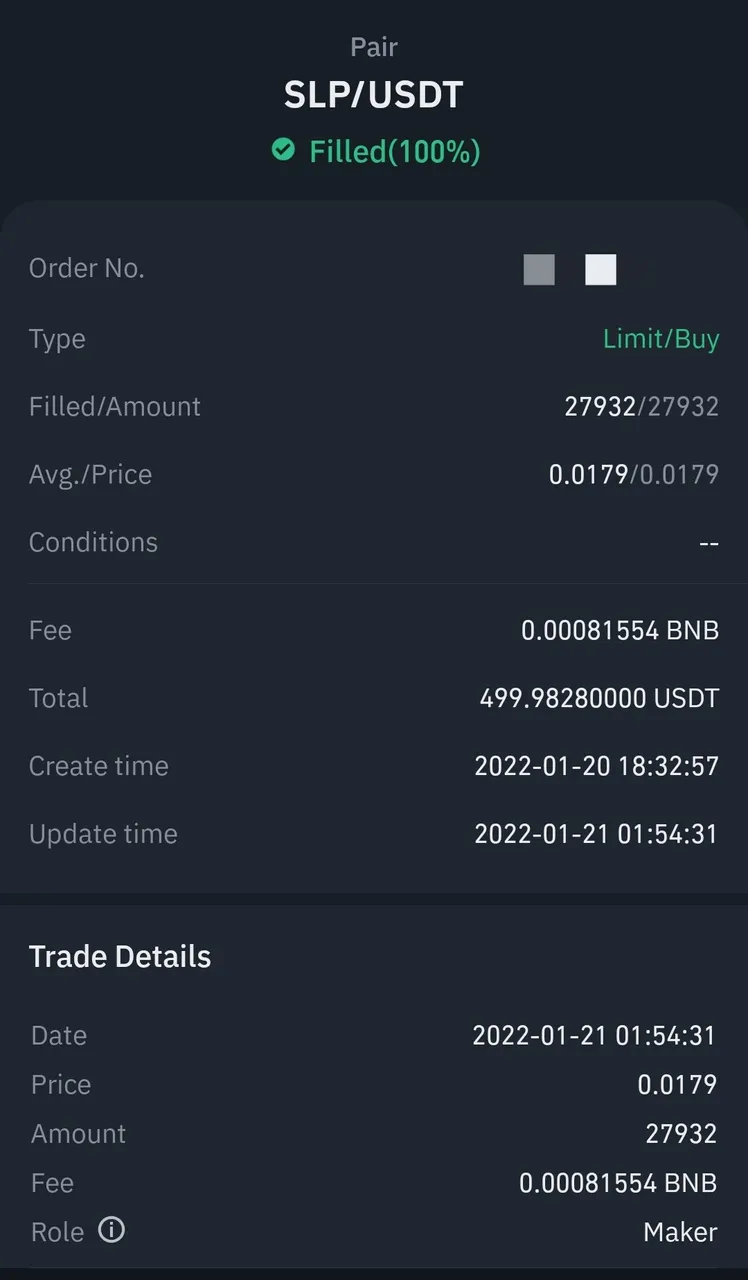

Here you can see that I placed an order at $0.0179 thinking that it will go up from here. I was really very happy that soon I'll make a handsome profit from my investment. But I went against my opinions and went more and more down.

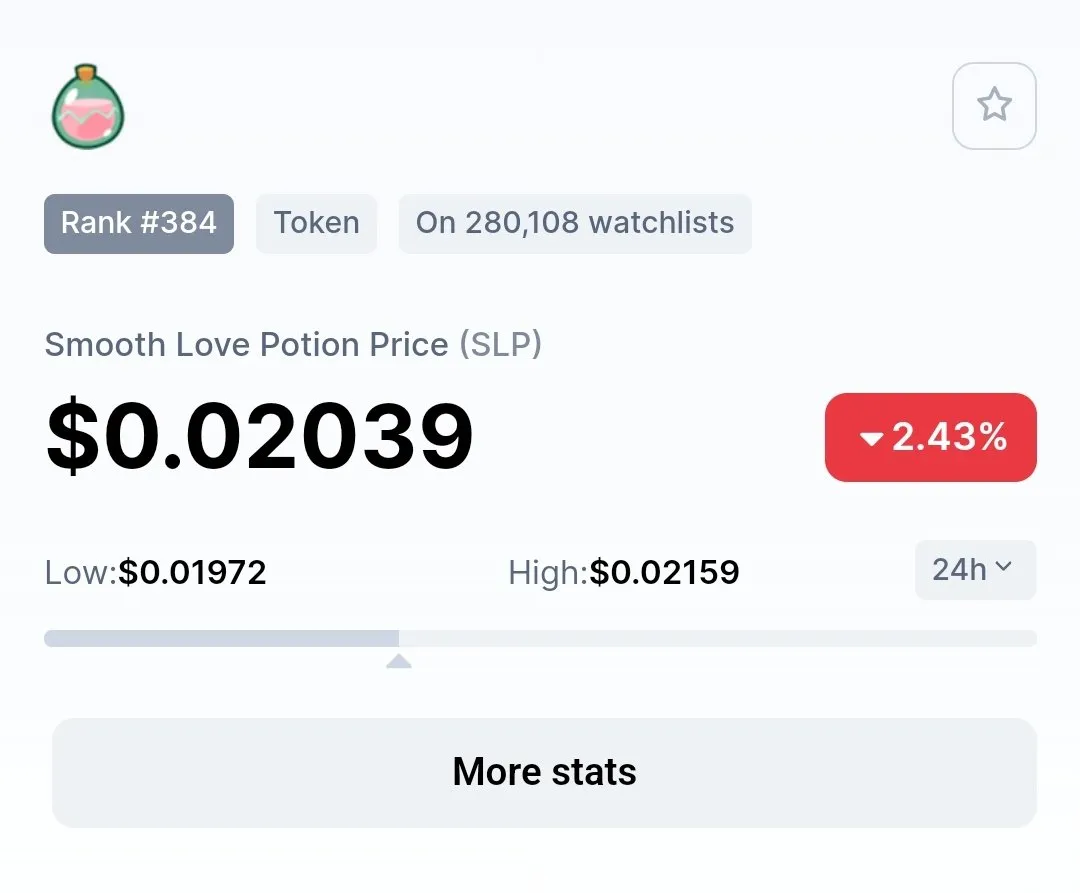

Here you can see the graph after my investment, that the price of this coin went too low in those days, and it went against my desires and thinkings. So now I was in great loss while I saw other coins were pumping turn by turn but I had stuck in that coin.

My investment was also stuck in it. As you can see that it touched $0.0087 it's all time low in the start of this year, when the crypto was crash. After that incident I learnt this Crypto Assets Diversification technique and now I use this technique and it keeps me safe from bigger losses and also help me to recover the loss.

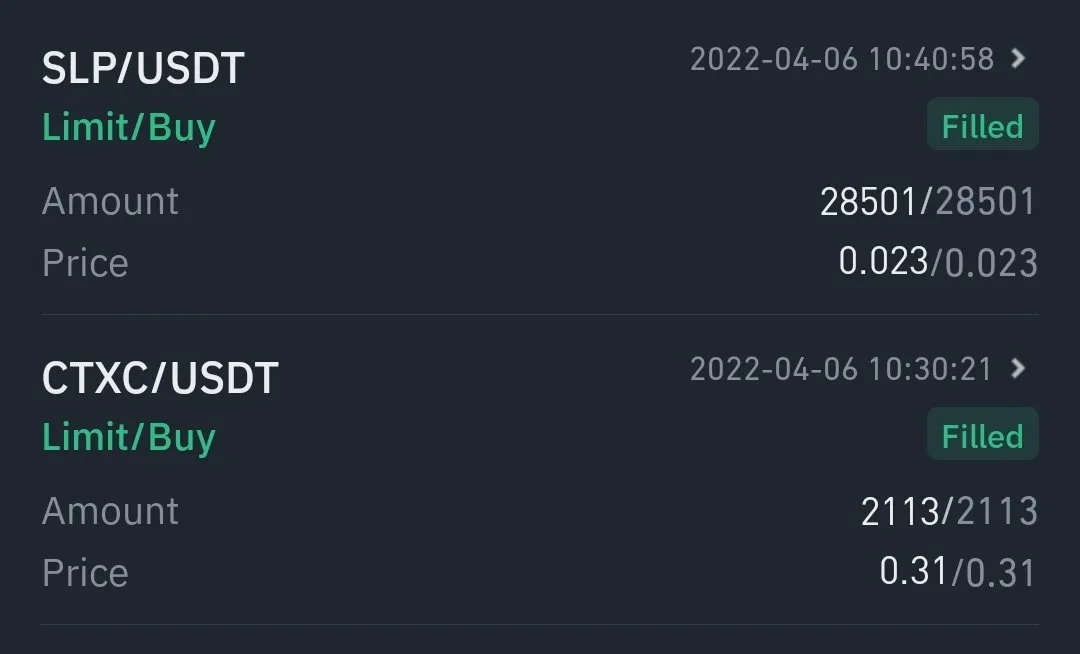

These are two of my recent trades in which I used this wonderful technique. I had almost $1300 and I wanted to invest these usdts . So I found two coins in the current situation which were looking good for the investment. I could invest in a single coin as I did before, but no I didn't do it and divided the investment into two equal portions.

How my investment went using Crypto Assets Diversification

So now it is the time to compare. So according to the Coinmarketcap currently SLP is trading at the current price of $0.02039 but I bought it at $0.0230, so now it is in loss but not my all investment is in loss.

I am in almost $77 loss of my investment in the SLP but I invested my whole amount in SLP then my current loss will be $154, but it is less because I have invested in another coin using Crypto Assets Diversification technique.

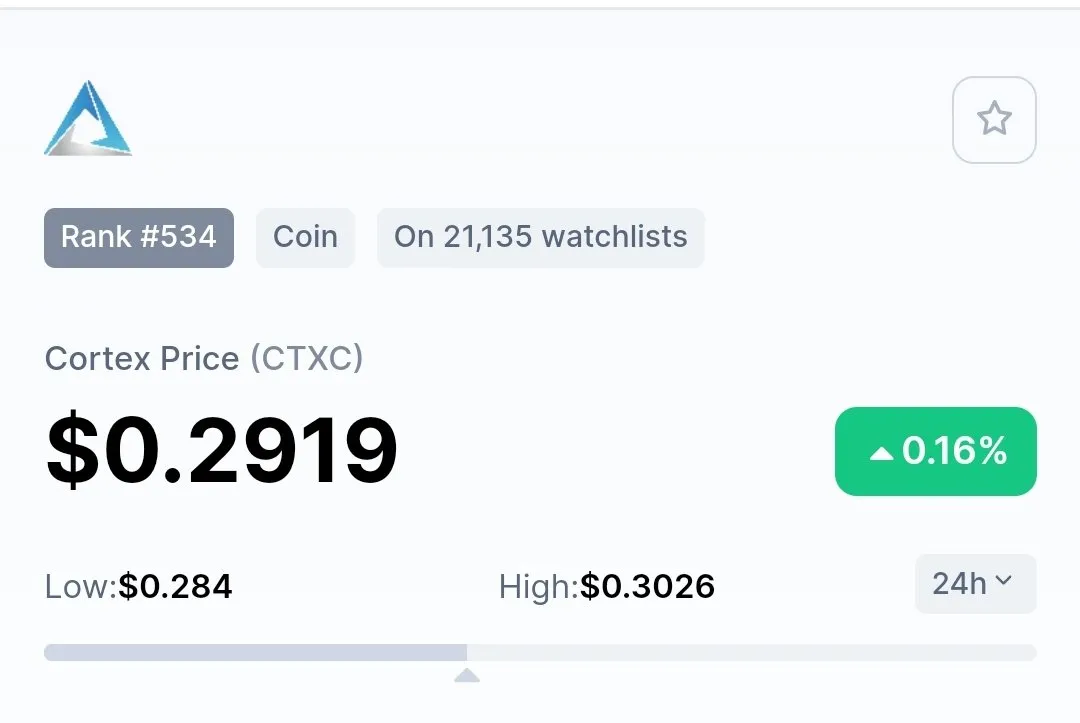

The other half of my investment is in the CTXC(Cortex) and it is not giving me such loss as SLP. According to the Coinmarketcap currently it is trading at the price of $0.2919 and it is giving me a loss of just $37 and it is less than the loss of SLP.

So if I invested in one coin SLP then my total loss should be $154 but rather than this currently my total loss is $114, it is all due to the technique of Crypto Assets Diversification.

All the sources of the images are mentioned, but being human if I have missed them please let me know if anyone found such a mistake.