A closer look at exchange block producers on EOS reveals how major exchanges wield undue influence over EOS DPOS blockchains and extract the lions share of value.

This post aims at exploring the current threats to DPOS on the EOS blockchain in light of recent Steem takeover powered by exchanges activating user funds without consent.

As most of you already know, the Steem blockchain was taken over in large part thanks to the misappropriation of user funds stored on several large cryptocurrency exchanges: Binance, Huobi and Poloniex.

User tokens were powered-up (staked) in order to vote out the Top 20 community elected Steem witnesses responsible for validating transactions and securing the chain. Ultimately, this led to the Fork of Steem and the creation of the Hive blockchain.

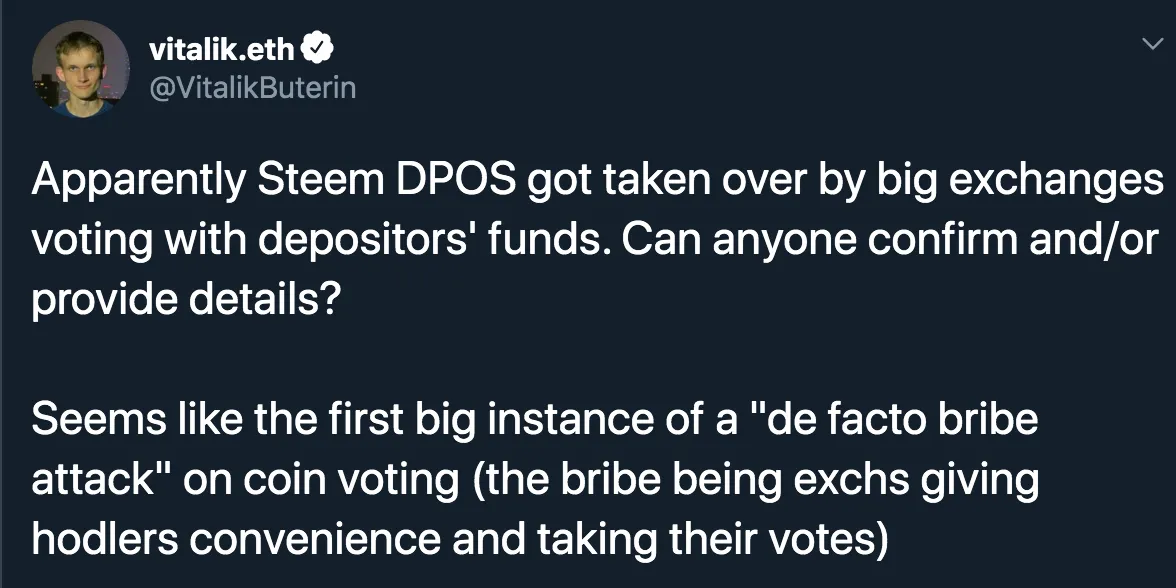

As noted at the time by Ethereum creator Vitalik Buterin, the actions taken by top exchanges underscores an unmistakeable vulnerability in DPOS governance systems.

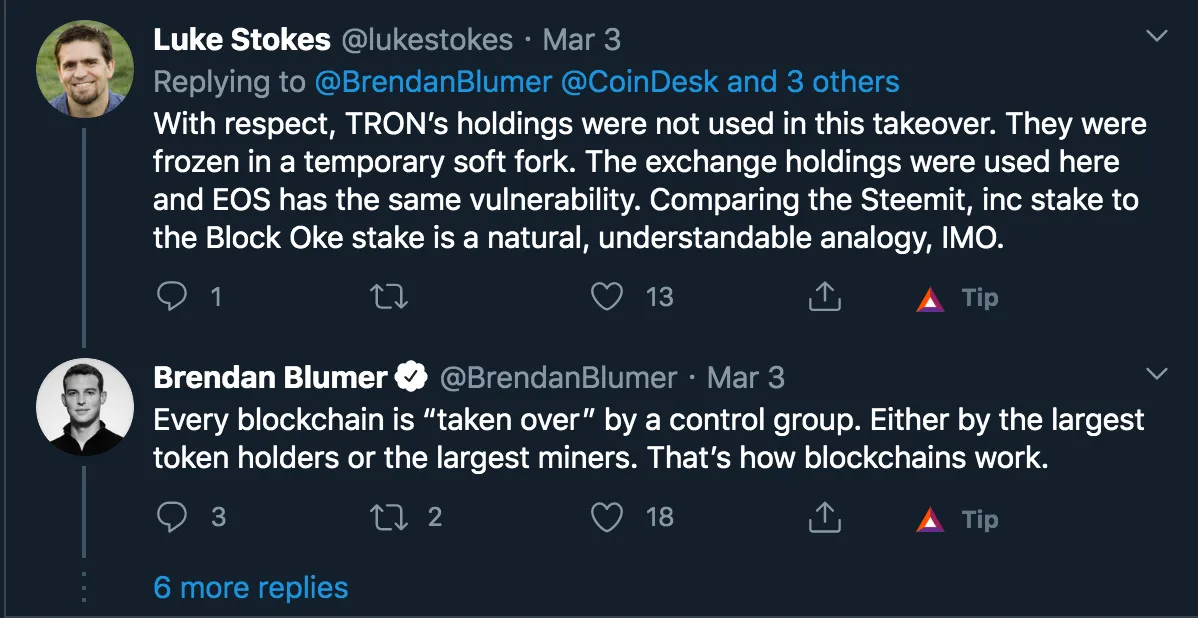

Former witness (now Hive witness) and long-time community member @lukestokes described the complete toppling of Steem community governance as a Sybil attack.

A Sybil attack is a kind of security threat on an online system where one person tries to take over the network by creating multiple accounts, nodes or computers.

This can be as simple as one person creating multiple social media accounts.

But in the world of cryptocurrencies, a more relevant example is where somebody runs multiple nodes on a blockchain network.

The word “Sybil” in the name comes from a case study about a woman named Sybil Dorsett, who was treated for Dissociative Identity Disorder – also called Multiple Personality Disorder.

Source: BINANCE ACADEMY

Ironically, this definition is provided to us by the Binance Academy, perhaps CZ and company should consider taking a refresher course in threat mitigation. While they're at it, they may find a course describing the importance of decentralization - illuminating.

The Steem Hostile Takeover is a stark reminder of vulnerabilities inherent in Delegated Proof-of-Stake protocols and should be a warning to other DPOS based blockchains. It also demonstrates the power and influence major crypto-exchanges have amassed in the space over the years.

The Steem blockchain is not the only instance of DPOS governance systems being taken over by large exchanges, although it's undo

ubtedly the most extreme case to date.

The EOS blockchain has long been suffering a similar fate as exchanges, powered by user funds, continue to operate their own highly profitable Block Producers onchain.

Similar to Steem and Hive, the Top 21 EOS Block Producers (BPs) earn daily rewards in EOS tokens for validating and for securing the EOS network.

Correspondently, EOS Block Producers are selected through BP voting by EOS users who have staked their tokens. The more tokens a user has, the more voting power said user has.

Over its short history, exchange BPs have solidified their position in the EOS Top 21 by using their substantial token holdings. At the same time, some of these exchange BPs have been suspected of running additional sock-puppet BPs concurrently in order to earn even greater rewards. Historically, this has lead to large EOS holders vote trading, buying and selling.

The race to maximize rewards by the Top 21 BPs has had a more serious negative side effect in that it has resulted in the displacement of value-adding community BPs outside of of the Top 21 and even outside of the back-up producer positions from ranks #22 down to #60. Typically, these BPs are experienced developers, DAPPs, tool creators and leading community thinkers who now find it increasingly difficult to sustain and fund their projects.

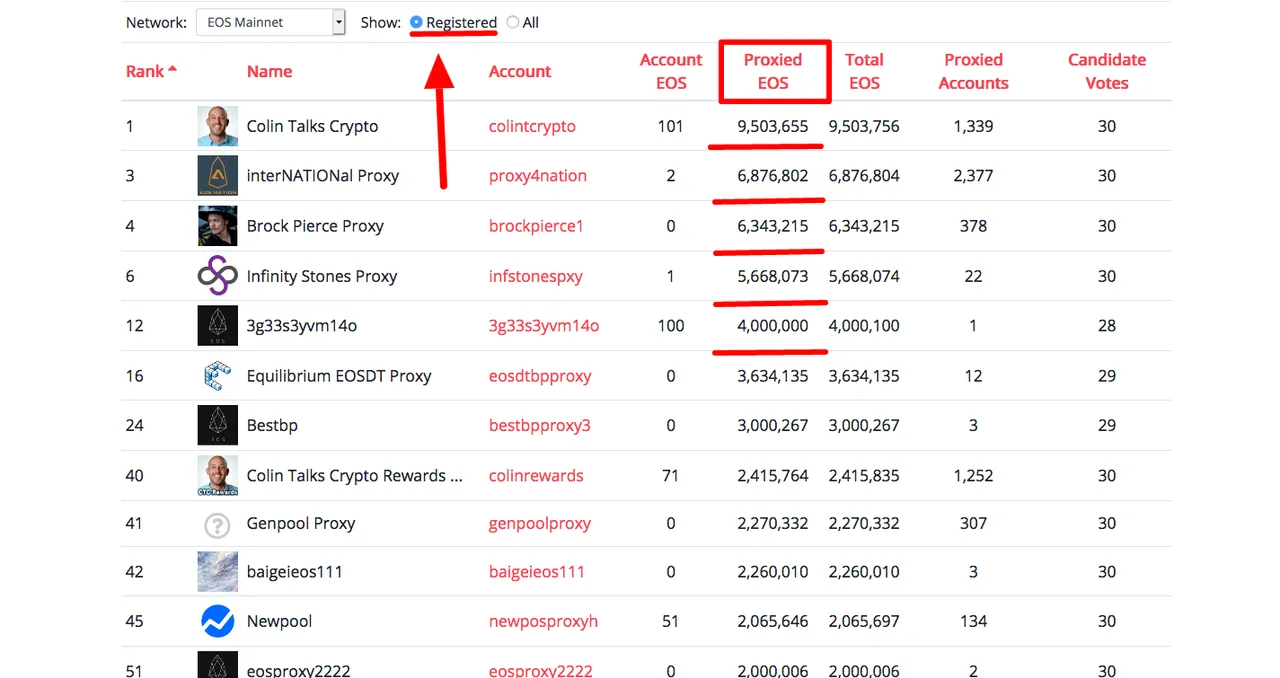

Registered EOS Vote Proxy Accounts

The idea behind proxy voting was to try to increase the participation of users in EOS governance and, it was hoped, to generate more support for value-adding BPs. Vote proxy services are offered for those who don't have the necessary time it takes to determine which BP candidates are providing the most value for the ecosystem.

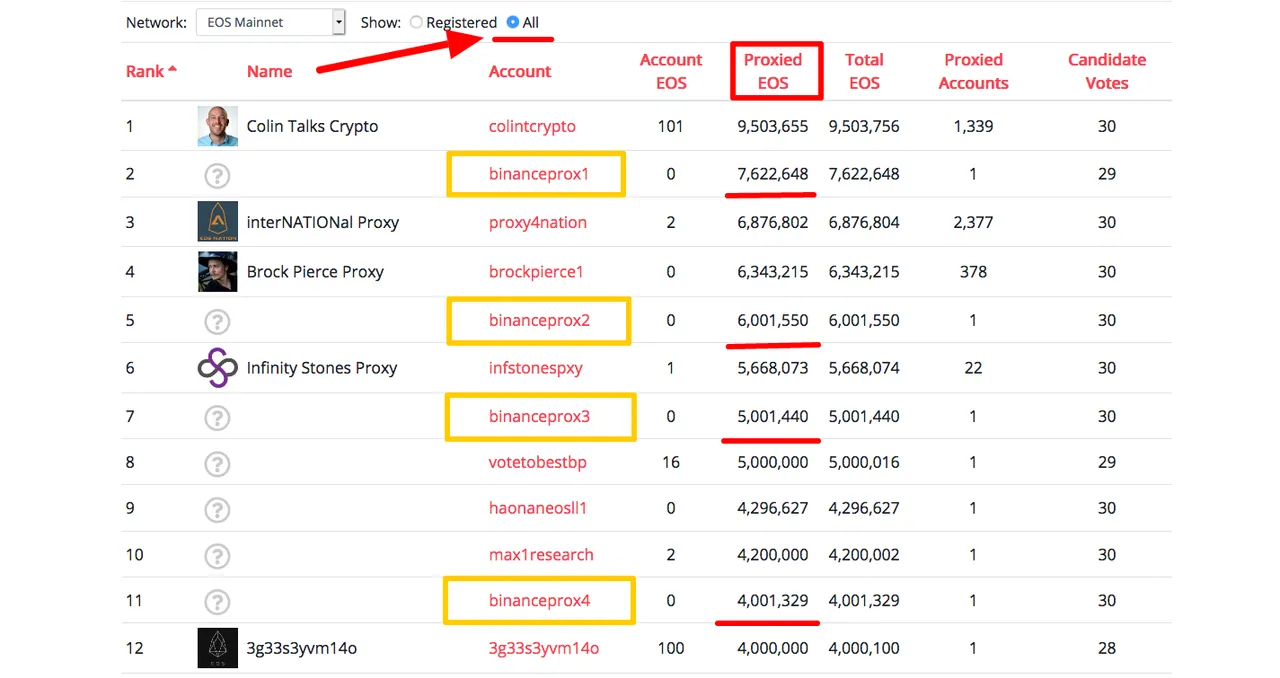

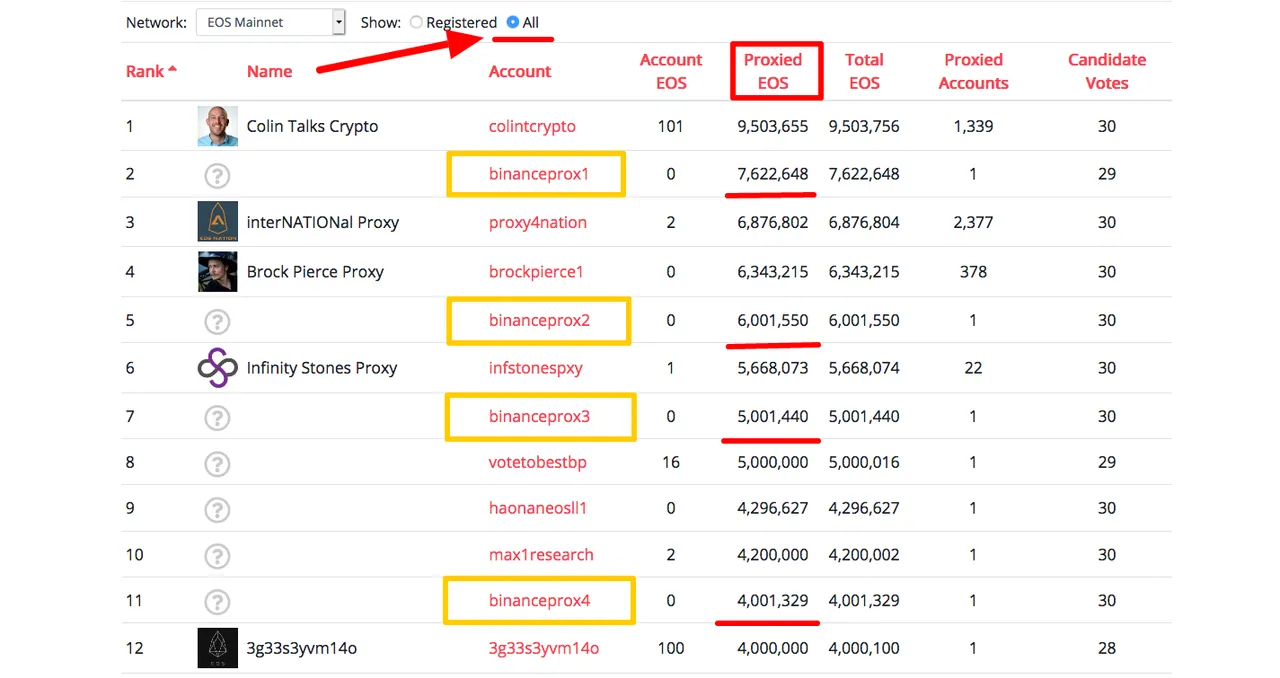

As we can see by the registered vote proxy rankings, courtesy of Aloha Eos, community run accounts appear to be doing fairly well when it comes to proxy services.

https://www.alohaeos.com/vote/proxy#reg

@colintalkscrypto proxy leads the way with over 9.5 million EOS tokens.

We can add an additional 2.4 million EOS tokens delegated to the Colin Talks Crypto Rewards voter proxy. A total of almost 12 million tokens.Over 2,500 individual accounts have delegated their Block Producer Votes to these 2 accounts alone.

Another prominent name in the EOS community is Brock Pierce who also runs a popular voter proxy, brockpierce1, which currently sits in the #3 spot with 6.3 million EOS tokens.

A total of 378 accounts contribute to Pierce's voter proxy

All EOS Vote Proxy Accounts

The picture changes dramatically if we include ALL vote proxies.

Take a look at the number of exchange proxies that move into the top rankings.

If want to understand why so many exchange Block Producers are voted into the EOS Top 21 BPs, then this will help explain how this is accomplished.

https://www.alohaeos.com/vote/proxy#all

Binance just recently announced on March 11th their participation in EOS Block Producing, joining fellow crypto-exchanges Bitfinex and Huobi who have been running BPs since the launch of the EOS mainnet.

Already, we can see that Binance's delegated voting power in the top 12 voter proxies represents a substantial amount - 22 million EOS tokens.

But this is only the tip of the iceberg.

Three major exchanges: Binance, Huobi and Bitfinex exert a substantial amount of influence over the selection of the Top EOS Block Producers with their individual power. Taken together, their disproportionate influence over the EOS blockchain poses a significant threat to the ecosystem.

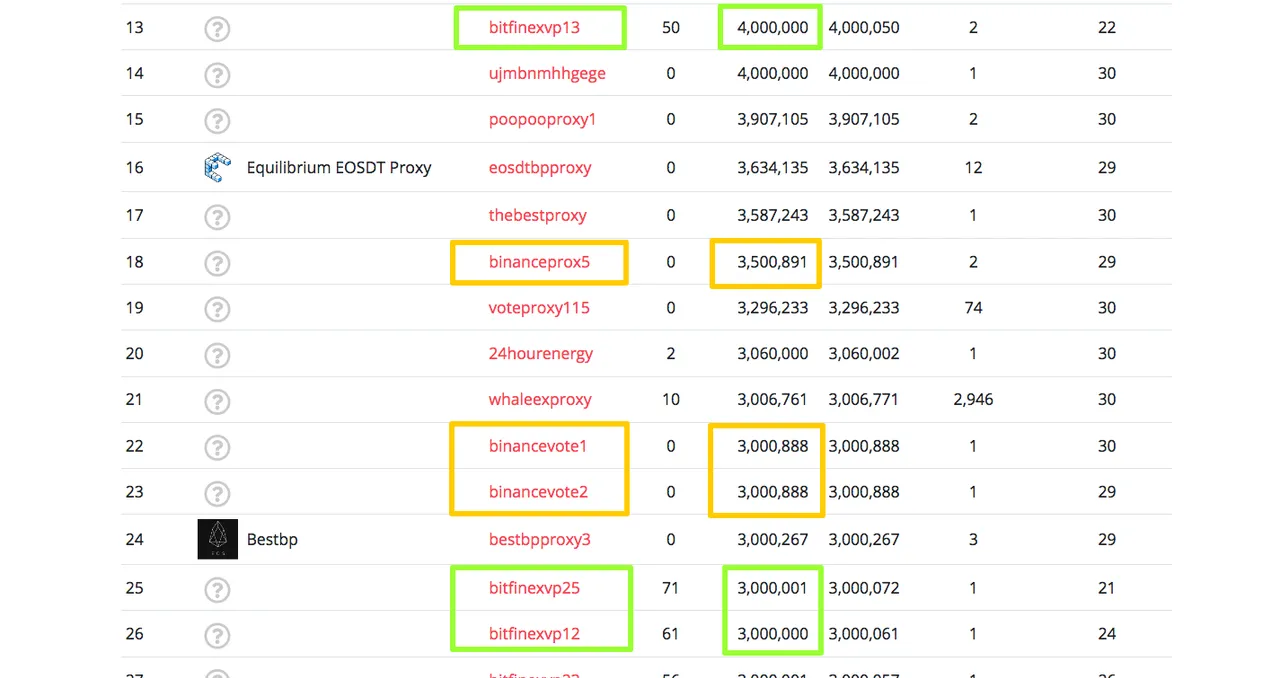

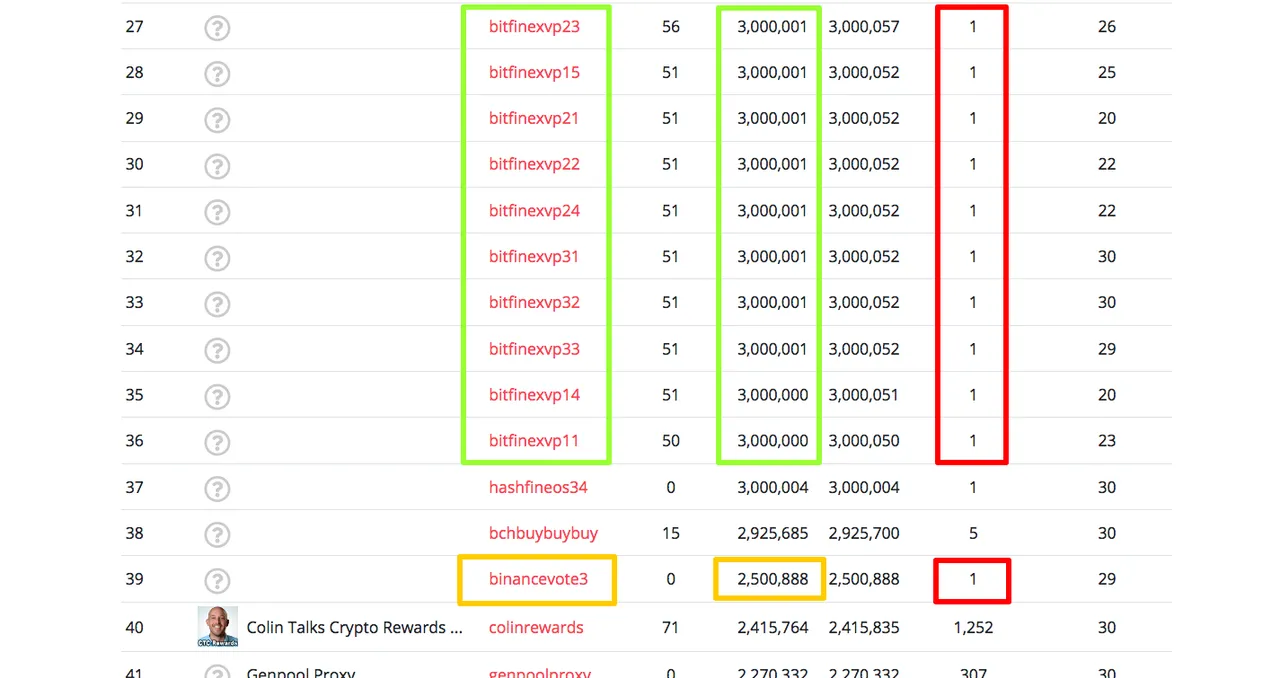

Lets widen the scope and move beyond the Top 12 proxies take into consideration the top 130 Vote Proxies on the EOS chain.

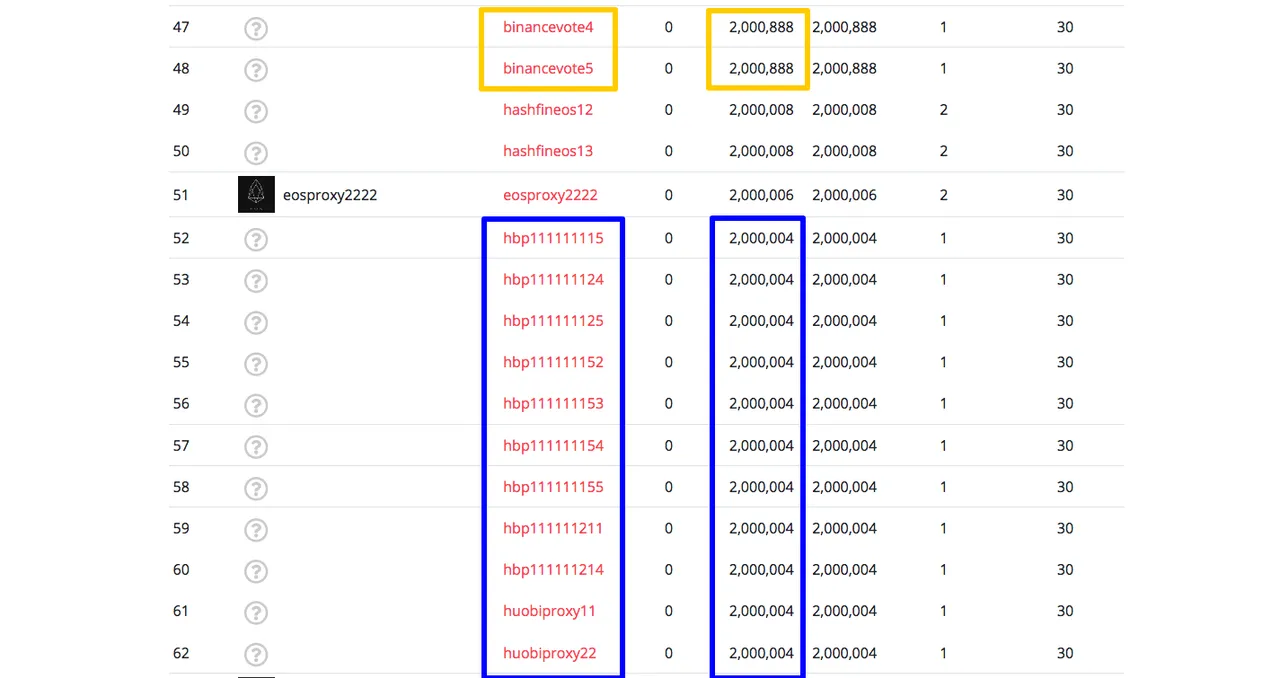

Binance Vote Proxy Accounts (min. 1 million VP)

| Rank | Proxy | EOS Amount | Primary Delegator |

|---|---|---|---|

| 2 | binanceprox1 | 7,622,648 | binancecold1 |

| 5 | binanceprox2 | 6,001,550 | binancestak2 |

| 7 | binanceprox3 | 5,001,440 | binancestak3 |

| 11 | binanceprox4 | 4,001,329 | binancestak4 |

| 18 | binanceprox5 | 3,500,891 | binancestak5 |

| 22 | binancevote1 | 3,000,888 | binancestaka |

| 23 | binancevote2 | 3,000,888 | binancestakb |

| 39 | binancevote3 | 2,500,888 | binancestakc |

| 47 | binancevote4 | 2,000,888 | binancestakd |

| 48 | binancevote5 | 2,000,888 | binancestakf |

| 83 | binanceprxy2 | 1,250,888 | binancestakh |

| 84 | binanceprxy3 | 1,250,888 | binancestaki |

| 100 | binanceprxy4 | 1,000,888 | binancestakj |

| 101 | binanceprxy5 | 1,000,888 | binancestakk |

Total VP: + 37 Million EOS

Bitfinex Vote Proxy Accounts (min. 1 million VP)

| Rank | Proxy | EOS Amount | Primary Delegator |

|---|---|---|---|

| 13 | bitfinexvp13 | 4,000,000 | bitfinexcw13 |

| 25 | bitfinexvp25 | 3,000,001 | bitfinexcw25 |

| 26 | bitfinexvp12 | 3,000,001 | bitfinexcw12 |

| 27 | bitfinexvp23 | 3,000,001 | bitfinexcw23 |

| 28 | bitfinexvp15 | 3,000,001 | bitfinexcw15 |

| 29 | bitfinexvp21 | 3,000,001 | bitfinexcw21 |

| 30 | bitfinexvp22 | 3,000,001 | bitfinexcw22 |

| 31 | bitfinexvp24 | 3,000,001 | bitfinexcw24 |

| 32 | bitfinexvp31 | 3,000,001 | bitfinexcw31 |

| 33 | bitfinexvp32 | 3,000,001 | bitfinexcw32 |

| 34 | bitfinexvp33 | 3,000,001 | bitfinexcw33 |

| 35 | bitfinexvp14 | 3,000,001 | bitfinexcw14 |

| 36 | bitfinexvp11 | 3,000,001 | bitfinexcw11 |

Total Voting Power: + 40 Million EOS

Huobi Vote Proxy Accounts (min. 1 million VP)

| Rank | Proxy | EOS Amount | Primary Delegator |

|---|---|---|---|

| 52 | hbp111111115 | 2,000,004 | vkjvkpuacezv |

| 53 | hbp111111124 | 2,000,004 | vivqpskirjzu |

| 54 | hbp111111125 | 2,000,004 | vzianygrhbfw |

| 55 | hbp111111152 | 2,000,004 | vqcblruvzlwc |

| 56 | hbp111111153 | 2,000,004 | vjohgywduxao |

| 57 | hbp111111154 | 2,000,004 | vkoklywxljua |

| 58 | hbp111111155 | 2,000,004 | vzbidyoaimrs |

| 59 | hbp111111211 | 2,000,004 | vdxjamspwcsu |

| 60 | hbp111111214 | 2,000,004 | vbioinjpihiw |

| 61 | huobiproxy11 | 2,000,004 | vqbhjbutawdh |

| 62 | huobiproxy12 | 2,000,004 | vvxrnzjhscdd |

| 108 | hbp111111112 | 1,000,004 | vqsaeptppqwh |

| 109 | hbp111111113 | 1,000,004 | vawzvsywbzcc |

| 110 | hbp111111114 | 1,000,004 | vkjqbqmcgwhl |

| 111 | hbp111111121 | 1,000,004 | vrtazlypvgms |

| 112 | hbp111111122 | 1,000,004 | vgjfergnllqs |

| 113 | hbp111111123 | 1,000,004 | vzcfbwbopixl |

| 114 | hbp111111131 | 1,000,004 | vwfrnbatpqfk |

| 115 | hbp111111132 | 1,000,004 | vuitojlalnau |

| 116 | hbp111111133 | 1,000,004 | vuvcfrlxuybq |

| 117 | hbp111111134 | 1,000,004 | vcbvryecdfmf |

| 118 | hbp111111135 | 1,000,004 | vbfckwhdgxek |

| 119 | hbp111111141 | 1,000,004 | vcunsramljcp |

| 120 | hbp111111142 | 1,000,004 | vjzzetgbwxhy |

| 121 | hbp111111143 | 1,000,004 | vlbaknpwsbms |

| 122 | hbp111111144 | 1,000,004 | vqeqwkusyemy |

| 123 | hbp111111145 | 1,000,004 | vjlzgftdoold |

| 124 | hbp111111151 | 1,000,004 | vwwguqqvbvnl |

| 125 | hbp111111212 | 1,000,004 | vdvrbmlpacqz |

| 126 | hbp111111213 | 1,000,004 | vqgwndvowlxq |

| 127 | hbp111111215 | 1,000,004 | vdajkuqngxkp |

| 128 | hptproxy3333 | 1,000,004 | vcloumeeyyoq |

| 129 | hptproxy4444 | 1,000,004 | vmdfotdurgjj |

| 130 | huobiproxy44 | 1,000,004 | vedyutqmysbe |

Total Voting Power: + 45 Million EOS

Binance vp: 37,000,000 EOS

Bitfinex vp: 40,000,000 EOS

Huobi vp: 45,000,000 EOS

Combined vp: 122,000,000 EOS

*Block.one vp: 100,000,000 EOS

*At time of mainnet launch (10% of total supply)

The fact that the major exchanges have enough combined voting power to eclispse Block.one is worth noting.

Does this mean that they will try to overthrow EOS DPOS governance?

Of course not, but considering what we witnessed on the Steem blockchain - which includes actions by two of the very same exchanges that colluded with Justin Sun take control of Steem - it's certainly not out of the realm of possibility.

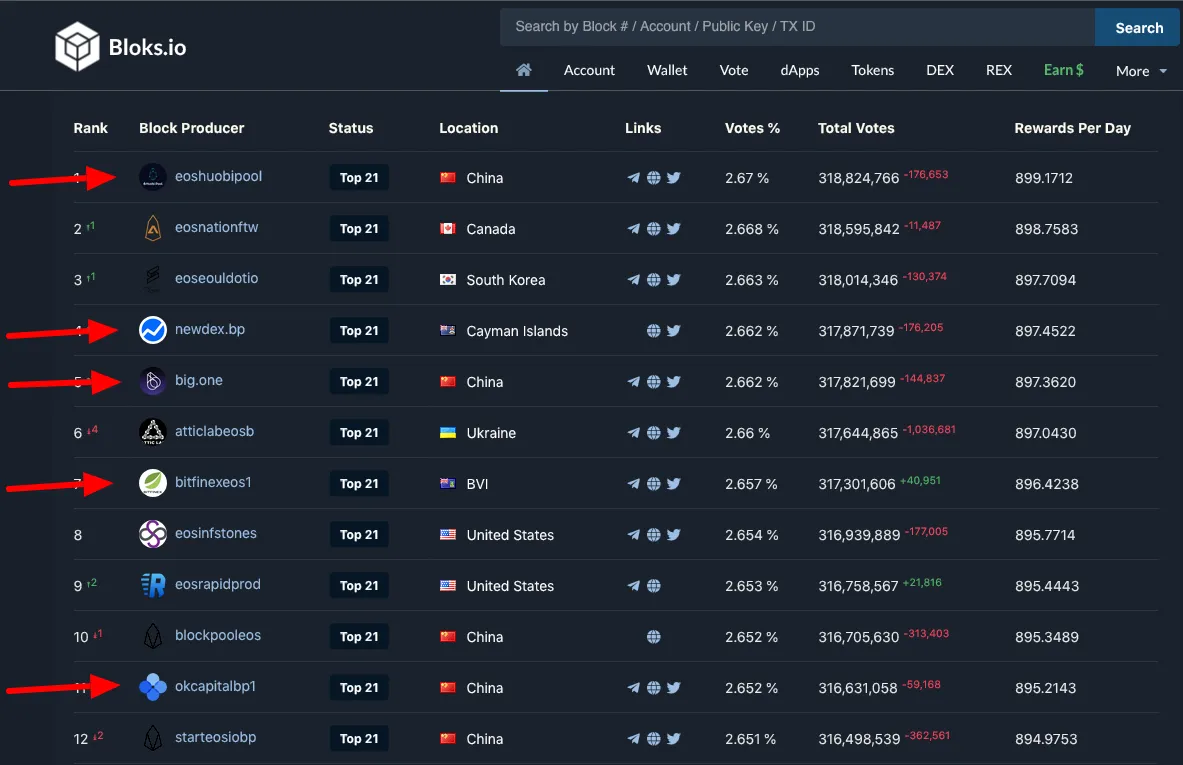

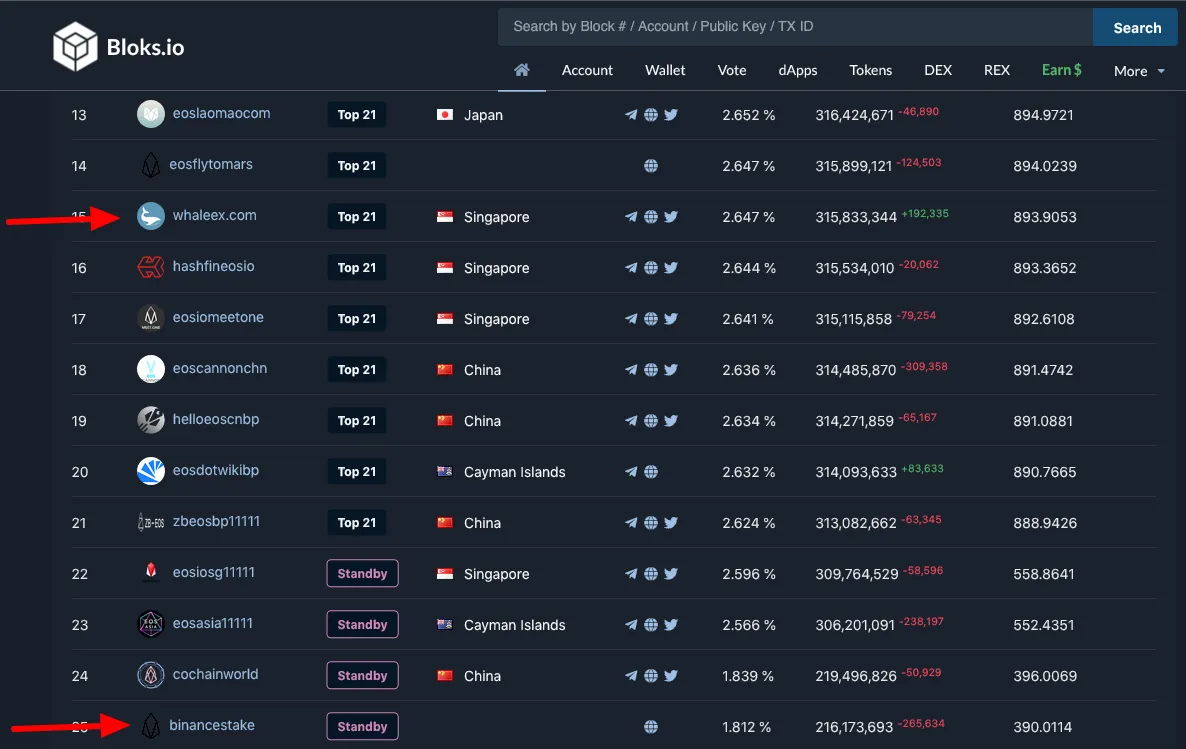

Exchange Block Producers

Currently, the EOS Top 21 Bps are a mix of exchange BPs, community accounts and large stake holder accounts.

https://bloks.io/

https://www.alohaeos.com/vote

Exchange Block Producers in the Top 40

| Exchange | Account | Daily/EOS | *Est.Month/EOS | *Est.Month/USD |

|---|---|---|---|---|

| Huobi | eoshuobipool | 899.1712 | 26,975.136 | $ 73,642.00 USD |

| NewDex | newdex.bp | 897.4522 | 26,923.566 | $ 73,500.00 USD |

| BigOne | big.one | 897.362 | 26,920.860 | $ 73,492.00 USD |

| Bitfinex | bitfinexeos1 | 896.4238 | 26,892.714 | $ 73,418.00 USD |

| OkEx | okcapitalbp1 | 895.2143 | 26,856.429 | $ 73,317.00 USD |

| WhaleEx | whaleex.com | 893.9053 | 26,817.159 | $ 73,202.00 USD |

| Binance | binancestake | 390.0114 | 11,700.342 | $ 31,914.00 USD |

| Hoo | hoo.com | 292.9837 | 8,789.511 | $ 23,994.00 USD |

| Binance | truststaking | 216.2218 | 6,486.654 | $ 17,710.00 USD |

[* Estimated based on EOS valuation of $2.73 USD]

The Top EOS BP is Huobi's eoshuobipool which earns roughly $74k per month from producing blocks (at time of writing).

Huobi proxies vote for a mix of exchanges and community accounts. However, there is a pattern of vote trading with other exchange BPs.

Presently, Huobi doesn't vote for Binance BPs but does provide alternating votes for: bitfinexeos1, big.one, whaleex.com, okcapitalbp1, hoo.com and newdex.bp.

Though Binance could soon push to the top of EOS BPs, for the time being, they are content to sit just outside of the Top 21 at #25.

Binance proxies provide interspersed votes to several other exchange BPs : bitfinexeos1, whaleex.com, big.one, and hoo.com.

Perhaps the exchange prefers not to attract too much attention since launching their two BPs on March 11th 2020. That's right, there are two Binance BPs in the Top 40 after being in operation for less than 30 days.

Binance launched a second BP on March 11th - truststaking BP. Together, Binance's BPs earn close to $50k monthly for the exchange in just their first month of operations. A sum only expected to increase as Binance climbs the BP rankings into the Top 21.

Rankings

#25 Binancestake

#35 Truststaking

binancestake

https://bloks.io/account/binancestake

Created: Feb. 5, 2020

Registered BP: March 11, 2020

Website: www.binance.com

truststaking

https://bloks.io/account/truststaking

Created Feb. 10, 2020

Registered BP: March 11, 2020

Website: www.binance.com

Exchanges Extracting Profits

Exchanges provide important services by supporting various crypto-currency tokens, such as providing liquidity and access to potential buyers and traders.

But what is the benefit to the native blockchain having multiple exchanges extracting hundreds of thousands of dollars worth of tokens and providing little in return?

Block.one

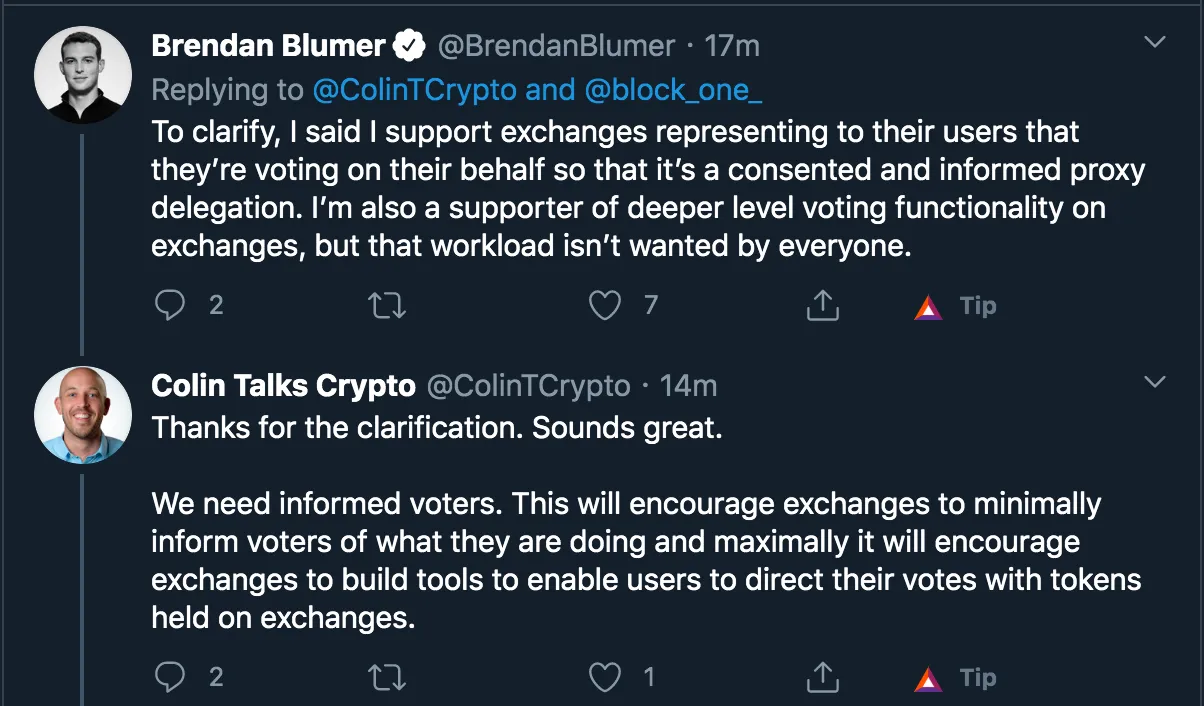

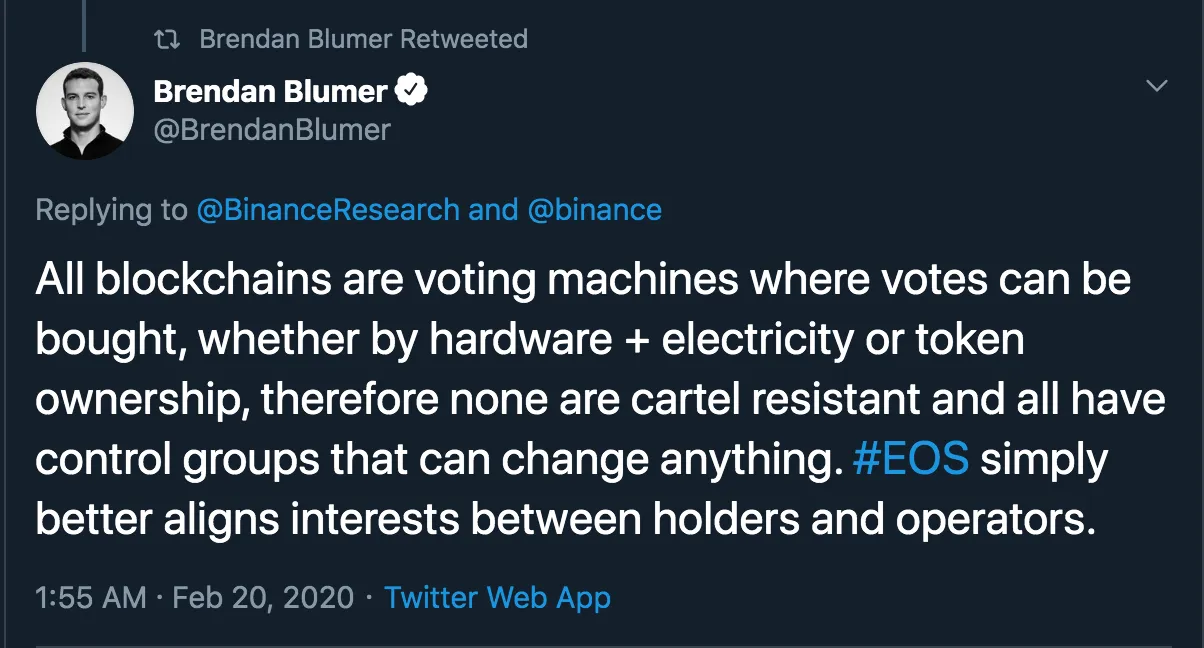

For more than a year, Block One's CEO Brendan Blumer has repeatedly stated that the system is working exactly how it was designed.

It's hard to imagine how multiple exchange and whale accounts continuously milking the ecosystem for profits is going according to plan.

Blumer argues that no public blockchain is immune to cartels and that the best solution is to incorporate vote buying and selling into the ecosystem. This way, he claims, overtime the majority interests will be aligned.

From his perspective, the B1 CEO sees that onchain governance will be controlled by the largest stakeholders regardless. That take overs are a feature of blockchains and not a flaw.

Staking on Exchanges

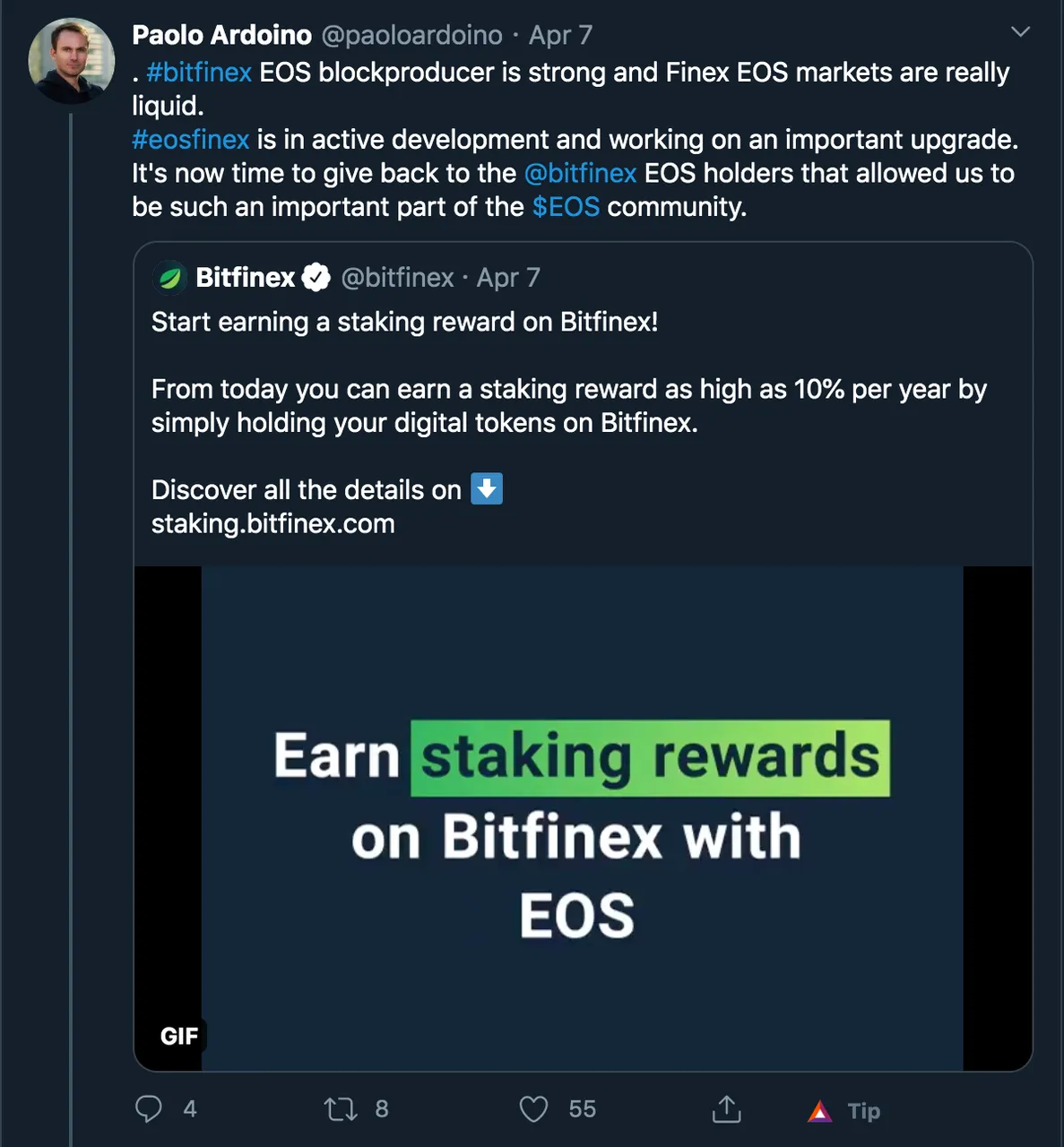

The majority of the leading crypto exchanges are now rolling out a variety of "staking" features of some of the most popular tokens on the market. Binance, Bitfinex, OkEx, along with Huobi are offering their customers the chance to earn passive income on their holdings by staking them to their exchanges.

https://www.binance.com/en/staking

https://www.huobiwallet.com/en/staking

https://staking.bitfinex.com/

[For informational purposes only, do not stake your tokens here]

Effectively, customers are asked to forfeit their voting rights as token holders in exchange for earning a small dividend/rebate.

This new flood of announcements regarding 'staking' comes at a curious time. For instance, both Huobi and Bitfinex have been employing user funds without providing any rewards for the entire existence of the EOS blockchain. Why the change of heart?

Here, we come full circle to the Steem Hostile Take Over. Exchanges were caught red handed misappropriating user funds and 'staking' the tokens to control the Steem blockchain.

Exchanges are rushing to gloss over the fact that they make a handsome profit off of their user funds.

Suddenly however, they have had a change of heart and would like to 'give back to the community'! It seems that hijacking of the Steem blockchain by centralized exchanges has also exposed their boundless profiteering.

"Dear valued customers, out of pure generosity we've decided it's about time that we share our rewards with our stakeholders. We're now offering you a 1%-3% reward for staking your tokens on our exchange. It's a win-win situation!"

Except...

Not your keys. Not your crypto.

You have no say in governance and your tokens are now controlled by a single entity that will act in their best interest - not the best interests of the token holder.

Exchanges are purely profit driven, their objective is to extract as much value from the ecosystem as possible. They do not care about their users and they do not care about decentralized governance.

Solutions to Centralized Control

Keep your tokens off of centralized exchanges.

There are other ways to earn passive income ONCHAIN. Users can stake their EOS CPU and NET then proxy your votes to a community based vote proxy. If you stake to @colintlakscrypto's reward proxy you will earn daily. He makes zero profit from the account and has pledged to only vote for BPs that add value to the EOS chain with full transparency.

Conclusion

Staking to the major exchanges helps to calcify exchanges in the EOS top producer ranks and centralizes EOS DPOS governance.

If we listen to those defending vote trading, buying and selling as an inevitable feature of DPOS governance then we're essentially consenting to being ruled by crypto cartels as monarchs of the space.

Let's do better.

Let's build better governance models rather than settling for rule by the richest and most powerful.

My prediction is that the Binance BPs will slowly but surely enter the Top 21 BPs, joining their fellow exchanges Huobi and Bitfinex in order to extract even greater rewards.

Update

These Tweets were posted just as this post was being completed...