Towfiqu barbhuiya | Unsplash

Monero is probably the cryptocurrency best known for its ability to maximize privacy. Thanks to complex encryption techniques, Monero succeeds in ensuring the anonymity of transactions, making it impossible to trace.

This could imply, on one hand, an improvement in privacy and confidentiality, but on the other hand, it is a technology that must be approached with caution because it can be used for other purposes such as money laundering or some type of criminal activity (payments).

While a technology is not created for these purposes, there will always be the possibility of misuse, and that is when many entities must intervene and take the initiative to put a stop to them, or at least exclude them from their platforms where people have open access to their market.

As a technology, Monero uses ring signatures to make tracking a transaction more difficult, in addition to having an interesting feature; it is fungible. What this means is that one coin has the ability to be substituted for another, making it impossible for an address with coins suspected of being involved in any illegal activity to be blacklisted or excluded if there are suspicions or real evidence.

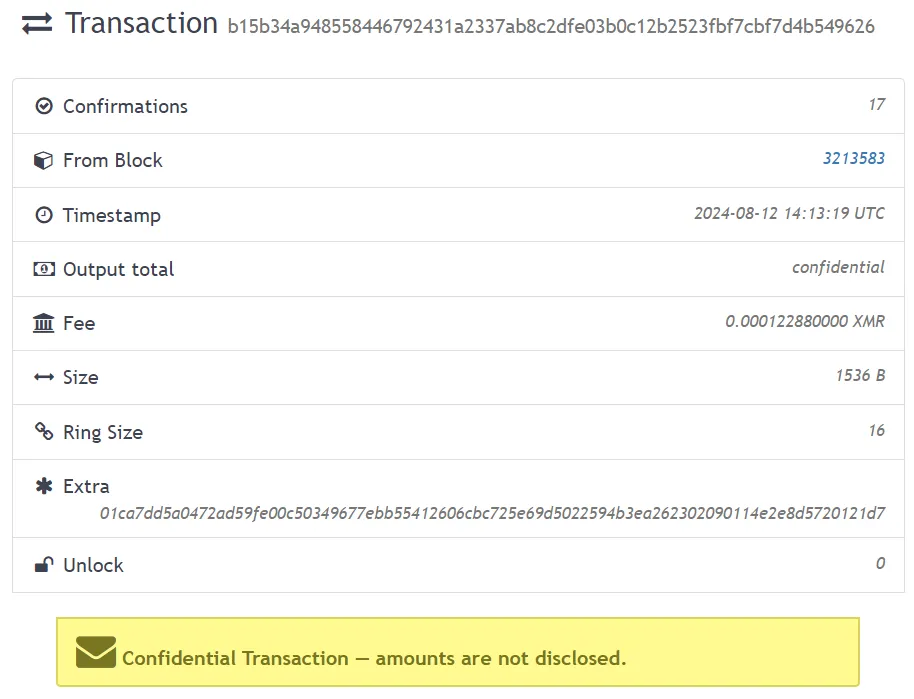

In fact, if we go to the block explorer, we will see a notable difference compared to traditional cryptocurrency explorers. The information that can be found is less, and we may even see a legend that says, "Confidential Transaction — amounts are not disclosed."

Something that has been noteworthy was Binance's decision to remove Monero (XMR) from its platform. This decision had been made in February, but we know it is not a simple task, as multiple steps must be taken. Today they have announced the final steps for this to happen.

The plan involves converting balances to USDC (USD Coin) as the preferred currency. This will take effect from September 2 of the current year, and the new balances will be available on March 1, 2025.

Additionally, there are 15 other assets being added to the list that share the same conversion rate parameter. The rate is set based on the average exchange rate between the mentioned dates. For those who do not wish to convert, they can withdraw their assets by September 1, 2024.

The truth is that many exchange platforms have made the decision to delist this coin due to compliance issues with regulatory frameworks. By not making this decision, these problems could affect the exchange itself and cause inconveniences for its current CEO.

It is worth mentioning that the price of XMR has fallen very slightly considering that it will gradually stop being available on Binance. In fact, at this very moment it has a decrease of 0.9%, with a price of $148.78 according to CoinGecko.

At some point, regulatory pressure could lead to these decisions being made hastily, and that is when users might find themselves somehow involved, having to decide what to do with their funds, provided that the centralization of these systems allows it.

Cryptocurrencies like Zcash and Dash could also face a similar fate due to the similarity in the infrastructure on which they were built, leading to practically the same unfortunate uses. Although each deviates towards notably different uses that greatly contribute to the technology itself, they share the goal of enhancing privacy and confidentiality to the maximum level.

- Main image edited in Canva.

- I have consulted information in decrypt.co and wikipedia.org.

- Capture of a block explorer of a random transaction.

- I have used Hive Translator to translate from Spanish to English.