Kanchanara | Unsplash

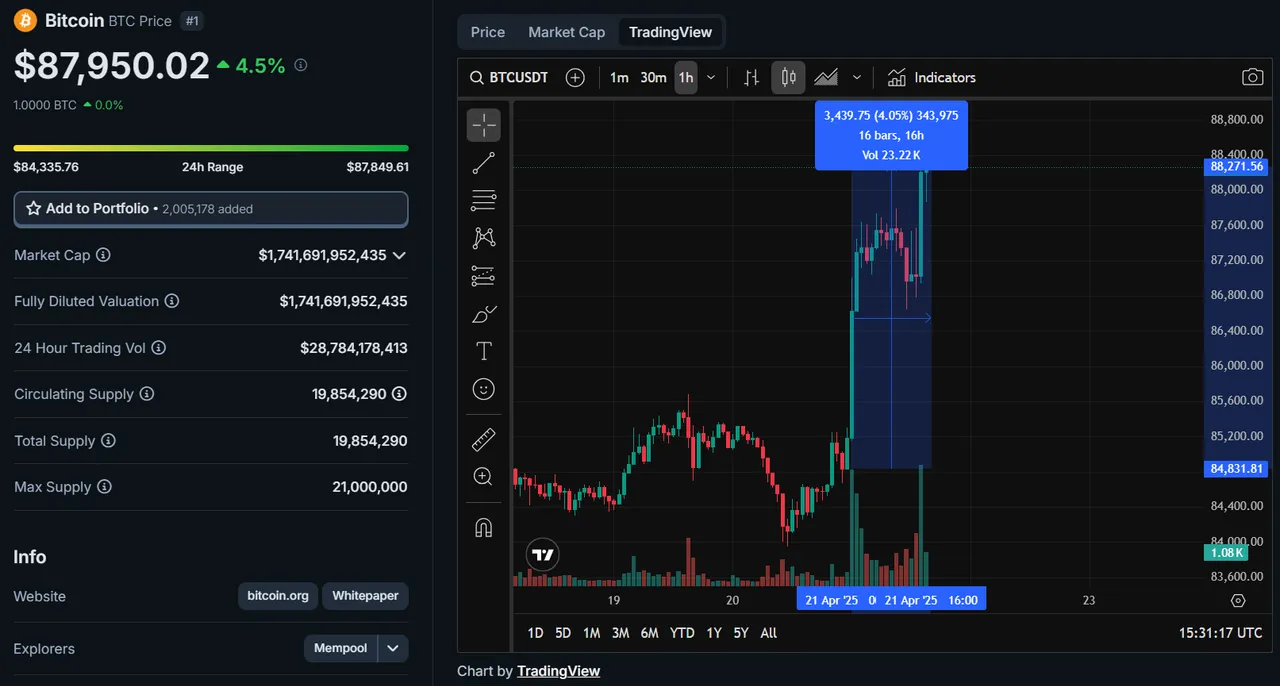

After a season with dramatic prices affected by international politics, Bitcoin has staged a substantial recovery that allowed its price to reach $87,600 dollars this Monday, in Asian trading hours. Moreover, that rise has marked a 3.6% increase in 24 hours, with an incredible $24.5 billion in volume.

Bitcoin Price | CoinGecko (TradingView)

All indications are that things have calmed down since Donald Trump imposed a series of tariffs through Liberation Day, which had triggered a general price drop in the asset market. Apparently, this rebound happens as a means in which saving in Bitcoin and gold are measures opted by investors to cope with inflation. According to Vincent Liu, chief investment officer at Kronos Research, the rally has transcended due to the expansion of the M2 money supply, which managed to drive increases around global liquidity.

Several indicators are showing positive Bitcoin performance. The Fear & Greed index is almost at 40 points, which inclines us to approach a zone of confidence. On the other hand, the S&P 500 RSI (14), measured over 14 days, represents the performance that the currency in question has had during this time. There is also a DXY index that relates to the US dollar, which showed a drop of 98.5, which would somehow coincide with the idea of the transition to Bitcoin. This situation occurs under a context in which President Trump seeks to oust Jerome Powell; Chairman of the Federal Reserve.

Another thing to keep in mind is that Trump had announced on April 10 the 90-day tariff exemption, which would be adopted by those countries that did not participate in the retaliation. This favored the perception of indicators such as NUPL and MVRV-Z which managed to see a significant improvement. However, the last word is not yet given, and investors are managing with some caution, but applaud a market recovery in a considerably short response time.

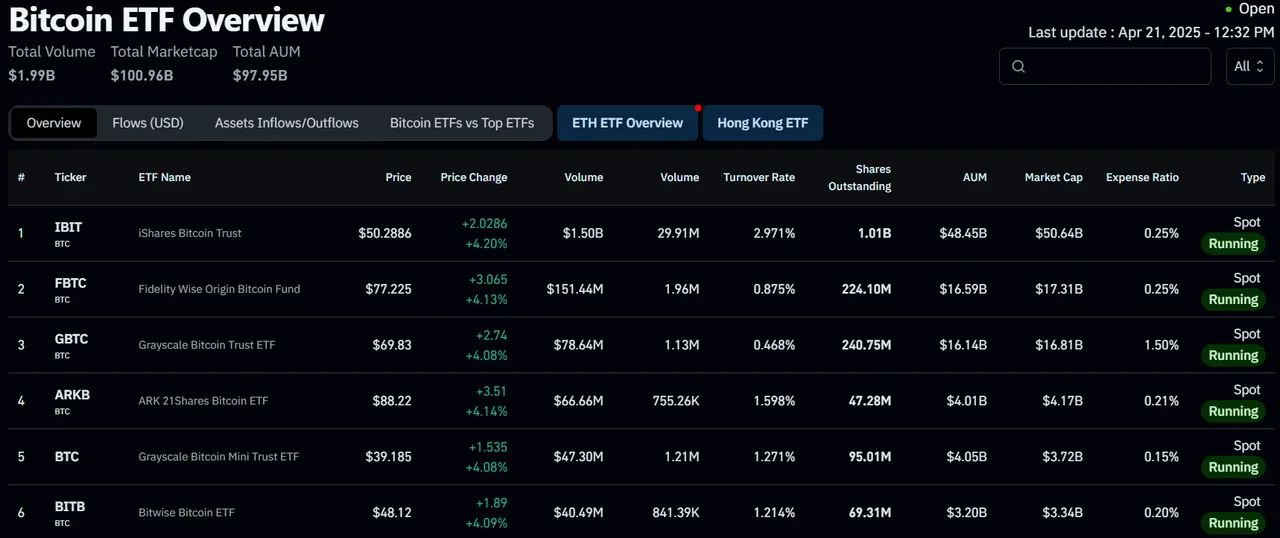

Bitcoin ETF Overview | CoinGlass

This situation also positively affects the institutional market, where we can find Bitcoin ETFs. Last week's flows showed that $12.7 million in net flows have been recorded, which represents a considerable sum with respect to the values in the red we had seen the previous week, although it must be said that it is still the lowest level since the beginning of this year.

By no means could we be assured of a bullish season, but we are seeing that this could lead to greater volatility in the price of the main cryptocurrencies, reflecting market activity in all its variants, under a key purpose.

There are some decisions being considered that could affect the way investors and shareholders conduct their operations. The cautious stance that is being preserved right now makes sense as we wait for further decisions to be made by the Fed, which could lead to significant financial stability with respect to the overall markets, as well as a more consistent flow of capital.

- Information consulted in decrypt.co.

- Main image edited in Canva.

- Translated into English with DeepL.