brayan garcia | Unsplash

Despite what is happening in the world in terms of geopolitical concerns, institutional investors continued to make investments in a tenth consecutive week. According to CoinShares, it is estimated that these inflows would set the year's totals at around $15.1 billion.

After coming from pronounced trading activity in the week, there was an apparent slowdown, which factors responsible could be the closure of the markets due to the June 19 holiday in the US, although we could also consider the entry into conflict with Iran, in support of Israel.

In cases where a series of geopolitical events occur, markets react unpredictably. There are those who take advantage of an opportunity to make purchases in high volumes, while other traders panic by divesting themselves of certain assets, or else behavior is reflected in the liquidation of positions.

The words of CoinShares' head of research, James Butterfill, anticipate the likelihood of seeing “minor panic outflows”, while an evident instability in prices could be the entrance to a greater increase in positions.

We can say that markets have become more susceptible to what is happening in the world. If we make the effort to recall similar situations, we could appreciate a substantial fall in the prices of the main cryptocurrencies, which in turn caused the exit of relevant positions. Currently, situations such as the war in the Middle East do not generate the same impact as in other times, which means that there has been a gradual change in the way institutions gain confidence in the cryptocurrency market.

Behnam Norouzi | Unsplash

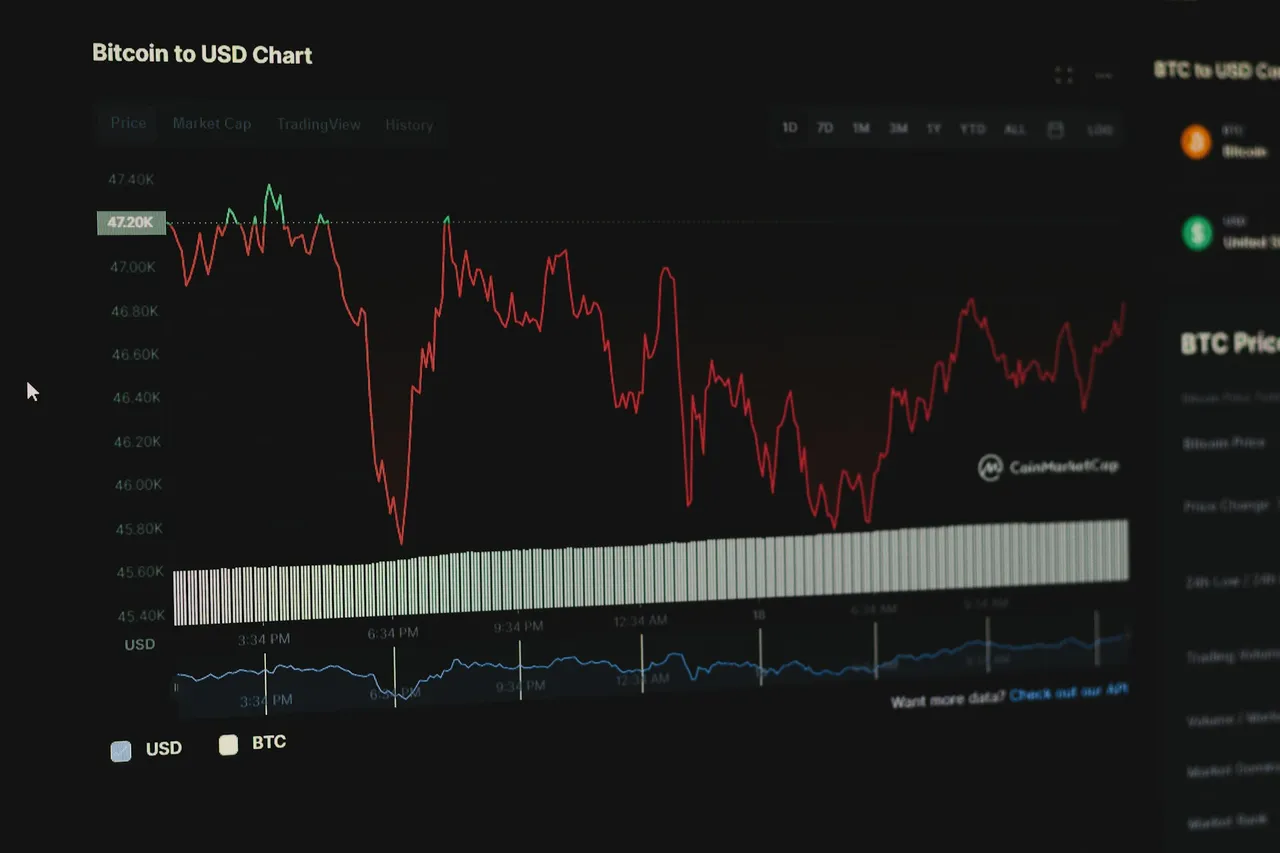

In many cases uncertainty is a substantial factor in the decision of cryptocurrency markets, as well as other areas. Bitcoin had been below $100,000 dollars, until the release of highly relevant details of the operation ordered by President Trump to put an end to the imminent danger posed by Iran's possession of nuclear weapons.

It was confirmed that three nuclear plants had been destroyed, along with any advances that may have been made over the course of years. This generated instant repercussions, as well as a thin line of debate and public discontent. On the other hand, China spoke out against the decisions made by Trump, increasing tensions and opening up a range of not very encouraging possibilities.

Bitcoin's recovery may have been due to this last fragment, considering the eradication of a latent threat to the world, or so we understand. Other countries aligned with Iran suggested the administration of war material, which could in some way negatively impact the market, again.

With this in mind we can affirm that the leading cryptocurrency par excellence in attracting the attention of the financial public. It is estimated that at least $1.1 billion has come in, even taking into account price corrections, meaning 88.7% of the inflows as a whole. According to CoinShares, an unpronounced bearish sentiment has manifested itself in traders, leading to the outflow of $1.4 million.

So too has Ethereum regained ground, following a 9-week streak of key inflows, in which $124 million has come in, with cumulative inflows reaching $2.2 billion. In parallel, altcoins such as Solana and XRP have achieved an inflow of $2.78 million and $2.69 million respectively, thus representing a notable importance in terms of how investors choose to diversify their funds.

- Main image edited in Canva.

- Information consulted in: decrypt.co.

- Translated to English with DeepL.