MΛTΞ | Unsplash

We know that meme currencies versus utility cryptocurrencies are mostly driven by pure speculation. This somehow allows for the movement of high volatility, but could also incur large losses. Still, memecoins tend to become popular because of the hype that acts on them, causing people who are interested to buy them and keep them in their wallets. Although it should be noted that there are also communities that support them, which means that if you are part of that community, you have probably made a substantial purchase as well.

They usually have no utility, and at most, the meme project itself offers some benefits for owning that memecoin, such as discounts, access to certain features, but in itself, there is no specific utility. Obviously, as in everything, there are exceptions to the rule, but these do not represent the essence of a meme coin.

There was a time when it was thought why memecoins became so popular and managed to generate greater impact than traditional currencies, represented by their technology and usability. It is very striking to think about how it all started, which in my opinion was when we met Doge. Although it was a long time ago, we noticed a beginning of what would later be taken up on a larger scale, and we met Shiba Inu, and many others that were born at an accelerated pace. Over time everything became more elaborate, with huge marketing campaigns, advertising, incredible websites, and a faithful and powerful community, which reflected its potential in the statistics in all social networks. That undoubtedly was a great merit for the growth of memecoin.

Now let's think about which direction the market is heading. One of the most influential people in the field of cryptocurrencies is probably Changpeng Zhao, or as he is often called “CZ”. He is none other than the former CEO and co-founder of Binance, who has spoken out on this issue that generates a debate in which we somehow wonder if we should dispense with pure speculation.

The answer might be a no-brainer, but the market has changed drastically, which means that we have to go through a process of adaptation if we are positioned as traders or builders. For his part, CZ shows he has no interest in this sector, although he makes it clear that he is not against it either. This means that the general cryptocurrency sector can perfectly coexist with memecoins, but that this is not the central point of the matter.

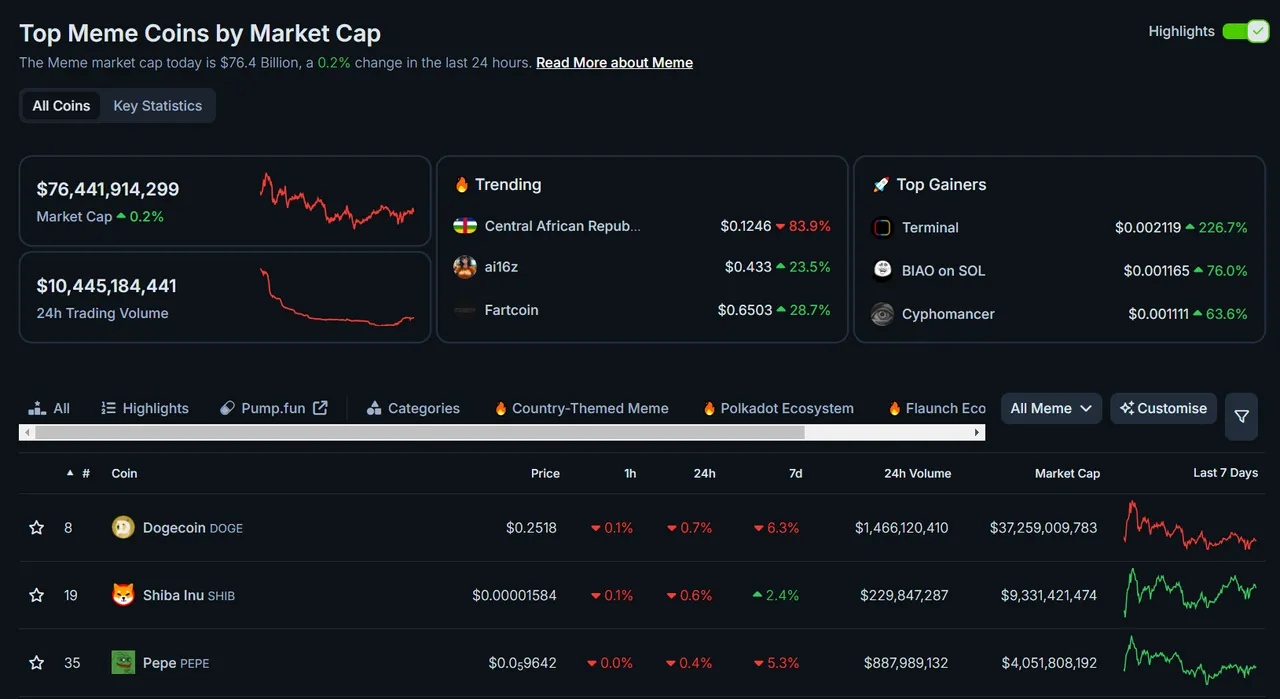

Top Meme Coins by Market Cap on CoinGecko

In Zhao's words, the growing origin of memecoins began when the process of regulating cryptocurrencies reached its most drastic point, making demands on cryptocurrencies that had great growth potential, claiming that these utility tokens were actually securities. Let's remember that the regulatory agency called “U.S. Securities and Exchange Commission” (SEC) was in the hands of Gary Gensler, who used to have an offensive and even intrusive position towards certain cryptocurrencies, resulting in an impediment to their growth. Well, if we go to the subject, many of the companies, large firms, and partnership projects, could not move forward with those planned investments or collaborations, at least not until the case has been resolved.

It is thought that with the new administration of Donald Trump, the perspective and position towards cryptocurrencies will become much friendlier. This could in some way mean a wider adoption that favors the market, and in a similar way to the growth of the technologies that will be built from now on.

In this crypto space there are things that don't seem to make sense, or at least, that really catch our attention. One concise example we can mention is a video tutorial by BNB Chain, intended to teach about launching memecoins on the Four.Meme site. At the time of launching the test token (TST), a lot of speculation began that made its market capitalization rise to $500 million, although it would later fall sharply. After the video was removed, several of the Chinese influencers continued to support it, which led to massive purchases making its price tend to rise. In this case CZ maintained that it had nothing to do with this unprecedented situation, nor did BNB Chain, and that it was only a test token.

He also pointed out that the listing of cryptocurrencies is not working properly, since there is a gap of 4 hours from the announcement until it is listed, which influences a lot if we take into account that in many occasions that token is traded first in a DEX, where there has been a strong tendency to buy, and later, when the CEX lists it, it could happen that a series of massive sales take place. That is, in those four hours, it is possible to make a kind of price manipulation, but we could also fall into scams because in decentralized markets, we could find projects of dubious origin, unaudited or poorly regulated.

Probably the best bet is to play it safe. In this case Changpeng Zhao prefers not to invest in Bitcoin or BNB at all, which represents an absolute belief in the good future and growth of these cryptocurrencies. For one thing Bitcoin has reached and surpassed the big $100,000 mark, and with new policies that will begin to favor cryptocurrencies, it is likely to be pleasantly surpassed again.

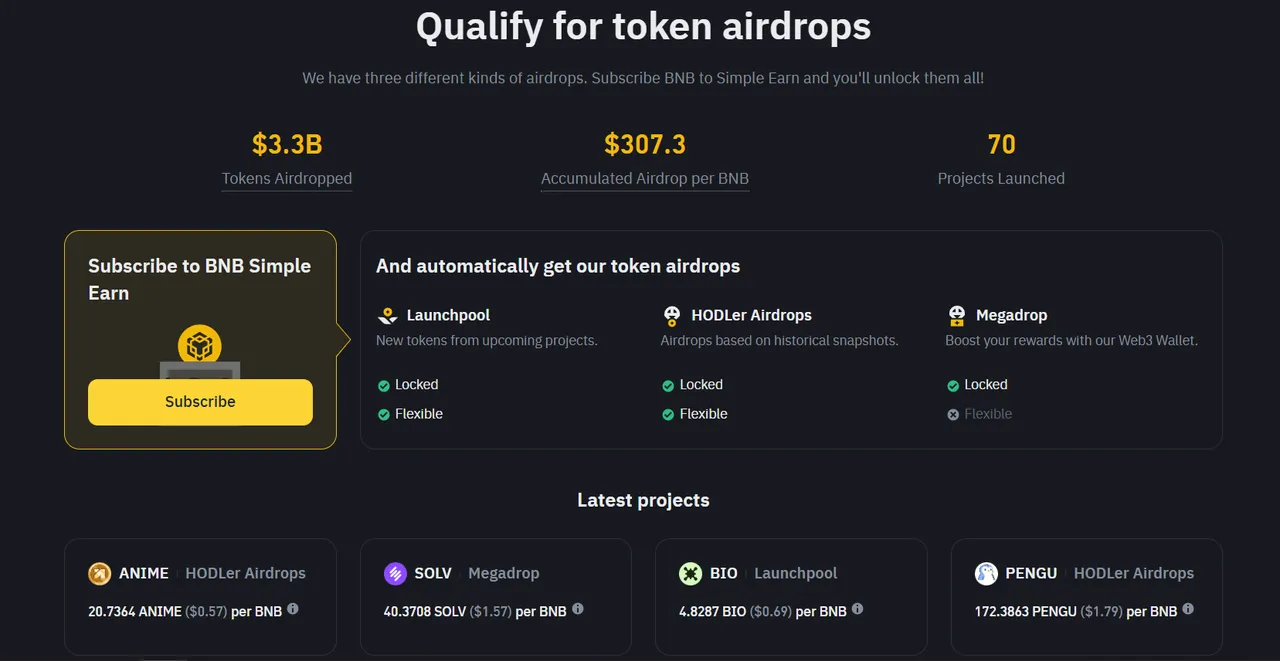

"BNB: Understanding its Utility on Binance"

Although there are some measures in geopolitics that will have to be solved to unlock this exponential growth, such as the tariffs applied to certain countries with the new Trump administration. On the other hand, BNB continues to have utility, either with investment programs where you can earn other tokens as well as get a really striking profitability by staking BNB, which translates to earning passive income.

- Main image edited in Canva.

- I have consulted information at decrypt.co.

- Translated from Spanish to English with DeepL.