Anne Nygård | Unsplash

We are once again witnessing a generalized fall of cryptocurrencies, with the great particularity of being located under a geopolitical context. Probably the market is somehow experiencing such uncertainty that leads it to trigger a series of liquidations, producing a bearish trend that has not been seen in a long time.

Truth be told, it comes as a surprise to many of us who thought there was a marked support line in the major cryptocurrencies, which have broken heading their prices to double-digit values. This collapse mostly started after the tariffs that have been proposed by President Donald Trump on “Liberation Day”. Universal tariffs considering 10% for most imports, but contrasting with an estimated 34% for China and 20% for EU products.

There is enormous concern that a trade war will be unleashed around the world. By this we mean that the government of countries with power and influence will take severe measures, producing a series of political and economic consequences that would impact both parties. I assume that behind this idea is the possibility that both countries that are discussing these tariffs, stop for a moment in search of a solution, but the truth is that at the market level, this is not a strategy.

Kronos Research's chief investment officer, Vincent Liu, argues that the tariffs imposed by Trump have caused a sharp pullback in the cryptocurrency market, but also the rush of affected countries looking to renegotiate trade terms.

Macroeconomic tensions create some paranoia. It provokes the idea that decisions must be made quickly to avoid being hit even harder. It is because of this that those who trade are intent on getting rid of all sorts of risks, so in turn, one big sell-off triggers several more like a domino effect.

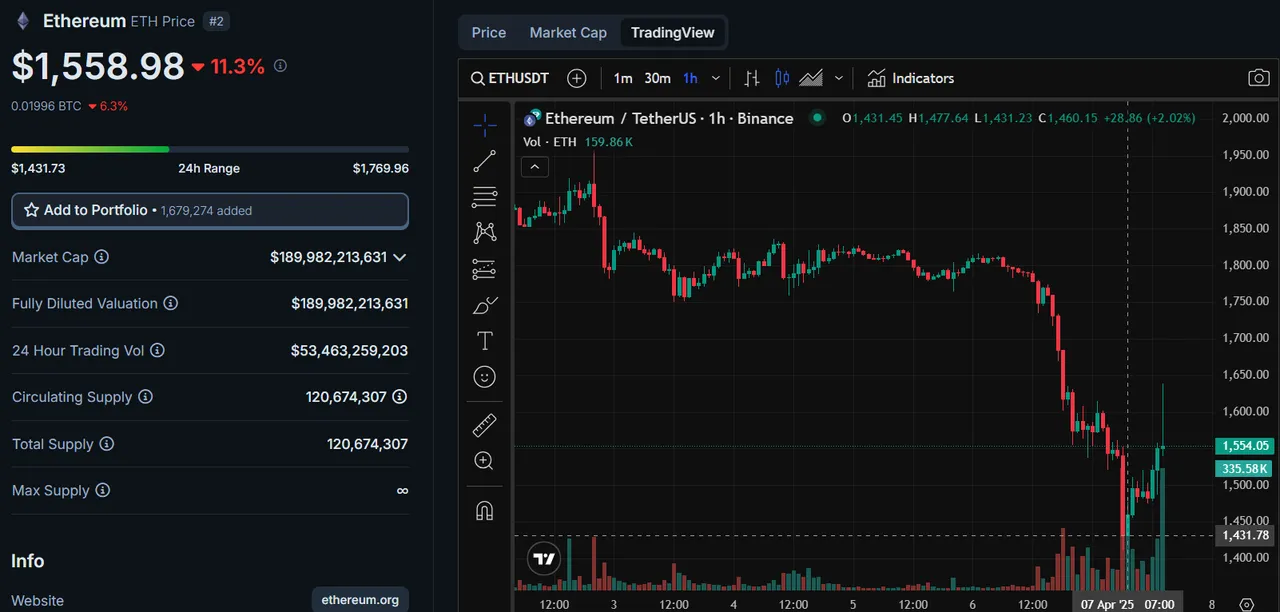

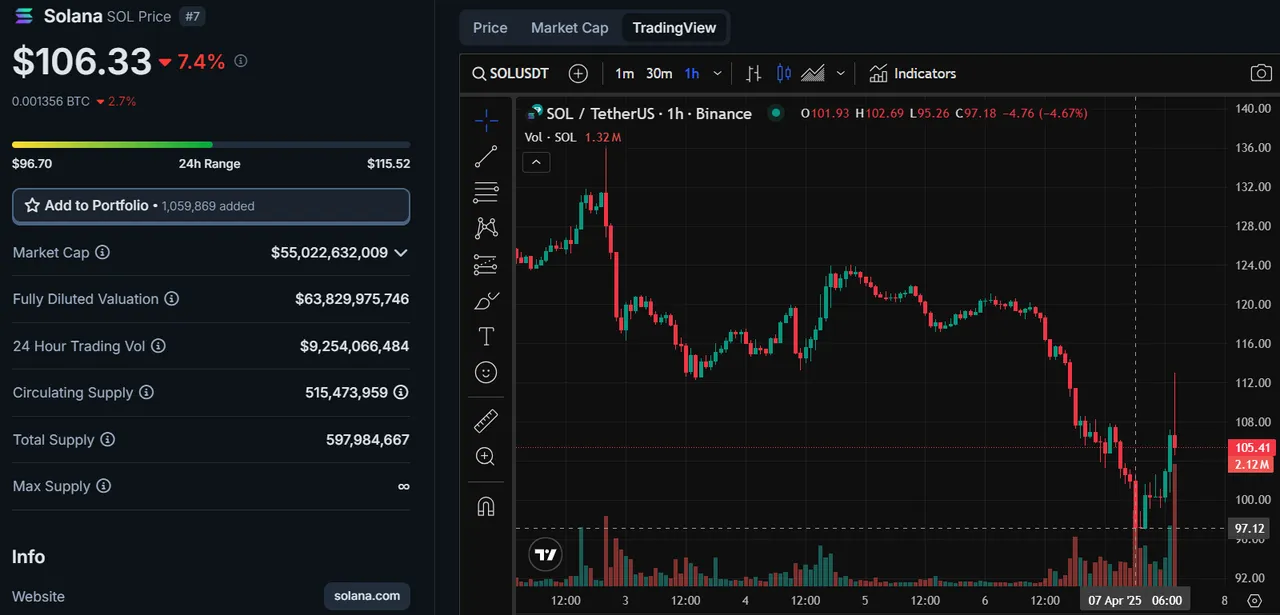

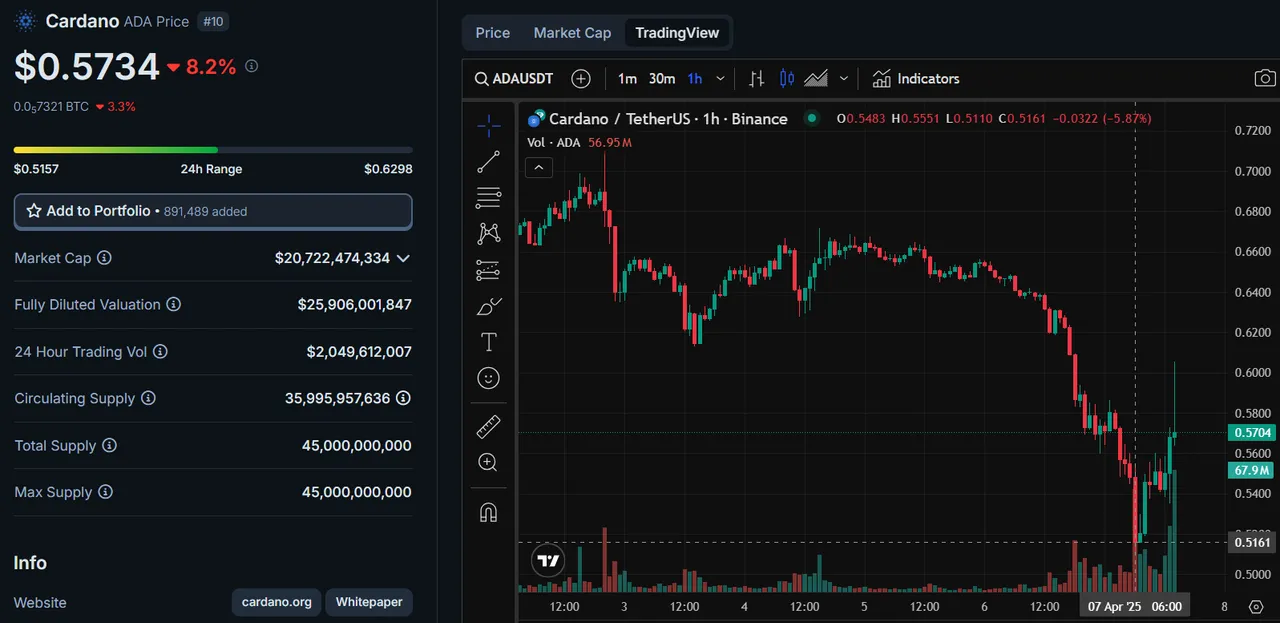

Cryptocurrency liquidations are probably growing even more as you read these lines. Right now we could say that cryptocurrency liquidations comprise an estimated $1.4 billion. If we were to mention just a few of the coins that have been most impacted by these events, we could say that they are Ethereum, Solana and Cardano. On the one hand, Ethereum had a 16.4% drop, reaching $1,431 dollars, to then rebound above $1,500 dollars. On the other, Solana witnessed a 15.4% drop, settling at a price of $97.31 dollars, being right now at $105.71 dollars. Finally, Cardano has also been affected with a 15.2% drop, with a price of $0.57.

The cryptocurrency market was not the only one affected, also the futures market has been involved in a desperate situation. The S&P 500 contracts showed a substantial drop of 5.98%, and those of the NASDAQ by 6.2%.

It is clear that the situation overflowing the global market began with a conflict between the United States and China, but has gradually begun to affect the other countries, which in turn, those who operate in the markets, must make quick decisions, which in a certain case produces such chaos, that orients us towards a downward trend. Indicators regarding inflation and indexes such as CPI and PPI are yet to be published. But it is assumed that the Federal Reserve will have difficulty in implementing interest rate cuts, which are required by the measures decided by Trump in order to circumvent future challenges.

Economic instability could continue to be an issue. At least for the moment, it is considered that there is a 61.9% bearish sentiment. Data offered by a survey proposed by the American Association of Individual Investors. As long as tensions are not released and decisions that could have an impact on an escalating war on the global economic level are not stopped, the markets will continue to be marked by the red color of a critical moment that affects everyone, and for the time being the margin for improvement is quite limited.

- Main image edited in Canva.

- Chart captures obtained through CoinGecko (TradingView).

- Information consulted through the site decrypt.co.

- Content translated into English with DeepL.