Kanchanara | Unsplash

Despite the fact that Bitcoin is not down and remains above $107,000, there is significant interest in applying Bitcoin accumulation mechanics as part of a strategy that some observers question. Possibly one of the existing concerns is about what could happen with such a large amount of BTC in the hands of a multi-billion dollar company, which will not last to make drastic decisions if the situation of a forced sale arises.

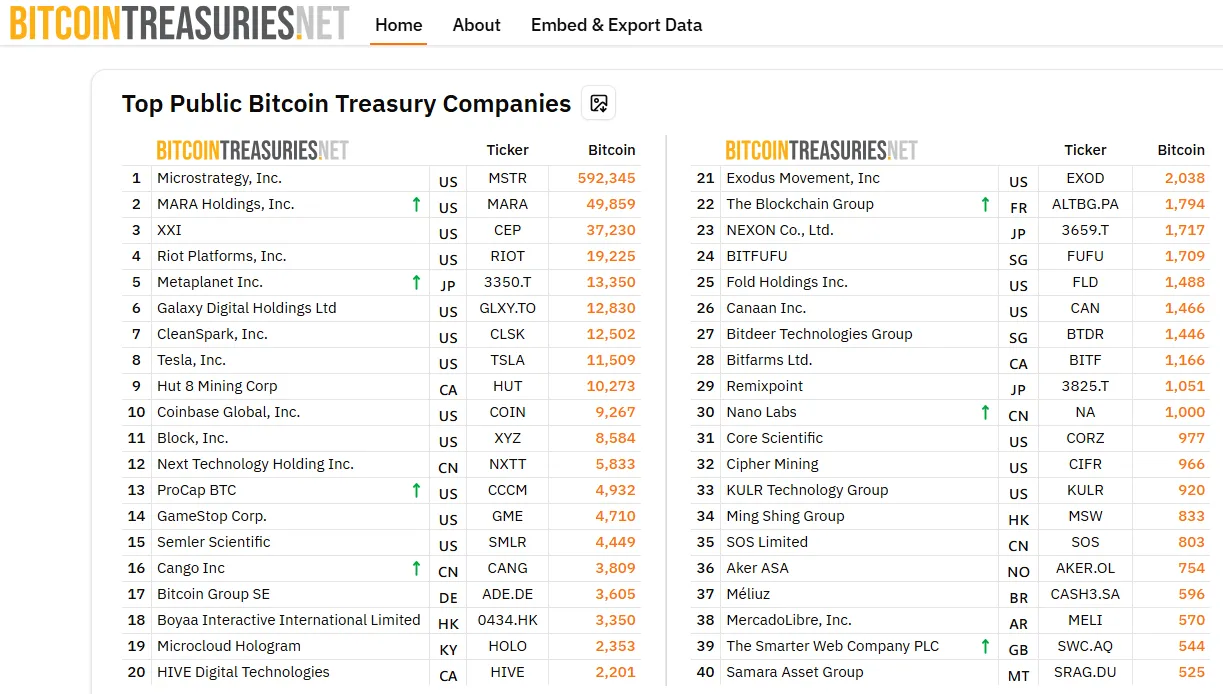

We are seeing more and more companies following the same pattern of accumulation, albeit with different approaches and ways of achieving it. Possibly Microstrategy, with the contribution of Michael Saylor's words, has been one of the companies that has pleasantly inspired the rest, producing an effect in which Bitcoin is seen as a unique opportunity that should not be missed now that there is time. Looking at it this way, it is like a race that you have to run to win, but there will always be the one who leads the first place, and that is the one who disburses the most revenue in the acquisition of BTC.

Bitcoin price through TradingView | CoingGecko

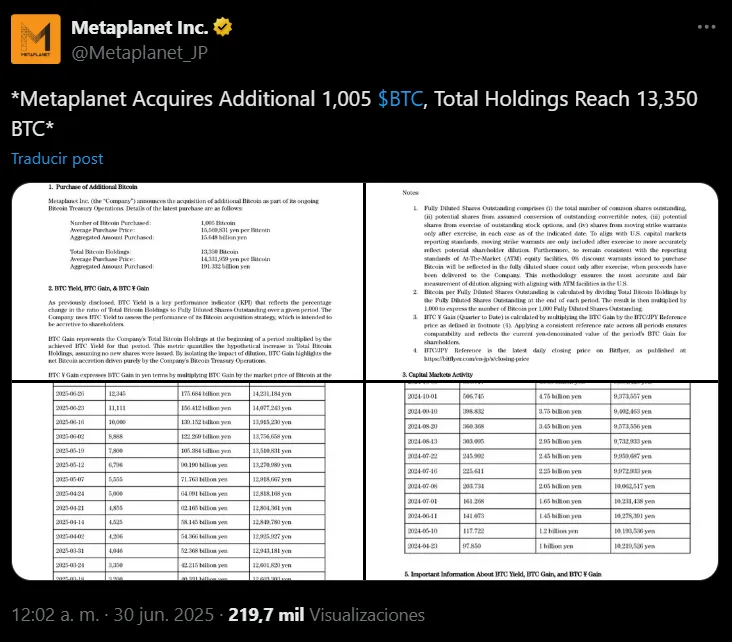

This time we must talk about the commitment of a company that is doing very well, demonstrating consistency and participation. Metaplanet has once again surprised with its most recent BTC acquisition as part of the Bitcoin treasury plan it has set out to promise and deliver on to the letter.

This latest purchase has raised total holdings to 13,350 BTC, with a value approaching $1.427 billion according to data provided by CoinGecko. In this recent acquisition, the Japanese company has purchased the amount of 1,005 BTC, worth around $107.4 million. At this rate, the company is leaving very good impressions about its commitment. Moreover, just three months ago through a shareholders' meeting, the company had communicated that it had reached 3,350 BTC; since then until today, the company has added 10,000 BTC more (you can check it in the third image).

Metaplanet post in X

However, we are quite distant from achieving a bigger goal, which is to reach the 210,000 BTC figure on the way to the year 2027. We should not say that it is impossible, but we should take into account some obstacles that may arise along the way. Personally, I think liquidity should be a concern as more companies are thinking about accumulating BTC.

There is an amount of 21 million BTC. It may not be a concern now, but as companies acquire more revenue streams, they will be looking to get their hands on a larger amount of coins. This in turn would drive up the price, causing other buyers to pay more dearly. For companies looking to hoard Bitcoin, at some point they will run into these difficulties when making large purchases.

Metaplanet has so far done very well in this goal. Its mechanism works in such a way that it has recorded a shocking return of 348.8% for the year. Its format issues zero-coupon bonds to EVO FUND, then redeems them early with the proceeds from the rights to acquire shares. This strategy has been described by analysts as a “liquidity flywheel,” putting the Tokyo-listed firm on the radar of public Bitcoin treasury companies.

Image from BitcoinTreasuresNET

It's not all roses, though. Industry observers express some level of concern about what the latent vulnerabilities could impact over time. The general manager of UAE operations at Flipster, Benjamin Grolimund, argues that the maturity of Metaplanet's bonds could bring refinancing risks, as there are obligations to be met in a considerably short time frame. This could trigger a “death spiral” by having to use funds for debt at an inopportune time (when cryptocurrencies are down), effecting a premature sale.

Grolimund also adds that Metaplanet's successful strategy could result in catastrophe if the markets take a bearish tilt, causing a liquidity mismatch between bonds and Bitcoin.

Another concern comes in a tax context. Knowing that Japan taxes unrealized Bitcoin gains, Metaplanet could find itself heavily taxed, even without dumping BTC. This would significantly deplete cash reserves, as the company has opted to use debt to accumulate BTC, creating a problem of capital availability to meet relevant obligations.

Lalith Krishnan's statements are even more telling. The Director of Growth and Alliances at Digital South Trust points out that BTC manages to rise from $100,000 USD to $160,000 USD, that $60,000 USD gain would be taxed accordingly, even if it is not sold. This carries over to a larger scenario, where unrealized sales could generate even higher taxes, which translates to a “visionary” strategy if it works, and “catastrophic” if it fails.

- Main image edited in Canva.

- Information consulted in: decrypt.co.

- Translated to English with DeepL.