NIKHIL | Unsplash

If there is something alarming when keeping funds in a centralized exchange, it is that it makes moves without prior notice, or at least without your consent. Of course, one should read the fine print when creating an account there, but I highly doubt that this is part of accepting the terms and conditions of the platform.

Although in some cases it seems justified, there is no way such a large movement of funds can be made to other exchanges. Additionally, we must mention the fact that many users have been unable to use the funds as they are frozen.

One of the regrettable events we must discuss today was the hack of the WazirX exchange on July 14. That day, the attack compromised assets worth up to $230 million. Most of the holders of these assets stored ERC-20 tokens, which is an Ethereum standard.

During the attack, several suspicious transactions were detected, which resulted in a series of moves to Tornado Cash; a cryptocurrency mixer that is known for hiding funds in a way that hackers can enjoy, although the protocol itself is designed to enhance privacy as a legitimate use.

Obtained from Tornado Cash Docs

After the incident, the platform decided that the best course of action at that time was to suspend withdrawals, making it impossible for users to access their funds. At this point, one wonders, why do they make us go through KYC if they cannot later verify that I am the one requesting the withdrawal, the one who provided my information to meet the requirements of this exchange (speaking generally).

It is striking that exchanges rarely accuse each other for any reason. What transpired was that the co-founder of CoinSwitch accused WazirX of transferring $75 million to KuCoin and Bybit, with these funds belonging to users who were somehow affected by the hack.

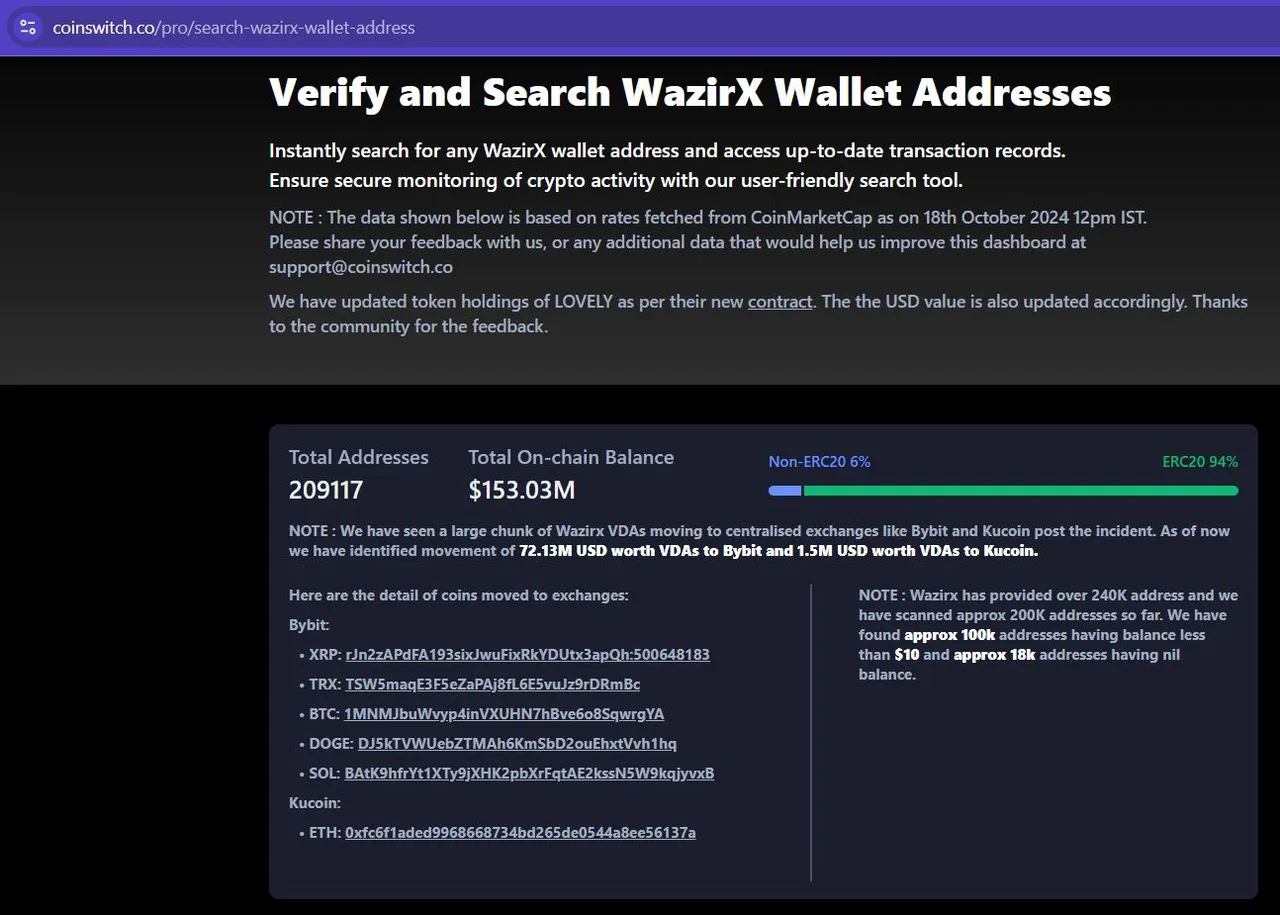

CoinSwitch has developed a tool that allows the search and verification of WazirX wallet addresses. This tool enables viewing information on block explorers of various networks. I suppose wallet monitoring may seem excessive, but given the circumstances, one would be willing to do without it in order to see if their own wallet has become involved, especially if one holds a substantial amount of money in it.

Obtained from CoinSwitch site

While WazirX claims that its intentions are nothing more than to ensure the safety of user funds, it had to undergo a sworn statement asserting that everything is related to a debt restructuring. In this sworn statement issued before the High Court of Singapore, the platform states that it is undergoing a restructuring process to reimburse its users.

Perhaps one of the dilemmas is how to handle such a large volume of assets. For this reason, the movements have to be carefully managed to avoid being affected by gas costs or network fees.

Furthermore, WazirX had to clarify through a tweet that the process is being handled by the firm Zettai Pte Ltd, with oversight that could address this issue. In that message, the company makes it clear that its principles are based on transparency, and that information regarding up to 240 thousand wallets will be disclosed to the court, as well as to the creditors in the restructuring process led by Zettai.

Post from WazirX on X

All this trouble stemming from the hack has caused a lot of uncertainty and confusion, so much so that the aforementioned tool had to be created to contain those users who have been involved in the matter. However, the tool itself is not able to improve the information provided due to legal procedures that are being carried out, so it is limited in that sense.

This doesn't seem to end here. Beyond the moratorium obtained by the WazirX exchange to have enough time to fix things, CoinSwitch has also been affected by having $9.7 million frozen in said exchange, so through a legal dispute, an additional pressure is somewhat generated that we hope will end with relief for both parties.

The issue is that these funds also belong to users who trust this other exchange. Among these funds, INR (Indian Rupee) had been deposited, and CoinSwitch had to come up with a solution to prevent losses, turning to internal treasury to maintain the 1:1 reserve ratio, ensuring that its users are not involved in this new dispute.

- Main image edited in Canva.

- I have consulted information in decrypt.co: I and II.

- I have used Hive Translator to translate from Spanish to English.