vjkombajn | Unsplash

The bullish season seems to have started, so we are seeing an increase in the price of many cryptocurrencies, mainly those with a higher market capitalization, placing these coins at the top of the ranking.

We had already mentioned how Bitcoin managed to surpass the impressive figure of $90,000. This has benefited the overall cryptocurrency market, allowing us to talk today about the growth XRP; the currency of Ripple is experiencing. The political landscape has also greatly influenced recent developments, such as Donald Trump's victory over Kamala Harris at the beginning of this month.

We cannot help but mention that the bullish sentiment is at its highest level. This challenges the decision-making of many investors, who are placing bets on specific cryptocurrencies, leading to increased investment flows and profits. These types of operations are commonly known as trading, but a much more interesting terrain from a profit-maximizing perspective could be the futures market.

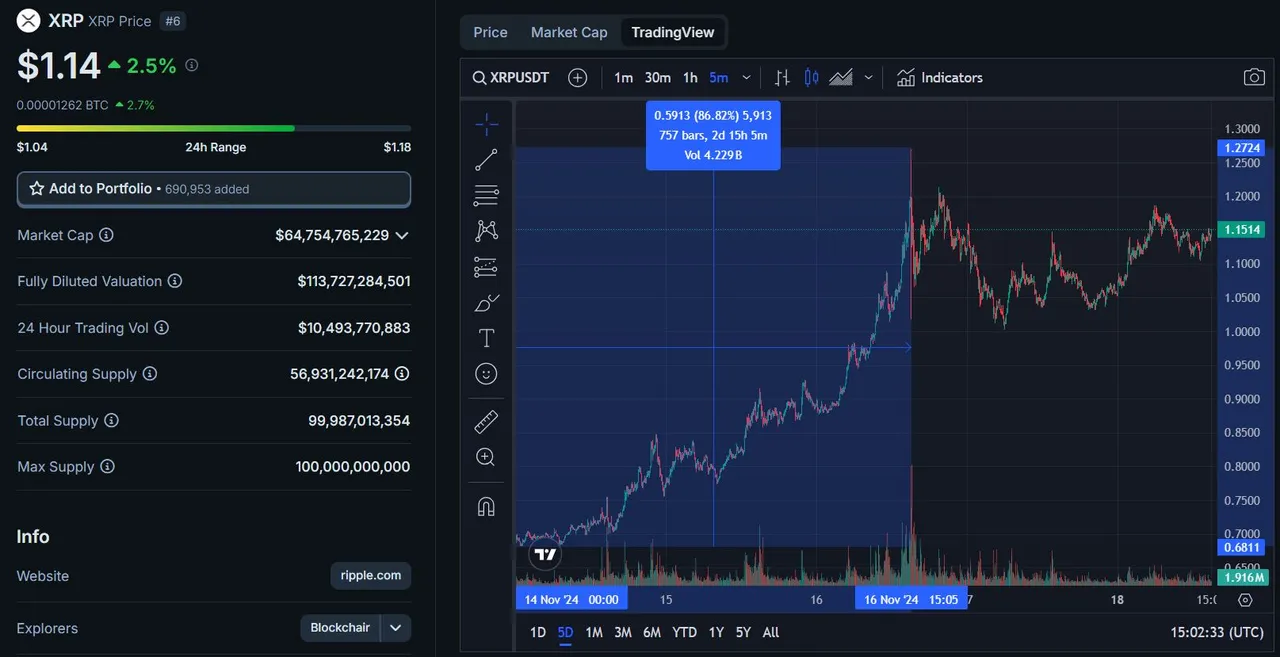

Interest in XRP is on the rise. This currency, managed by Ripple Labs; an infrastructure and digital payments company, is being traded at values reminiscent of the year 2021, practically close to today's dates. With a price of $1.14 and a current increase of 2.5%, this coin could be set on a path to significant growth. The most spectacular aspect emerges when looking at the chart for the previous 5 days, showing an increase of over 80% within this recent timeframe filled with events.

It's amazing how the open interest of XRP has reached its highs. According to CoinGlass data, it is detailed that these levels have reached values of $2 billion dollars, with an increase of over 7.77%. To understand a little about what this concept is, we can mention it as the total number of open contracts in futures that have not been settled. We could see it in a simpler way, for example the positions that enter the futures market and are open, creating more activity in the market.

Perhaps it is important to consider something, which is the fact that speculative operations under this context are accompanied by higher volatility because leveraged positions end up amplifying gains or losses, taking into account the news or events that come to light. To put it another way; when something happens in the geopolitical aspect that influences the market, prices are altered along with leveraged positions, so these positions are somehow magnified by these effects.

If we were to talk about the impact of events that could be expected in the medium term, without a doubt we would mention how Trump could favor the cryptocurrency industry, but also influence individuals or commissions that are impeding their expansion and growth. A clear example could be the SEC, which has sued Ripple on more than one occasion for considering XRP as a security, while a federal judge argued that the sale of XRP to retail investors did not constitute any violation, but institutional sales that violated such laws did, resulting in Ripple being fined an estimated $125 million.

The SEC maintains an appeal to all of this, so the court has set a deadline of January 2025 for the reports to be clarified by the SEC. What's important is that, based on the upcoming new mandate, both the SEC and whatever happens in court will be much more significant regarding this issue, giving way to favoring more the decisions that need to be made. Much is said about how the arrival of Trump to power could impact. In fact, it has been mentioned that he himself said during his campaign that when he took office he would fire Gary Gensler. Although this is unlikely to happen. However, it is speculated that Gensler would submit his voluntary resignation in the coming months.

The rise of XRP price could be attributed to many factors. Many assert that this is due to the company's proximity to the new political administration led by Trump. In fact, the CEO of Ripple, Brad Garlinghouse himself, could be advising Trump on cryptocurrency policies, although at the moment these are just rumors, it could be considered part of market enthusiasm. Also, it is hoped that there will be a boost in merchant interest, as Bitwise had applied for an XRP ETF, and if approved, we could expect significant growth.

- Main image edited in Canva.

- Screenshots obtained from CoinGecko.

- I have consulted information at decrypt.co.

- Translated from Spanish to English with Hive Translator.