Hi HODLers, Hiveans and Lions,

Disney just published their Q3 Results (their fiscal year is Sept to end of August).

There were a LOT of moving pieces in this publication. Please find below some of the metrics and I'll add my 2 cents afterwards.

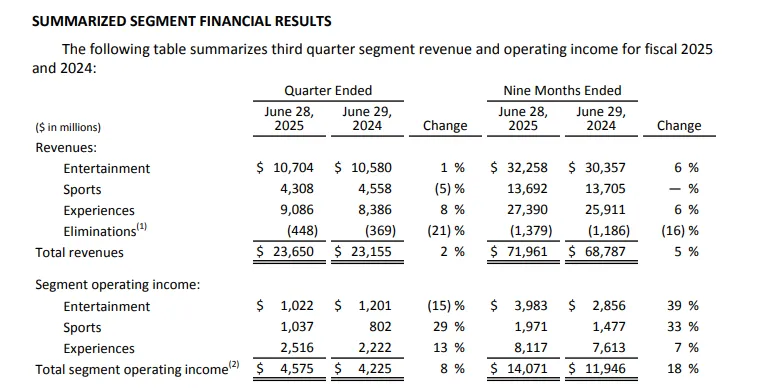

Revenues

- Entertainment $10.70B vs StreetAccount $10.81B

Linear Networks $2.27B vs SA $2.34B

Direct-to-Consumer $6.18B vs consensus: SA $6.32B

Content Sales/Licensing and Other $2.26B vs consensus: SA $2.13B

- Sports $4.31B vs consensus: $4.43B

- Experiences $9.09B vs consensus: $8.88B

Cash from operations $3.67B vs consensus: $4.00B

In summary:

- Parks and Cruise did extremely well and are expected to do well going forward

- Sports was under pressure as customers are cancelling their cable, etc.. but new deals were signed with the NFL and WWE for upcoming content to be distributed through the new ESPN Streaming Product which they will release end of August

- Streaming business added some new users but nothing exceptional, this could be seen as a little disappointing.

Overall, I felt as most professional financial analysts that this was a very solid Q3 and that the Disney turnaroudn which started 9/12 months ago is strongly continuing. I have confidence that Disney's share price is going to be substantially up over the next few months/years.

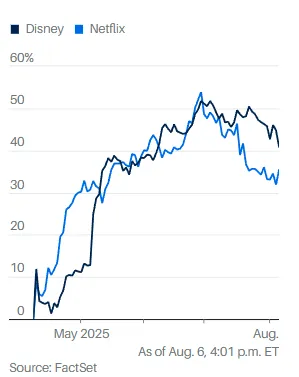

$DIS and $NFLX Performances since the tariff pause