Hi HODLers and financial analysts,

I was reading the Wall Street Journal and this article popped up and was really interesting.

It is going over the current SP500 2nd quarter earnings season with some long term valuation metrics.

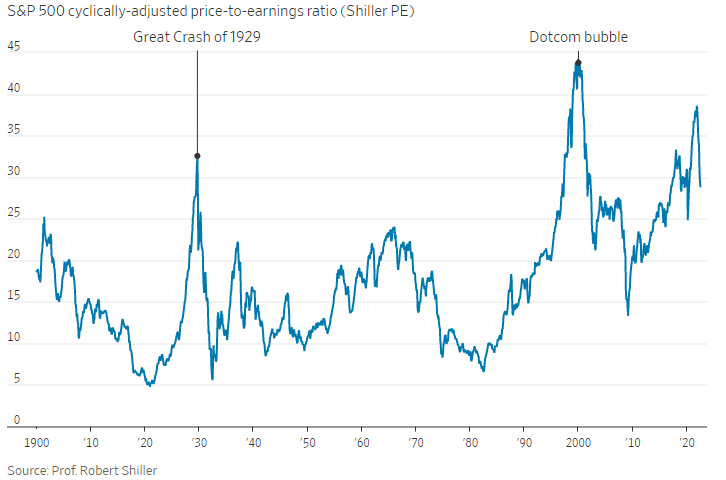

The first we will lookat is the Price to Earnings ratio from Pr. Shiller also called Shiller PE.

Price to Earnings is: Market Value of the stock /(divided)/ company's earnings for the coming year.

This one is specific as it takes into include in which part of the cycle wemight be to adjust the number.

As you can see, the current drop of the market is making us closer to the long term average. Nevertheless, this tells 2 things, the P or Price has been adjusted due to the market's correction but usually, earnings are updated AFTER the earnings season.

Therefore, even if the price stay consistent, as we are seeing a lot of downgrades and lower earnings projection. The PE Shiller valuation should bounce back up and show that the market is still "expensive".

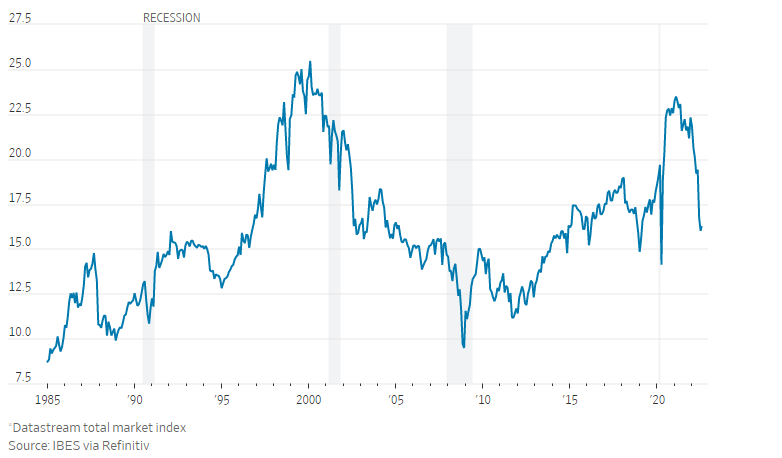

Price to Earning (Next 12 months)

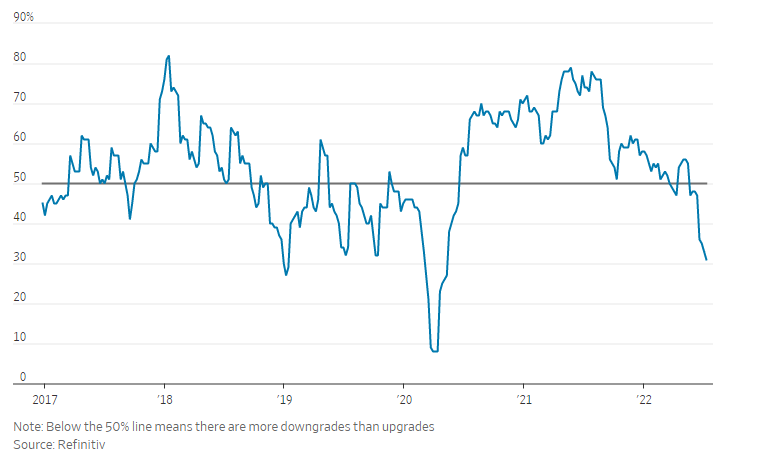

Proportion of new estimates for S&P500 companies that are upgrades

Do I need to comment?

This is showing that guidances from companies are quite gloomy and most companies are actually lowering/keeping their previous forecasts.

I am still very cautious as we could also have J.Powell come out of the wood and lower rates/announce more QE is coming.

Volatility is going to stay very elevated!

Stay safe out there!