SOURCE

In times of uncertainty, in times of upheaval, in times of war, in times of inflation, in times of recession everything floods back to precious metals.

-welshstacker

Theres no denying that we are in the midst of some bat-shit crazy times. Inflation soaring, the brink of a new War in Eastern Europe and stock markets beginning to faulter. Could the "everything bubble" be about to pop??

Whilst im throwing the term "everything bubble" out there, I dont actually mean everything..... There will alsways be a few safe havens out there, where smart investors can stash their wealth to see them through these difficult times.

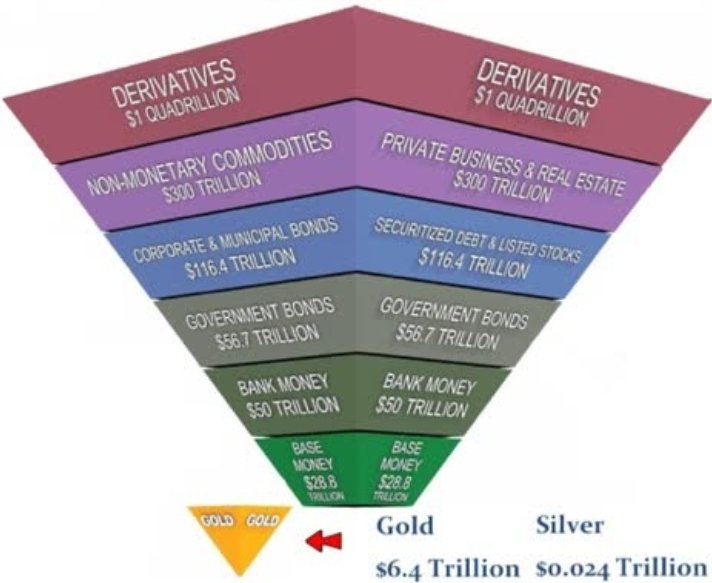

EXTER'S PYRAMID

When the SHTF, time after time, money always floods back to Precious Metals. This time, I personally feel, its a little different though. Not that i dont think smart money will dump risky assets, but i honesty believe we could be at the end of this current financial system. I just cant see anyway to save it this time.

Weve had our ups and downs over the years. The dot-com bubble of the early 00's, the housing bubble of 2008(Go watch the "big short" its amazing.), the financial recession of 2012, the pLandemic of 2019-22, with the brink of War in Ukraine and global debt skyrocketing could we see the end of life as we know it happening sometime in 2022??

[SOURCE]

The world runs on the USD($), theres no getting away from that. Oil, gold, wheat, cotton, coffee and sugar, to name but a few, all trade in USD, and with US debt at an all time high, US inflation official at 7.5% and climbing, whats going to happen when the markets and the rest of the world finally realise the dollar is failing??

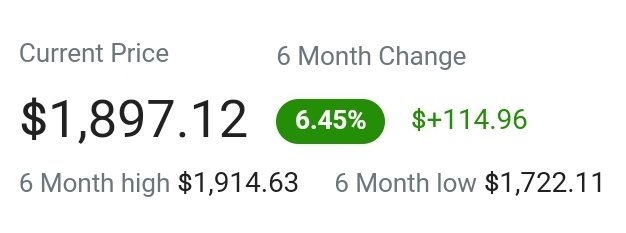

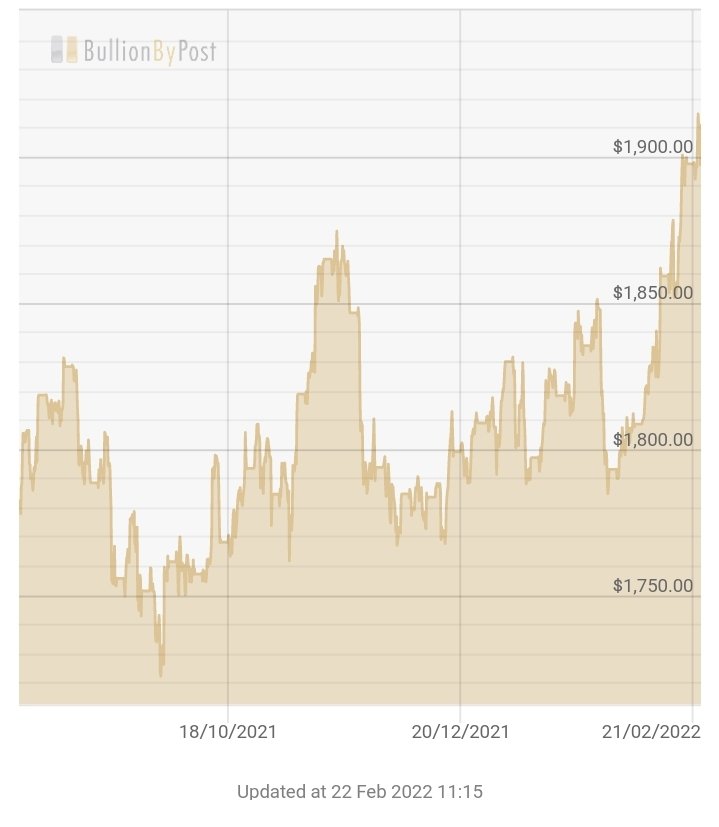

Gold is already bouncing off its ceiling resistance of $1900, and it wont be long before the ceiling becomes the floor, as gold shoots off towards $2500+. Since 2019 weve been in a gold-bull cycle, and pressure is building. These cycles have historically lasted for approximately 5yrs. Many gold buggs see the shiny yellow metal propelling to around $2700 by the year end, before springboarding and moonshooting for $7800 by the end of this cycle.

The Precious metals game is a tricky one, some days your up, some days your down, but only if you play the short game. HODLers like myself see gold and particularly silver as a way of preserving wealth and transferring over to the next paradigm, or what ever comes next. The truth is, as long as governments can continue to devalue their currency by printing endless supplies of fiat currency, precious metals will always be a safe haven.

Remember, its never about timing the precious metals markets, its always about time in the markets that will prevent you from becoming poor.

40+yr old, trying to shift a few pounds and sharing his efforsts on the blockchain. Come find me on STRAVA or #actifit, and we can keep each other motivated .

Proud member of #teamuk. Teamuk is a tag for all UK residents, ex-pats or anyone currently staying here to use and get a daily upvote from the community. While the community actively encourages users of the platform to post and use the tag, remember that it is for UK members only.

Come join the community over on the discord channel- HERE

Want to find out more about gold and silver? Get the latest news, guides and information by following the best community on the blockchain - #silvergoldstackers. We're a group of like minded precious metal stackers that love to chat, share ideas and spread the word about the benefits of "stacking". Please feel free to leave a comment below or join us in the community page, or on discord.