The Crypto Weather Forecast is my daily take on the crypto market, sometimes serious, sometimes sarcastic, often with a wink, and Always Honest.

There is this saying, that you hear quite often around this time of year.

Sell in May and Go Away

This ancient wisdom tells us that whatever we are holding, we should get rid of before summer starts. Now with the summer of 2021 fresh in our memory that indeed makes sense. Crypto prices literally melted. End of May BTC was still at 38K and at the end of July, prices hit 28K.

Why?

Because smart money, institutional investors, and even retail are more involved in zipping cocktails and watching the bikini curves than Curve DAO.

That sounds plausible and it´s a pearl of ancient wisdom, so who´s gonna argue with that?

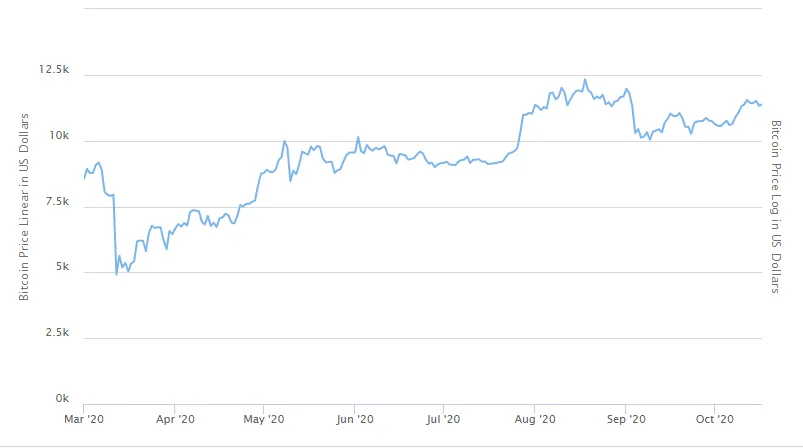

Well 2020 does

Of course, it all depends a bit on your perspective but for me, the real season is July and August and Aug 2020 was damn hot.

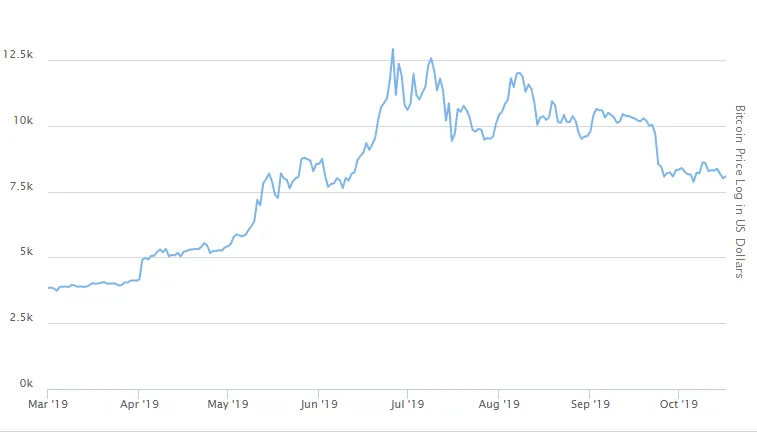

2019 also does

I hope nobody listened to that old cracker that came up with that saying in 2019.

The old cracker was right in 2018

Who would have guessed that Bitcoin went down during the 2018 bear market? Well, the guy telling us to sell in May. Although I would have rather sold in March 2018.

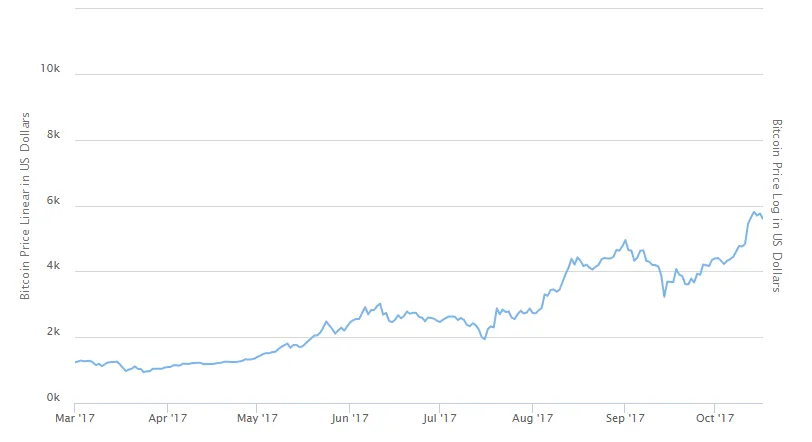

You would have missed the boat in 2017

And in 2017 coming back to work end of Aug or early Sep would mean paying twice as much to buy back the BTC you sold in May.

Now I am sure that some wiseguy is gonna tell me: "Yeah but that saying comes from the stock market."

If it works for the stock market, that would prove that the current correlation between stocks and crypto is indeed temporary and probably to the global economic climate (nobody likes risk assets atm).

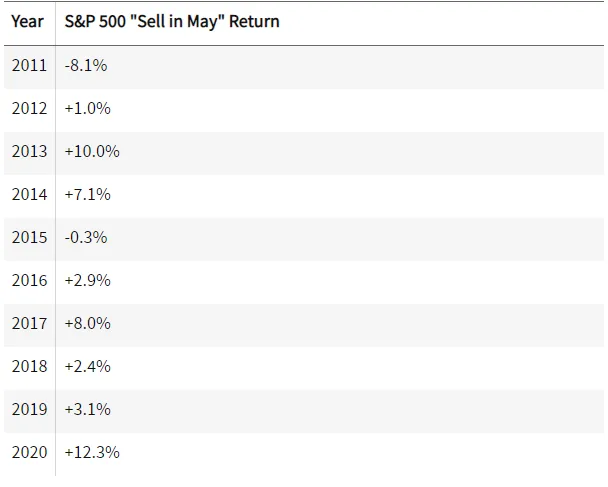

Even the stock market does not follow the rule

My guess based on this data is that the saying is outdated. Even the stock market did an average 3.8% up over those 10 years.

It might have worked during the stock market of the '50s when dad would take the family on holiday and there was this unofficial agreement to not trade between June 1st and Aug 31st but those days seem to be long gone.

Source

Now don't get your hopes up just yet.

First of all 2022 is very similar to 2018, also when it comes to its place in the 4-year cycle.

Secondly, most of the summer profit was obtained in August. The biggest summer dips were mid/end of July. Not gonna spell that out, but doesn´t it give a pretty good idea of when to buy?

Thanks for the read, remember that liking this article is free, and see you tomorrow!