Evening

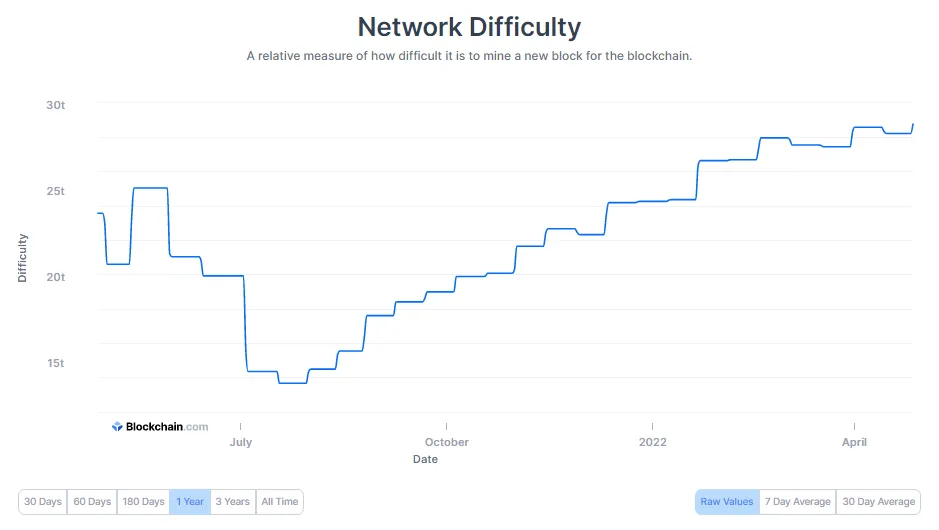

Bitcoin network continues to flourish with network hash rate and mining difficulty touching all time high, despite the price struggling to move ahead of $40,000.

Bitcoin network hash rate touched all time high value of 258 EH/s today, before retracting to a current value of 220.48 EH/s. Network difficulty is also at its peak with a value of 29.70 trillion.

Increased network hash rate means greater mining power vested into the network by miners looking to validate the next block on Bitcoin network. Higher network hash rate means the network is more secure, due to immense computing power required to take majority control of the network.

The network difficulty also got adjusted(increased) accordingly, to keep the average block time to 10 min. Bitcoin network auto adjust the difficulty depending upon how much computation power is vested into the network by miners and keeps the average block mining time at 10min.

Current, Bitcoin network hash rate marks more than 400% rise from last year's low of 70 EH/s following China's blanket ban on Bitcoin mining.

Bitcoin network have survived rigors of time since its inception. Each time the network gets pinned down by external factors like regulatory measure, the network bounces back even stronger. We have already witnessed what happened last year after China imposed complete ban on Bitcoin mining. Following the ban the network hash rate plummeted by more than 50%, but the network slowly recovered in a few months and now we have an all time secure network than ever.

Whereas many Bitcoin pundits hails increasing network hash rate, but many climate groups have also raised concerns regarding the ever increasing energy consumption. Greenpeace has already launched a campaign last month to shift Bitcoin consensus mechanism from energy hungry POW to eco-friendly POS, just like Ethereum. Whereas, security of POS consensus mechanism can be debated with heavy stakes accumulating in fewer hands, POW can be considered more secure as with increasing hash rate 50% attack continues becoming highly unlikely.