Image designed by me using Canva.

There are two terms we mostly hear a lot when dealing with our cryptocurrencies. We hear fundamental analysis and technical analysis a lot. It’s understandable since these two terms form the very core of cryptocurrencies.

Before you start out your cryptocurrency journey in the form of investing into an asset or a project, you have to make enough research about the project in question to as much as possible ascertain the feasibility, security, use cases and also if it can help you make profit.

All these things you do about are analysis. You make analysis of a project even after investing in it. These sort of analysis are what have been broadly grouped as fundamental and technical analysis. For this post, I will be focusing solely on the fundamental analysis of a project.

Fundamental analysis is the kind of the analysis carried out on a crypto asset or a project before you dip hands into it. For this analysis you need to carry out extensive and detailed research about the asset. These include reading the project’s white paper, performing on chain metrics, finding out the team behind the project, among others. This can be used to sort of predict the future price of the project or asset you look to invest it.

Project metrics is the part of the analysis that deals with reading the white paper of the project, the team behind the project, vision, use cases, roadmap, among others. The project metrics is done to determine the level of work done by the team so you can determine it’s level of security and it’s future.

The on chain metrics are done to find out what happens behind the scenes of the projects. They involve a lot of work and can be very accurate.

Financial metrics, another aspect of fundamental analysis deals with the numbers. For this one, you determine the market capitalization, trading volume, coin circulation, and others.

Fundamentals of a project affect the price of an asset, can be used to predict the future price of the asset and can also be used to tell if an asset is undervalued or overvalued by using the asset’s historical data. How can you determine if an asset is overvalued or undervalued? Check to see if the coin has future. Also check the current price of the coin and the fundamental value of the asset.

Sometimes you take a glance at technical analysis and fundamental analysis and think that fundamental analysis is easier or less complicated. That is far from the truth. Fundamental analysis entails a whole lot and when done right, can yield a lot of good results.

Fundamental analysis is for long term investments. Let’s take a crypto taken like bitcoin and try to make a short fundamental analysis.

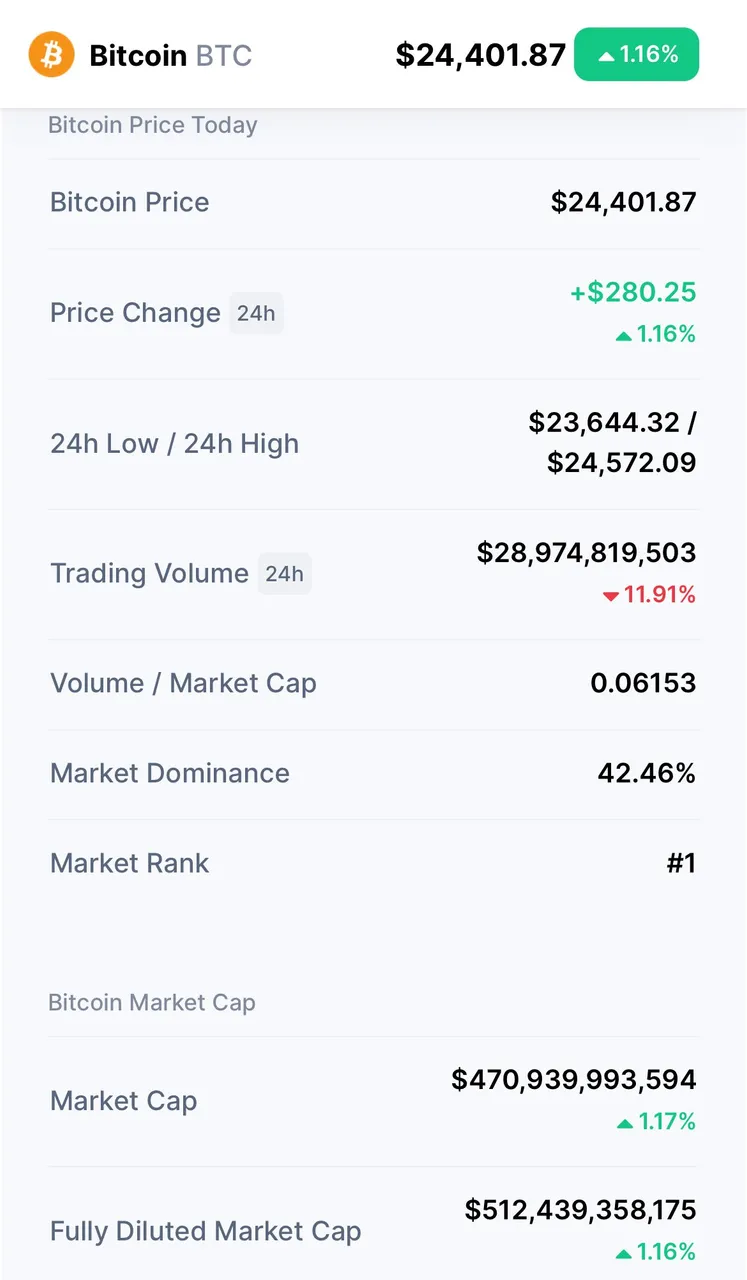

Let’s check out bitcoin’s financial metrics from the screenshot of CoinMarketCap.

The current price of btc is $24,401.87,24hr trading volume is $28,974,819,503, volume/market cap is 0.06153, market dominance is 42.46%, market rank is #1, market cap is $470,939,993,594, fully diluted market is $470,939,993,594.

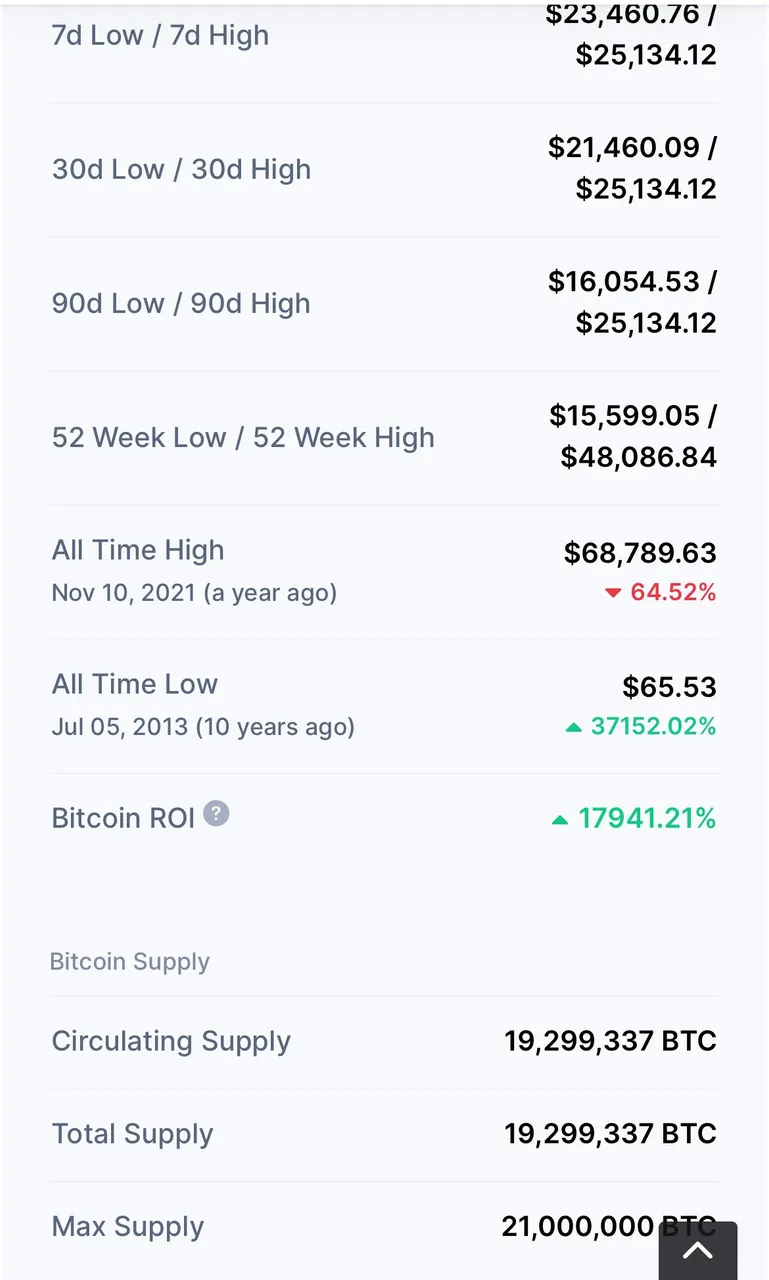

Btc has a circulating supply is 19,299,337 BTC, total supply is 19,299,337 BTC and market supply is 21,000,000 BTC, all time high of $68,789.63 and all time low of $65.53.

Let’s move on to the project metrics.

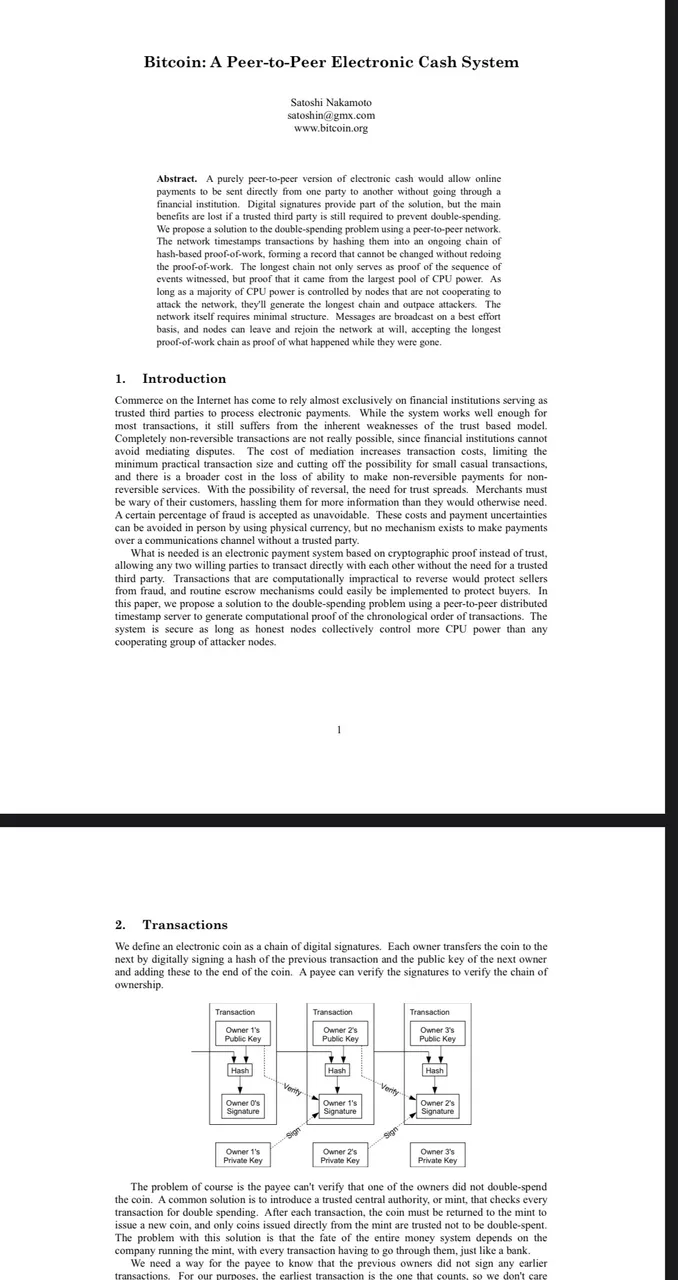

BTC white paper.

From this white paper, you see that Satoshi Nakamoto is the founder of BTC, the consensus algorithm used (proof of work),network,incentive, privacy, simplified payment verification, and others.

When you look at the transaction data kf holders of btc, you realize that the short term holders are making profits but the long term holders are making slight losses. To view the transaction history of an asset, you can use sites like blochain explorer

So here you have it guys, a post about fundamental analysis, what it entails and a short analysis on the bitcoin.

Thank you.