One of the most recent news is that the DeFi ecosystem has been rocked by a series of attacks targeting the #Exactly and #Harbor protocols.

And this leaves as clear evidence the importance of security in decentralized finance, and have generated concern in the cryptographic community, I have to clarify that I personally was not inside either of these two projects, but I did have a follow up to each one, because I was very interested in what they offered.

To give a bit of context of what Exactly and Harbor are all about I want to explain a bit about each of them so you have an idea of what each of these projects offer:

A little bit about Exactly

Exactly is a DeFi protocol that offers lending and token issuance services. This allows us as users to create and manage smart contracts for decentralized financial transactions.

Something interesting is that we users can take loans using cryptocurrencies as collateral and we can also issue our own tokens through the platform.

https://harborprotocol.one/home

A little bit about Harbor Protocol

And, on the other hand, there is Harbor Protocol, which is a DeFi protocol that facilitates trading and investment in digital assets in a decentralized way, providing users with a secure and reliable environment for financial transactions, or at least that was what they promised until a few hours ago when they failed with their security.

He also gave the proposal of the $CMST coin which would have the function of Stable Currency and would also be multi-chain.

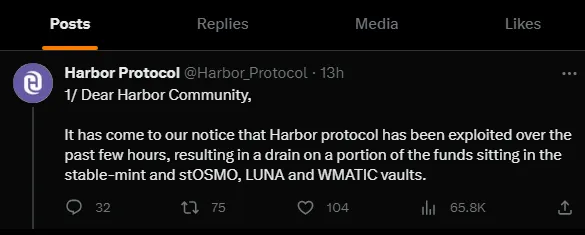

But the chaos to the networks about these two projects came on August 18, as it was reported that the Exactly and Harbor protocols were subject to attacks, although they explained that they were separate attacks, nothing to do with the same person or the same theft.

A large amount of funds were lost in those attacks, and it stands to reason that this would greatly affect the projects in question.

The Exactly protocol suffered an attack in which it is estimated that almost USD 7.3 million was stolen, while the Harbor team I believe has not given much information on an exact figure, or so I believe based on my research, but if you know anything about this topic it would be great if you could share your opinion in the comments.

This was shared by Exactly Protocol.

https://twitter.com/ExactlyProtocol/status/1692950170705518879

- ExactlyProtocol

Although a few hours later they also shared a new publication where they said that they were in the process of identifying all the attackers who took these funds.

They also said that they would return the assets to the users that were affected, but this will not be such a fast process, here I share the screenshot.

https://twitter.com/ExactlyProtocol/status/1692952169249456321

- ExactlyProtocol

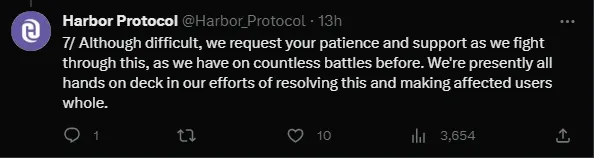

And in the case of Harbor Protocol, they are with the same speech, promising to somehow recover the funds so that the user investors are not dissatisfied with what happened.

It is really incredible to see that two projects like these, with good promises, fell into insecurity and resulted in the theft of their assets, although I repeat, Harbor Protocol did not give an exact figure of the total amount they have lost, this can be bad and at the same time good, because in this type of projects transparency with investors and the community is very important.

https://twitter.com/Harbor_Protocol/status/1692836252498723154

- Harbor_Protocol

I had already said at the beginning that I am not part of either of these two projects, but I was interested in them.

But I remind you that what I am writing here is my personal choice, as I am not an expert in the #Crypto world either, but these attacks are a reminder of the importance of security in DeFi systems.

While blockchain technology and smart contracts offer significant benefits for many of us, they also present inherent risks, and by that I mean that no matter how secure or trustworthy a project may look, the risk factor will always be there in every type of digital investment.

The decentralized nature of DeFi protocols makes them attractive to both investors and attackers.

In this regard, increased attention to smart contract auditing and the implementation of robust security practices is required. Transparency and collaboration between DeFi projects are also critical to ensure the protection of user funds, and this is the most important thing, assuring users that funds will be safe in such a project.

No matter how much they manage to recover the funds and give them to the affected users, the trust of the community will no longer be the same, so I believe that these two projects will no longer have the same community support.

It is important to note that while these attacks are concerning, they should not completely discredit the potential of decentralized finance. DeFi protocols continue to revolutionize the financial world by providing open and transparent access to financial services, it's just that some projects don't turn out as expected.

With this I say goodbye for today and you who are reading this, surely you can give your personal opinion on this topic, because as I said I am not an expert in finance, but I am passionate about this topic.

Happy day to all of you.

Translated with www.DeepL.com/Translator (free version)