Price of Arbitrary

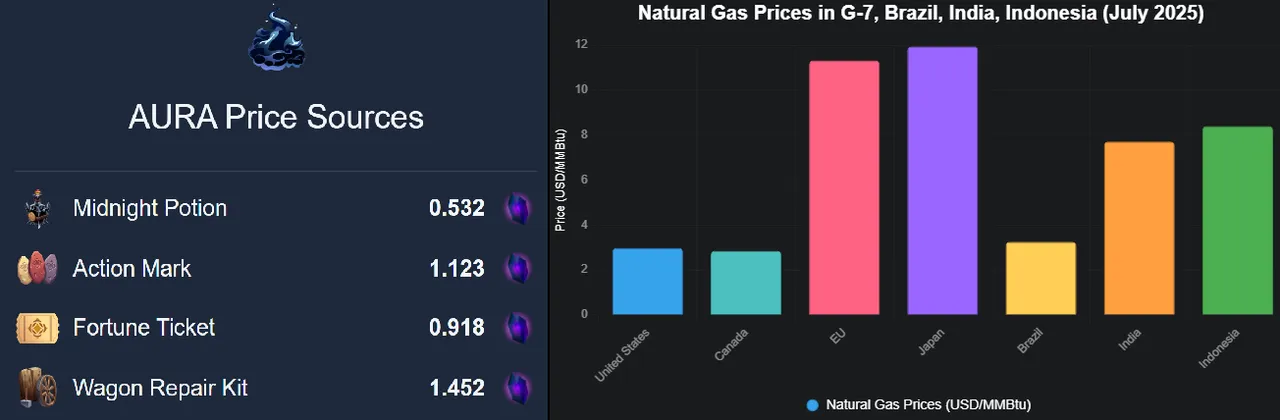

Today I was having a discussion with @beaker007 after he posted the price of Aura in the Splinterlands discord. His tool calculates the Price of Aura, based on variety of different use cases. Although it is the same Aura, but it can be valued differently based on the end use case of the the sold product. This is simply because, Aura can't be sold, it is soul bound. This immediately reminds of a very similar real live situation that I personally deal with a lot. It has to do with price of Natural Gas. As you know Natural Gas requires transportation in a pipeline. Therefore, it is not easy to transport it across different continents. Though US has a lot of Nat Gas production (and remaining resources), it is not easy to transport or export that to Europe (cheaply), where the prices are high due to low production and high demand. So while US can enjoy prices near $3 at Europe prices can be as high as 4X!

| Country/Region | Price (USD/MMBtu) |

|---|---|

| United States | 2.98 |

| Canada | 2.85 |

| EU | 11.32 |

| Japan | 11.94 |

| Brazil | 3.25 |

| India | 7.71 |

| Indonesia | 8.40 |

This is largely true for almost any commodity, but especially true if a commodity is hard to transport or store, like Natural Gas. It is possible to liquify Nat Gas, in the form of LNG, but that is a costly process and requires a lot of upfront investment to build a LNG plant. So following are the reason, Nat Gas prices are so variable across continents and countries:

| Reason | Description |

|---|---|

| Supply Availability | Abundant U.S./Canada shale gas keeps prices low ($2.85–$2.98/MMBtu). EU/Japan rely on costly LNG imports ($11.32–$11.94/MMBtu). |

| Demand Fluctuations | Seasonal spikes (e.g., EU winter, India summer) drive volatility. Industrial use in Brazil/Indonesia varies ($3.25–$8.40/MMBtu). |

| Geopolitical Factors | Supply disruptions (e.g., conflicts) impact EU (TTF) and Japan (JKM). Indonesia’s prices are less affected but tied to LNG trends. |

| Infrastructure Constraints | Limited EU/India/Indonesia pipelines or LNG terminals raise costs. U.S./Canada’s robust infrastructure stabilizes prices. |

| Currency and Market Structure | Exchange rates and regulations (e.g., Indonesia’s cost-plus, India’s imports) cause variations. EU/Japan face global market swings. |

| Storage Levels | Low EU storage spikes prices ($11.32/MMBtu). High U.S. storage lowers prices ($2.98/MMBtu). Brazil/Indonesia have limited storage. |

| Energy Policies | EU’s carbon pricing and Japan/India’s energy transitions raise costs. U.S./Canada benefit from stable fossil fuel markets. |

If you are wondering about what is TTF and JKM, they are simply standard pricing created to stabilize prices by different 'cartels' (read governments or private entities)

TTF (Title Transfer Facility): A virtual trading hub in the Netherlands for natural gas, used as the primary pricing benchmark for Europe.

JKM (Japan Korea Marker): A benchmark price for LNG spot market transactions in Asia, published by Platts, primarily reflecting delivered LNG prices to Japan and South Korea.

Contango and Backwardation

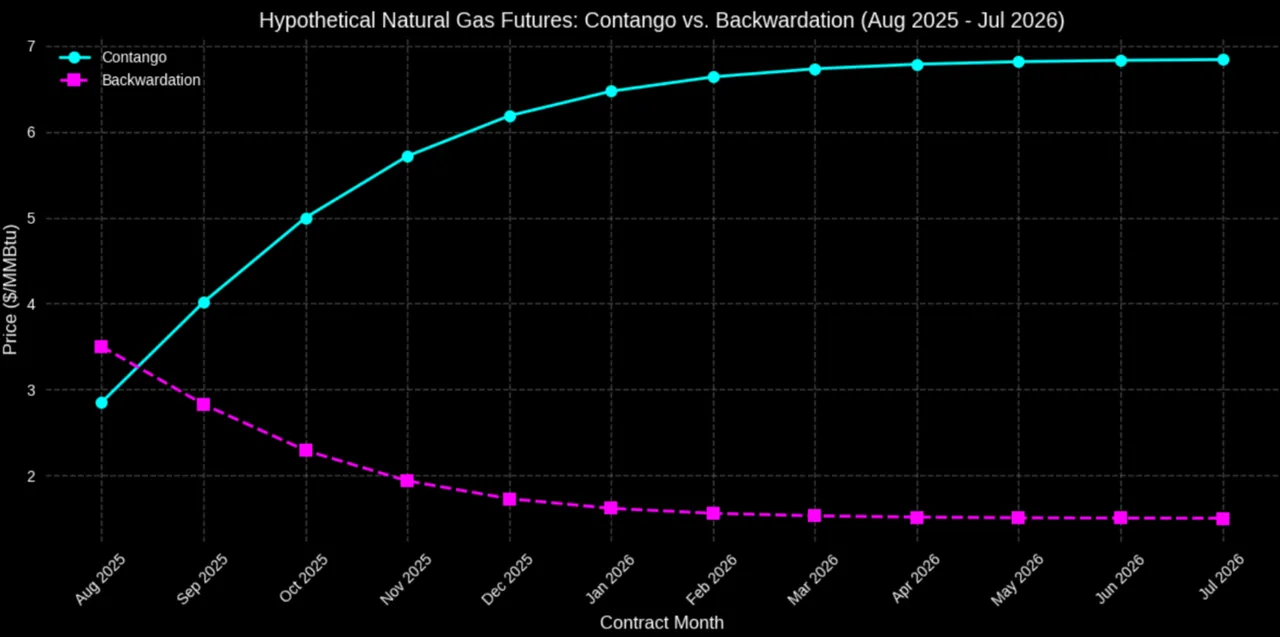

I love terminology. Trust me these terms are not made up by me :) The price variation above is based on geography. However, there is another possibility of price variation and that is due to time. Most widely used commodities are traded as futures.

Commodity futures are standardized contracts traded on exchanges to buy or sell a specific quantity of a commodity, like natural gas, at a predetermined price on a future date. They allow producers, consumers, and investors to hedge against price volatility or speculate on price movements. In the context of natural gas, futures are traded on exchanges like NYMEX (e.g., Henry Hub contracts), with prices reflecting market expectations of future supply and demand.

Nat Gas futures, just like other futures, is a standard contact worth 10,000 MMBTU. So if the price of Nat Gas is $3, a single contact is worth $30,000 US. The contracts expire each month at the end of business or the 3rd Friday of each month.

| Contract Month | Contango Price (USD/MMBtu) | Backwardation Price (USD/MMBtu) |

|---|---|---|

| Aug 2025 | 2.85 | 3.50 |

| Sep 2025 | 3.53 | 3.20 |

| Oct 2025 | 4.13 | 2.95 |

| Nov 2025 | 4.63 | 2.75 |

| Dec 2025 | 5.03 | 2.59 |

| Jan 2026 | 5.34 | 2.47 |

| Feb 2026 | 5.59 | 2.38 |

| Mar 2026 | 5.79 | 2.31 |

| Apr 2026 | 5.94 | 2.26 |

| May 2026 | 6.06 | 2.22 |

| Jun 2026 | 6.16 | 2.19 |

| Jul 2026 | 6.24 | 2.17 |

This is hypothetical prices of Nat Gas futures in two different scenarios. In one case, the future prices of Nat Gas contract rise in value, this is called Contango. In the other case, the prices fall in value in future months, this is called Backwardation. That's about it.

Most commodities requires a storage cost, some are higher than others, so typically most commodities are in contango, that is the normal situation. But if there is an expected surplus is envisioned today, chances are it could be in backwardation.

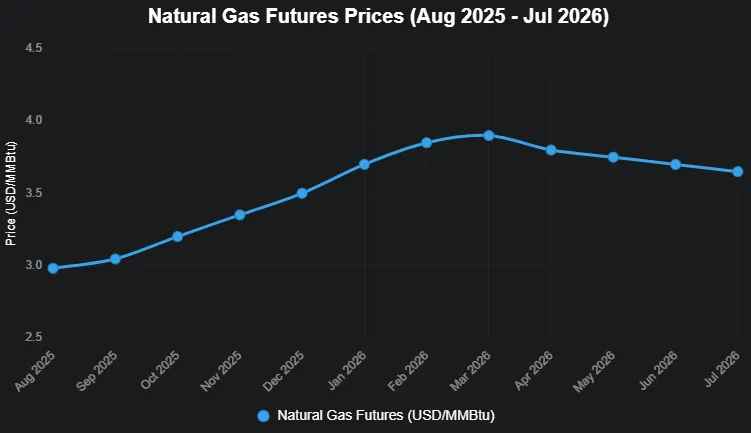

Here is a current real future contract prices for Nat Gas (Henry Hub). It is clearly in contango till March, which is the end of the colder season, after that it is slowly in slight backwardation.

There you have it. Price is never constant, but at a given time, it is always right! :)