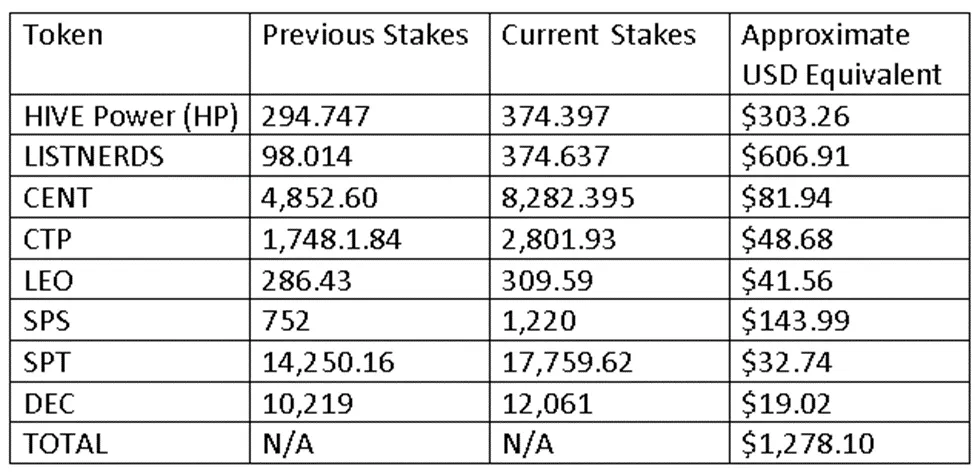

The 2nd of May was the last time I published a report about my crypto holdings. At that time, the price of LISTNERDS was still high and that’s why I came up with an approximate USD equivalent of my account at $1,278.10. After two months as everybody knows, the prices of cryptocurrencies keep falling. The good thing in this digital space is that though the market value of your holdings declines, the quantity of your tokens is increasing. That is if one will take advantage of the widespread negative sentiment as a time to build.

Below is the summary of my holdings two months ago:

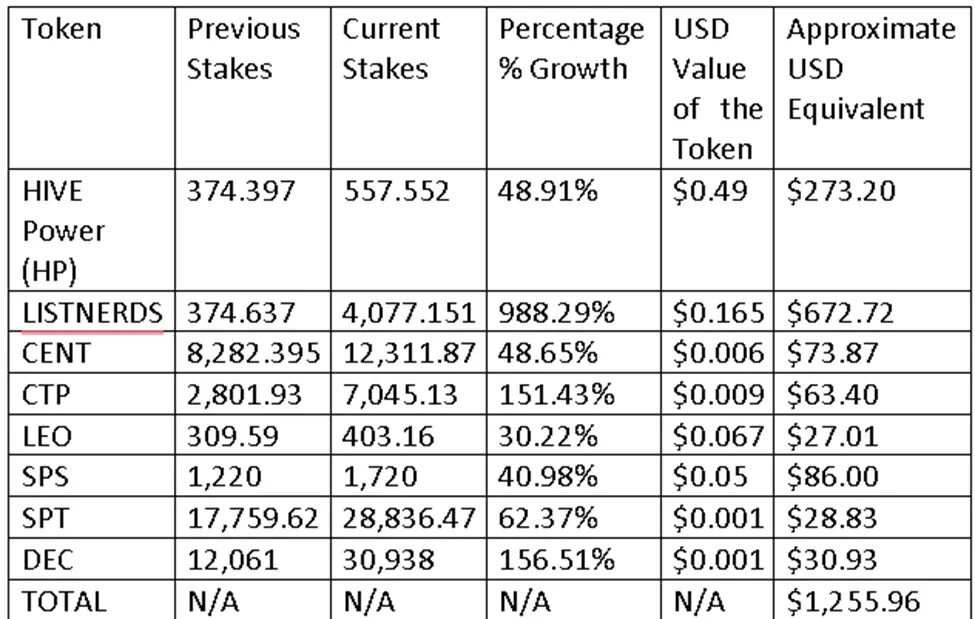

Comparing it to my current status, you can see a big discrepancy between the number of stakes and the USD value of the tokens.

HIVE Power (HP)

My HIVE Power (HP) increased from 374.397 to 557.552. Though the quantity of the token increased by 48.91%, the value dropped by 9.91% from $303.26 to $273.20.

LISTNERDS

Among the above eight tokens, LISTNERDS, CTP, and DEC performed better compared to the remaining five tokens. As for LISTNERDS, my holdings increased 988.29% in two months from 374.637 to 4,077.151. Despite a huge jump in quantity, the percentage increase in its USD value is just 10.84% from $606.91 to $672.72.

CENT

In the case of CENT, I stopped accumulating this token for a month to give way to a comparative analysis of its monthly yield compared to CTP and LEO. However, after a month, I resumed my accumulation to reach 20,000 CENT power.

Despite the one-month rest, still, my CENT power increased 48.65% from 8,282.395 to 12,311.87. However, due to the low price of CENT today, such growth was not reflected in its USD value. Instead, the total value of my CENT power declined 9.84% from $81.94 to $73.87.

CTP

CTP is another excellent performer. My total CTP power increased 151.43% from 2,801.93 to 7,045.13 of which 5,000 of that is staked at listnerds.com and 2,045.13 at ctptalk.com.

LEO

Though I recognize that LeoFinance is the number one platform on Hive when it comes to crypto and financial content, I decided several months ago to prioritize other tokens instead due to a few considerations, and one of them is a capital constraint.

It was exactly the reason why I failed to participate in LEO Power Up Day (LPUD) last 15 June. However, I will try my best this 15 July to join the LPUD.

As you can see, my LEO power is very small. Currently, I just have 403.16. It grew 30.22% in two months from 309.59, but its USD value dropped 35.00% from $41.56 to $27.01.

SPS

For the last two months, I added 500 to my staked SPS and as a result, it grew 40.98% from 1,220 to 1,720. Nonetheless, just like the other four tokens, regardless of its increase in quantity, its market price suffered a 40.27% loss from $143.99 to $86.00.

SPT

In the case of SPT, I stopped accumulating this token. I decided to just let it grow naturally, that is, powering up tokens coming from both content creation and curation rewards.

Even though I am no longer buying this token, my holdings increased 62.37%, but its market value dropped 11.94% from $32.74 to $28.83.

DEC

DEC is another outstanding performer in this down market in terms of size accumulation. It increased 156.51% from 12,061 to 30,938. Its USD value also increased by 62.61% from $19.02 to $30.93.

Conclusion

Despite the persistent downtrend in the prices of cryptocurrencies at the moment, I consider the drop in the total value of my portfolio very minimal. It is just 1.73% from $1,278.10 to $1,255.96 after two months. And the reason for the small decline is that the volume of my tokens has greatly improved. This is the reason why I think comparing cryptocurrency to the stock market is ridiculous. In the stock market, there is nothing to offset my 52.90% loss whereas here on Hive, the loss was counterbalanced by the increase in size.