Where I live we celebrate St Brigid’s day when the giants of Winter and Spring fight it out. Today, economically speaking, Winter (the force of deflation) is battling with Spring (the force of inflation).

Inevitably Spring wins.

Photo pinterest.com

General Winter battles the Green Man

The winter has been much longer than many of us expected. The usual cycle of boom/bust in capitalism is well understood. This, however, is not an ordinary market anymore. It is nearly completely under the control of central forces (who work the for the too big to fail banks) and therefore there’s been no bust.

This delaying, this stick your finger in a dam – is only holding back the forces. The trouble is no-one can tell when it will break.

Winter

We’ve been living this steady erosion. Shrinkflation, no return on savings, essential bills increasing by more than wages/benefits. Chilly indeed. Now as we emerge into the sunlight from this current lockdown we are witnessing increases all round as the impact of the price of the pandemic starts to spread through society.

Currently, there are sections of the population who have accrued extra money under lockdown conditions and are happy to get out even if that means paying more. How much more though? If for example, theatre tickets double as a result that can only have a downward drag on the market.

Fur-coated Winter is over-burdened with debt. Student debt, which according to forbes is as of Feb 20121 about $17 trillion. There are so many baby boomers in the winter of their lives who are asset rich, whilst younger generations are increasingly abandoning any hope of owning their own home. Many of whom have found themselves back living at their parent’s house. These are the features of economic depression.

Spring

Spring, on the other hand, is youthful. It literally has a spring in its step! Expect things to go up, especially prices. At present price increases are coming at us from a number of directions. Commodity price increases like oil have a very broad impact on a society which is largely oil dependent. House prices have been going strong across the board. I can tell you houses are flying round where I live.

Spring provides the job opportunities that were perhaps lost a decade or more ago. Innovations and technological developments many hastened by lockdown has supported a change in people’s working life. I also put Bitcoin and the crypto world in general in the Spring category. It seems to be where a lot of bright young talent is being drawn to.

The Blockchain technology will be Spring-like as it grows seeking answers and solutions to the problems that beset us currently. Bitcoin et al are something new on the block and arguably the expected increase in their price is set to be a reflection of the money printing as large institutions and billionaires swimming in free cash continue to invest in the field.

For now inflation is in the ascendancy. A lot of commentators are saying its temporary. However, the inflation is coming at us from multiple directions – some temporary – some not. It has been some time now since the banks re-branded 2% inflation as a “target”. It looks set to go above that this year but this is where the “it’s only temporary” comes in useful. So don’t expect interest rates to go up soon to head off that inflation.

Let’s be frank. They want the inflation. They’ve been printing money excessively for years now. Finally, measurable inflation. That is measurable by their own rigged measures. John William’s shadow stats has had US inflation running nearer to 6% for years now.

Image- publish0x.com

Debt

Of course, you now have consumers squeezed by higher prices across the board. Low interest rates actually encourages borrowing. Personally, I bought an item lately for which I got the 0% finance and the total cost was cheaper than if I had paid cash!

Ultimately, increased levels of debt are deflationary. The interest you have to pay to service the debt reduces how much money you have left over to buy other things.

However, we know the US Federal Reserve and the other central banks around the world are colluding to keep interest rates at rock bottom. Printing money in an effort to devalue the currency and are actively seeking an inflationary outcome to inflate away the debt.

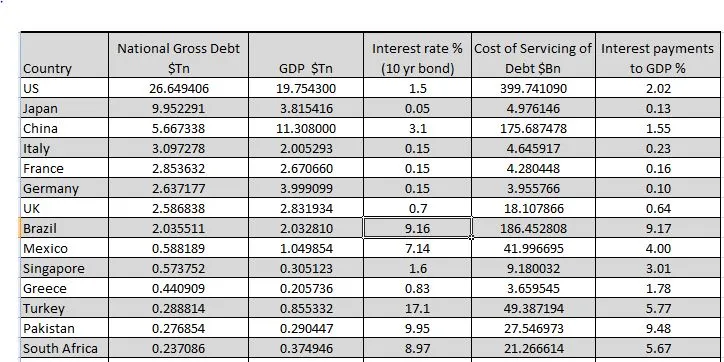

Where are we on that trajectory? Due to the amount of control being exerted by the banks I think there is still a while to go in this game. A key indicator that governments pay attention to is the ratio of interest payments to GDP. The Bank of England has a reference value of 3% would be considered an excessive deficit. A deficit of double that would spell out big trouble for the country.

As you can see in the table above, due to the impossibly low interest rates, the ballooning deficits are of no great concern to governments. The largest debtor nation in the world is Japan, but their interest rate of 0.05% allows them to carry the debt. In the US rising the interest rates to 2.2% would result in a ratio of 3%. If the US debt doubled and interest rates remained the same it would hit nearly 4%.

Well, I’m pleased to say I’m often wrong about things. Looking ahead I see more wintry weather on the horizon with Spring showers of inflation.

Inevitably Spring wins.

Sources – 10 year yields

Debt Clock