Many newcomers to the Cryptocurrency and Blockchain are not aware of network and mining concepts related to the blockchain. One such concept is "Proof of Stake". Many blockchains make use of the proof of stake for verifying and validating the transactions on the ledger.

Previously I have covered - Public & Private Key. You can read if you are interested in it.

So in this post, I am going to explain the concept of Proof of Stake algorithm in a simple ways.

Image Credit: Designed with Canva

What is Proof of Stake?

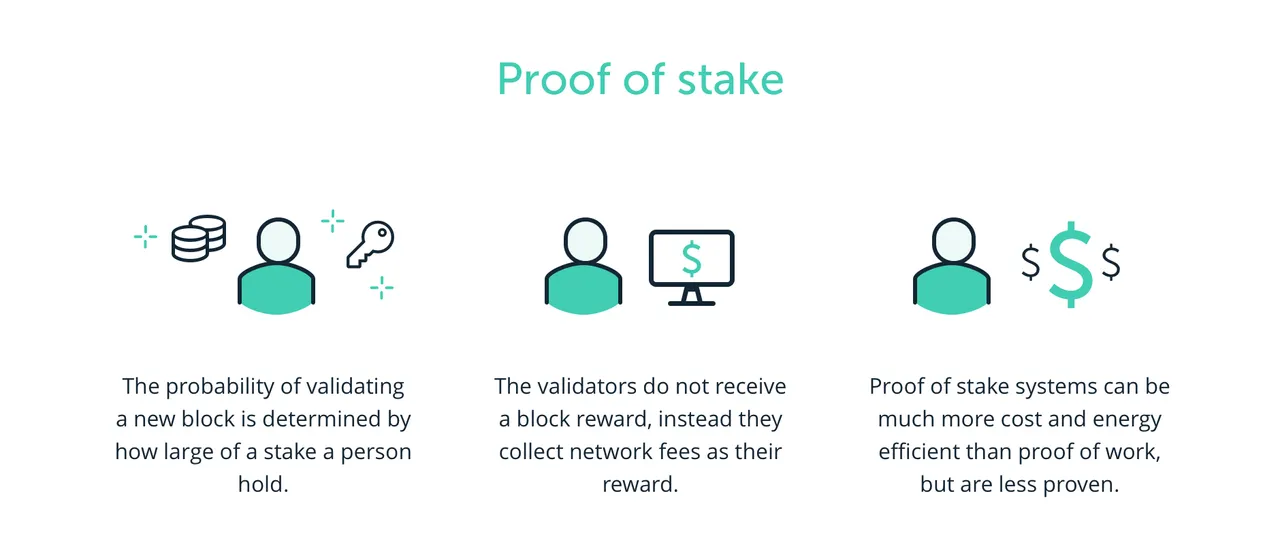

To put it in simple words. In this type of the algorithm the person who wants to verify the transactions, stake his tokens in the process and so he gets the chance to validate the transactions. And like any other miner, here the staked person earns the reward. Only difference here is that instead of mining the coins are forged based on the staking.

In short, the person with the coins stakes into the network to participate into the validation of the tokens in the network.

Image Credit: Ledger

Now let's take a look at what are some of the cryptocurrencies and blockchain that make use of this consensus algorithm.

Which Cryptocurrencies make use of the Proof of Stake?

Peercoin is one of the popular cryptocurrency that makes use of the proof of stake. And they are popular among the staked holders for doing so. Apart from that there are some new cryptocurrencies that you can check out who participate into the stake reward based system. e.g. TRX, CMPND, KAVA are few of them who are making use of the Proof of Stake.

Why Use Proof of Stake?

There are many reasons why many blockchains and the DeFi smart chains make use of the POS. Few of the reasons are outlined below.

- Energy Efficient - You don't have to mine forever to validate transactions.

- Cost Effective - POS is lot more cost effective than Proof of Work (bitcoin) like validation.

- DeFi - Such algorithm is more useful for the decentralized use cases.

- Secure: Such algorithm is more secure as it focuses on the staked rewards and validation security from 51% attack safety.

And this makes proof of stake pretty much useful in many scenarios including DeFi where the people can put their assets into the stake and get rewarded in the network.

Proof of stake too has it's issues like lack of staking and limited staked numbers as that could slow down the validation process. However various supportive algorithm, oracles and the 3rd party smart contracts can take care of it's shortcoming.

I hope that any newcomer who had doubts about the proof of stake can now easily understand how it works in the background.