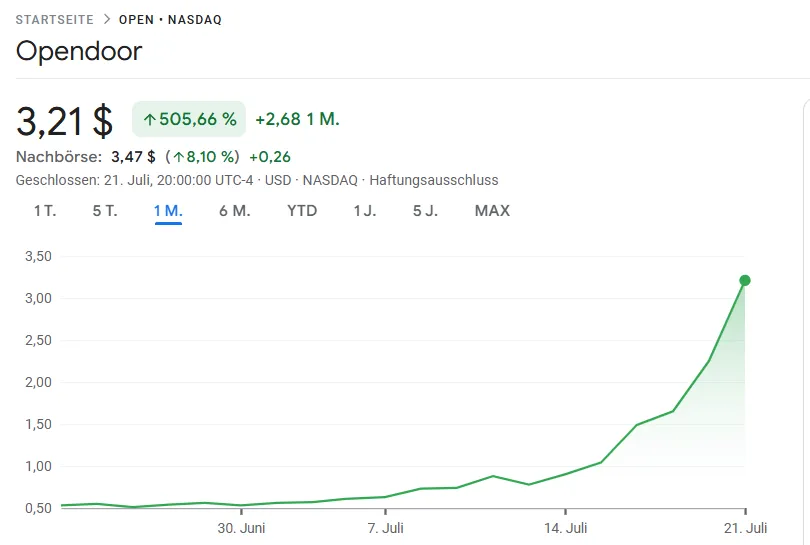

I looked into my portfolio the other day and was surprised that a stock that I had left for dead in there was up. Quite a bit. 600% in the last 30 days. Which is great, as I wasn't down 80% anymore, but up 60% - more or less. My brokerage account calculates weirdly, so I'm not sure what my actual buy-in was. I think it was 3,30€, my notes say 2,25€, and the brokerage says 1,62€. Doesn't really matter.

Anyway, the stock is Opendoor. Apparently there's quite the hype going on, with Retail-Investors creating an anti-short bubble. Additionally, the fund manager that called the Carvana-Recovery said that OPEN is going to 80$/share (it was 50ct a month ago).

After setting my stop-loss to 2,25€, I went and had a look at their latest earnings statement. As I have very little money in this one and held it more as a reminder to investigate before buying, I didn't follow it anymore.

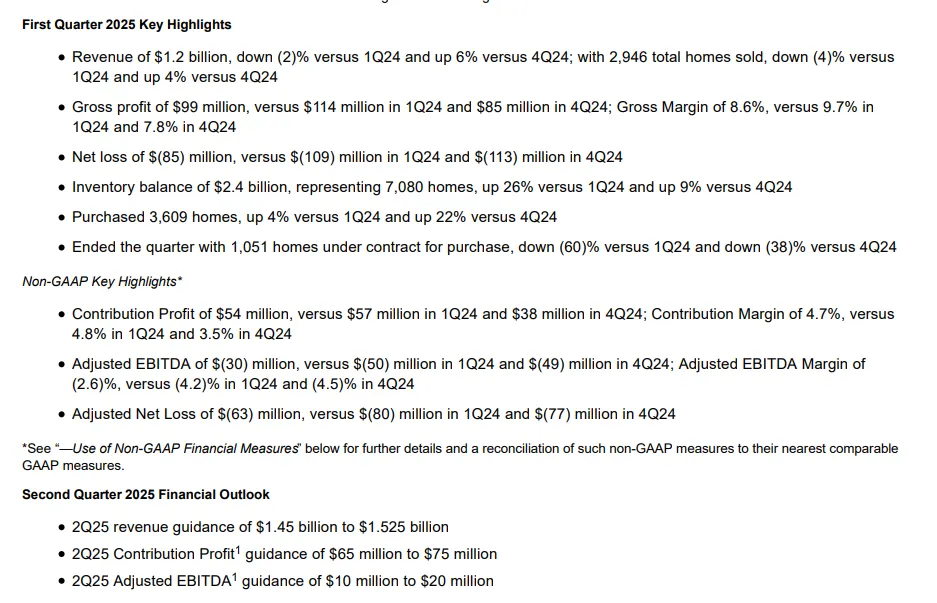

Revenue is still going down. Bummer, after doing that since 2021. BUT it's "only" -4% YoY and 4% up QoQ! Wow! Is there a turnaround? Not really, in the last 4 years, Q4 was always the weakest in the year, so a QoQ is not a good indicator.

Net loss is going down - that is indeed great and highly necessary, as they have quite a bit of debt and the dilution of 1,2% per quarter in average can only get you so far. They have around 560 Mio. $ in Cash, and with an operational cashflow of negative 279 Mio. and GAAP net income of negative 85 Mio., that is not enough - they're probably diluting the hell out of the shareholders as I write this, though it's after hours.

But what if they turn profitable?

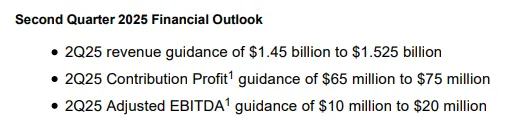

Let's look closer at the guidance:

As you can see above, there's a difference between GAAP and Adj. Net Loss of 22 Mio. $ in Q1/2025. Which is quite a bit, around 25% polishing.

If the Revenue comes in like they think, it's still either flat or a little below the Q2/2024. Nothing to write home about.

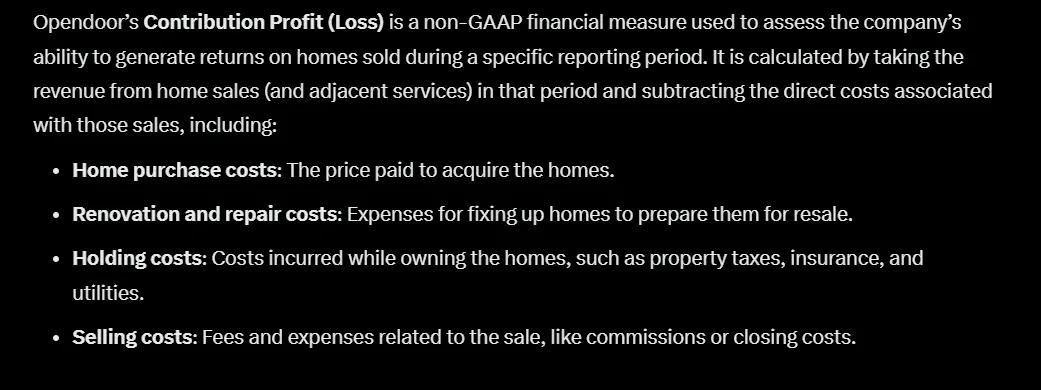

Now, contribution profit - what an interesting thing. It's basically what's left when only considering the buying and selling of the house, with the maintenance cost in between. No company cost. Grok gave me this:

So, it's a great little metric to track that part of the business - but it excludes a big chunk of the cost, as we can see when comparing the Contribution Profit to the GAAP Net Loss.

I personally care more about cash flow - and I don't see them anywhere near profitability on that metric, yet.

I don't see the $80

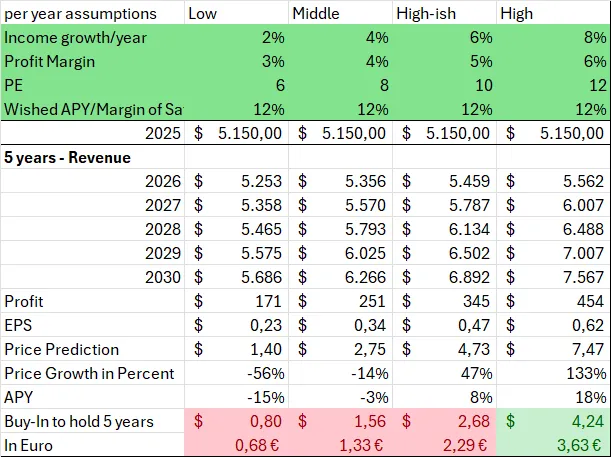

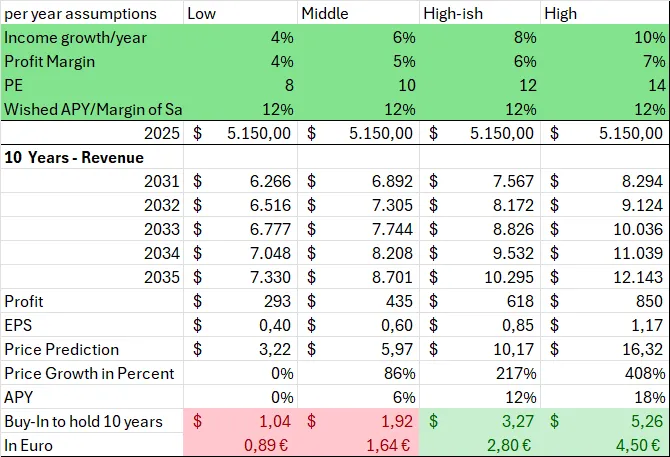

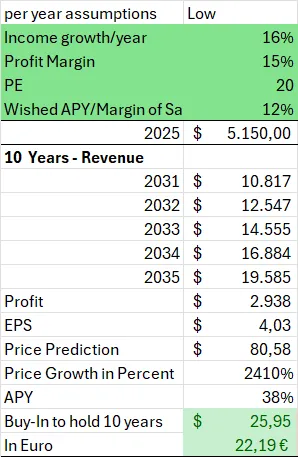

I ran some calculations. Yes, I love my excel for that. I really don't see $80, nor anything near it, for the next years.

5 year Calculation with assumptions that I see as reasonable, if the company does not go bankrupt, which I still see as very possible, even after diluting a lot at the current share prices.

10 year calculation - I put in a little higher numbers here, though I don't expect them.

10% Revenue Growth is possible, especially if mortgage rates go lower again and some buying pressure comes into the real estate market. But a profit margin of 7% still seems high.

Just for fun, here's one of many possible calculations that lead to a share price of $80 - in the next 10 years.

Conclusion

I don't bet against the current sentiment - that stock might keep flying. I'll keep upping my Stop-Loss orders and see how much I can squeeze out of this one. But I don't see a rational projection to make holding this stock any longer worth the risk.

I still learned my lesson, even if I got incredibly lucky on this one.

As always - this is not financial advice of any kind. You can make your own decision as a free thinker! If you find flaws and mistakes, please let me know, I still have much to learn and would love to do so.