I had used Excel for years and years to track my finances. Simple tracking - income, expenses, the delta between the two, and more recently, some calculations to let me know how long savings will last me should there be no new income coming through.

Having recently become unemployed, this is much more important than what it once was. I need to know things, so that I can do things.

I know there's forty-ka-trillion different budgeting applications, websites, apps, and spreadsheets out there, but I wanted to make one that was for me, by me. Maybe someone else can find it useful.

It is live on github, and it stores absolutely no data on anyone's machine except your own. I published this on Github quite some time ago, and I've all but abandoned my spreadsheet, and load / save a simple json file to track any changes in my position.

Here's how it works:

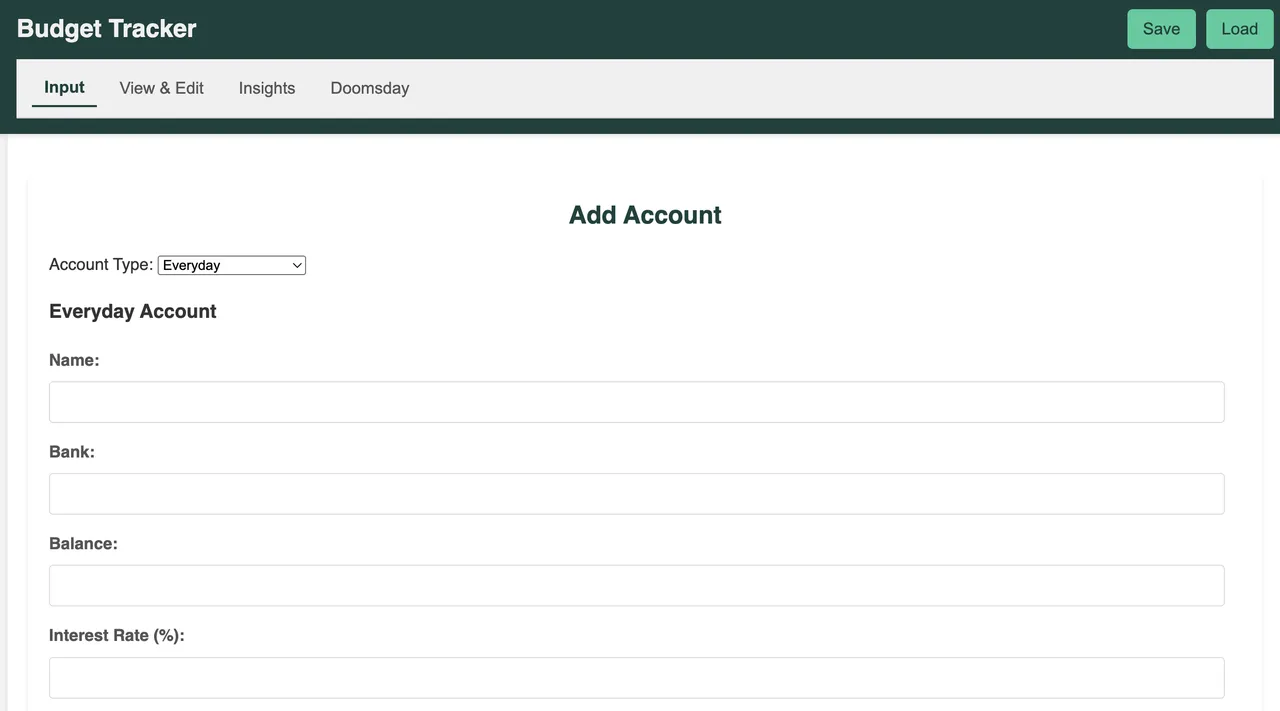

Page 1: Input

Accounts

On the first page, you add all of your account information. I've got a few slots available - Everyday Accounts, Saving Accounts, Credit Cards, and Mortgage Accounts.

You input the current balance, hit add, then for any credit card account you put in the available balance, and the limit of the card. This is so the page can do some fancy calculations later on.

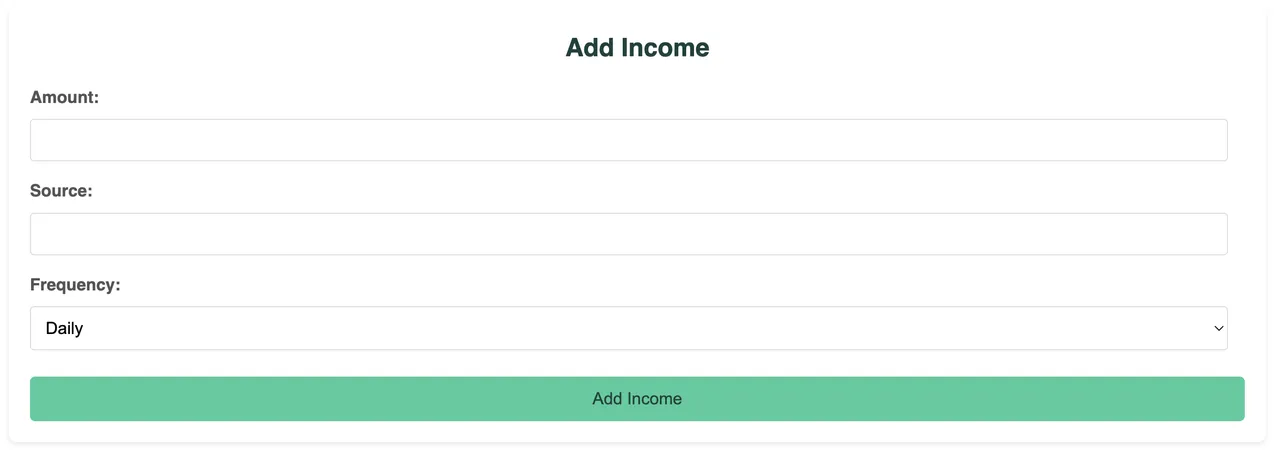

Income

Hopefully you make some income. This is where you add your income. You can add multiple income streams, if you're budgeting as a couple, you can add in the other income streams of your partner if you are the type to combine finances.

You can even change the frequency of the income, as well. It doesn't really have support for non regular types of income, but that money should be in your accounts anyway. Just make sure you put in the money post-tax, as in what you will get into your account when you get paid, as I'm not going to make a look up table for every countries tax, an indicator that I couldn't even be bothered doing it for my own country!

Expenses

This is the hardest part about money. You should probably put every possible expense you can think of in here. I think the most obscure expense was either cat food, or the renewal fee for my driver's licence.

Sit down and work out what your expenses are as accurately as possible, because this will determine how useful the rest of the app is.

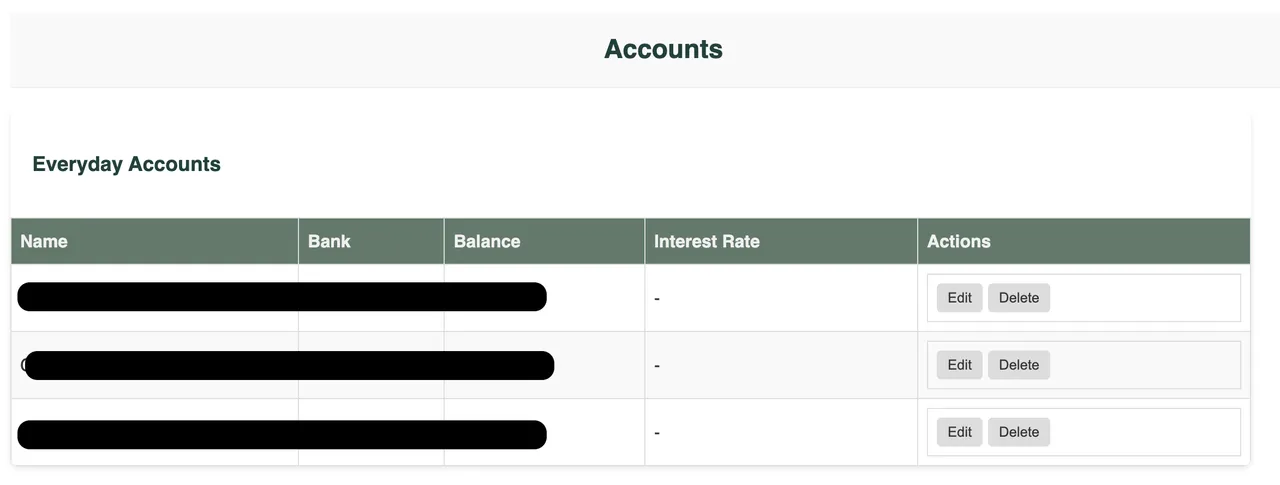

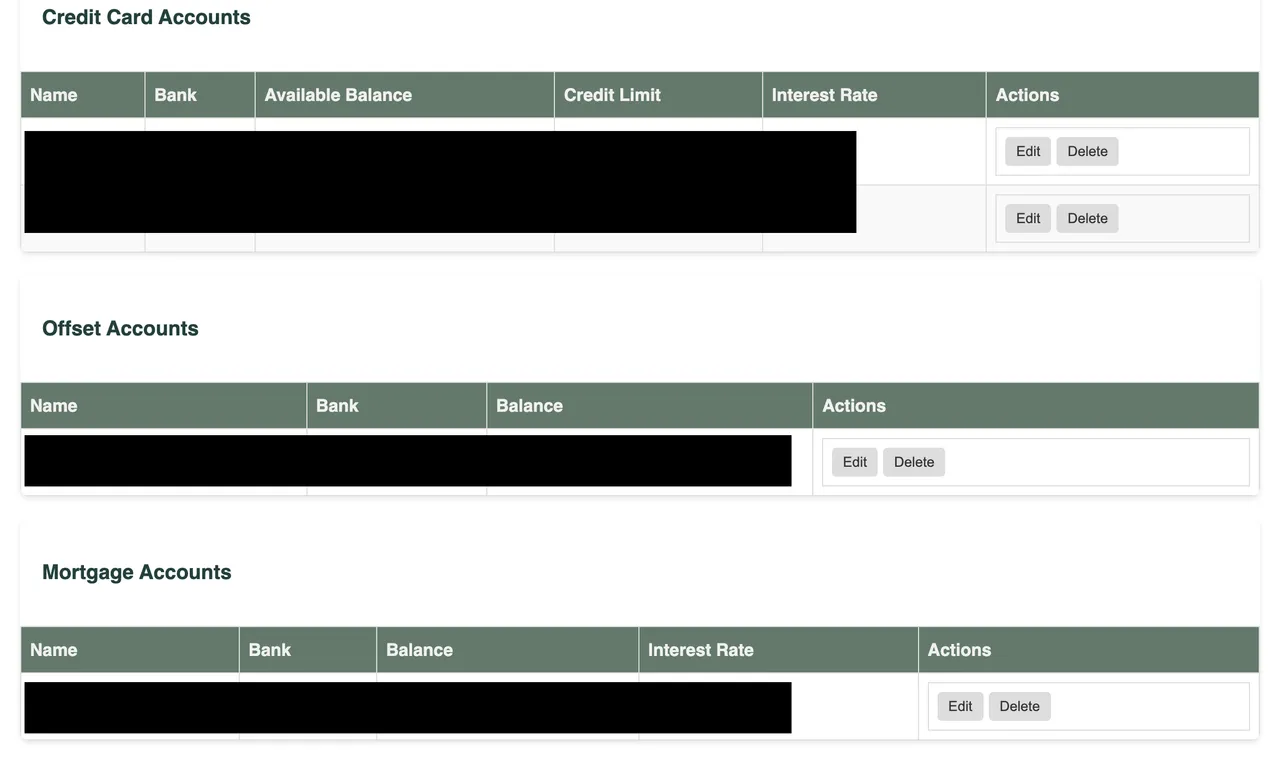

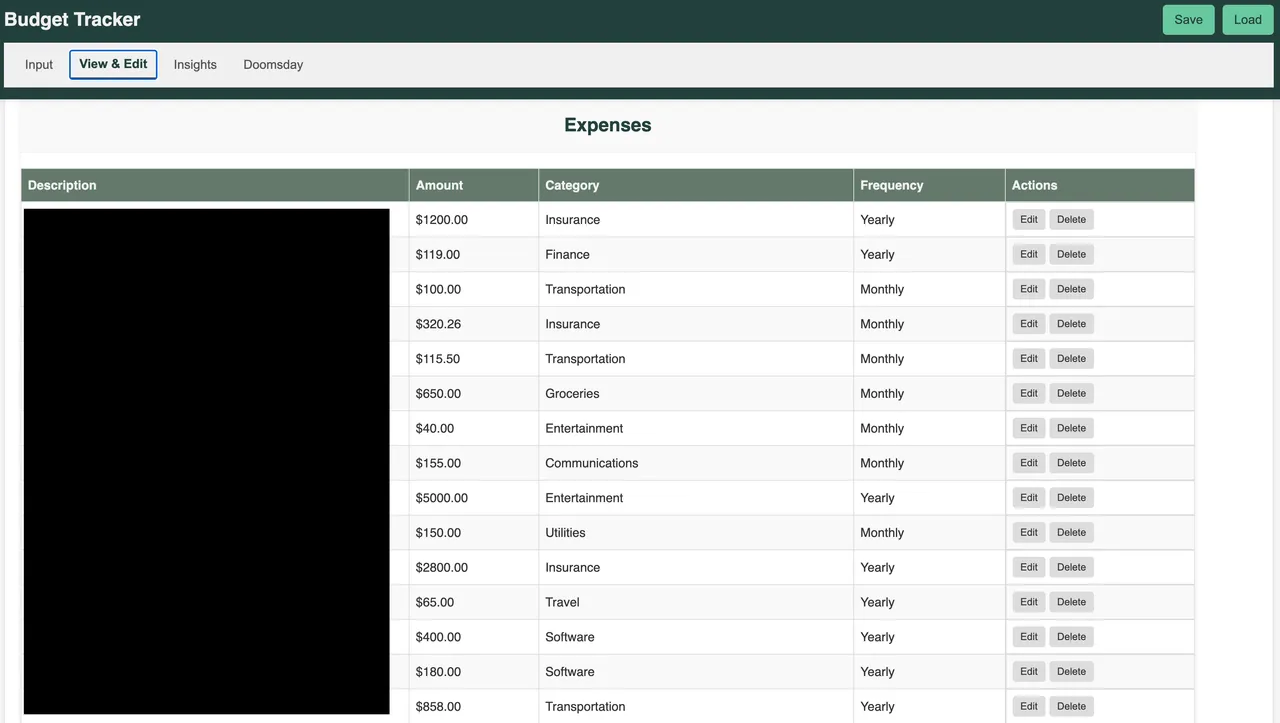

Page 2: View And Edit

This is where you will spend most of your time once you've put in all your details. As you move money around from account to account, as your expenses are eliminated, or begun a new, you'll modify them. You'll also edit any bank account balances after you spend money.

I tend to update this stuff every couple of days, or after I've had a big expense, or income come in. As none of this connects to any of your accounts, or any banking APIs, or any of that (because I don't want your data!)

Redacting my personal financial position

So with all of your accounts and balances visible (that you put in) - you can scroll a little bit further and see your expenses, as well.

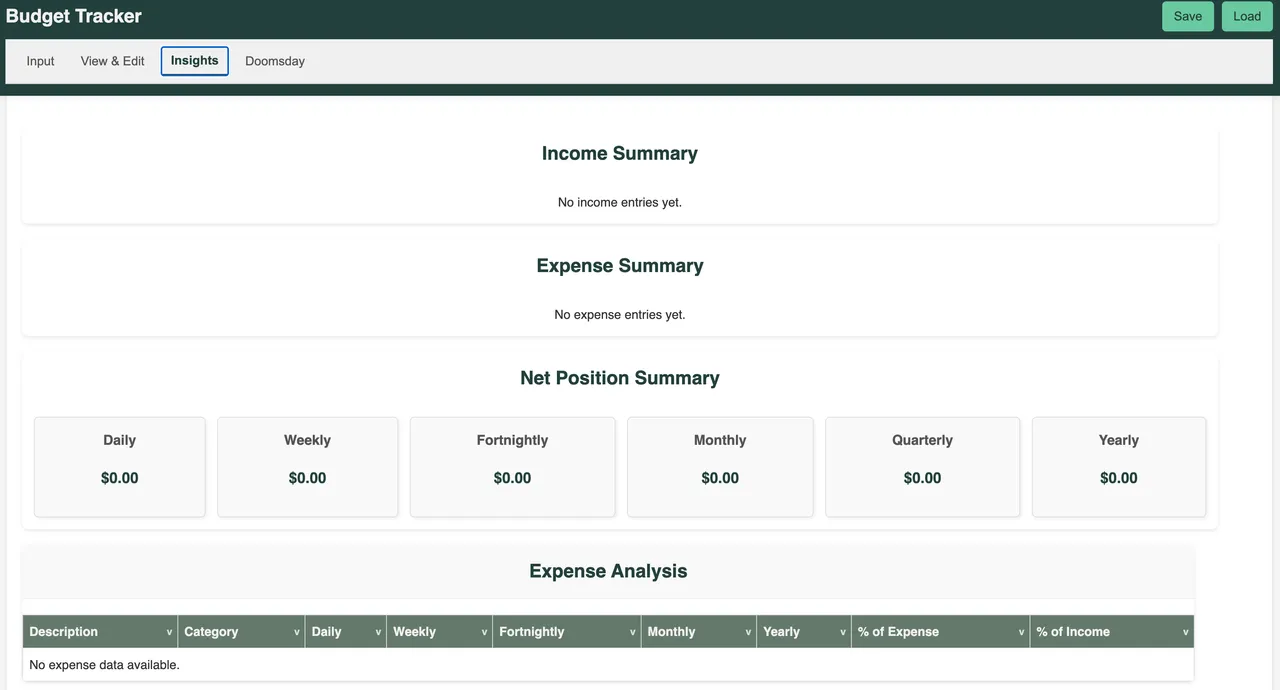

Page 3: Insights

This is where the fun begins. Once you have your data in, you can see your total income and total spend broken down into daily, weekly, monthly, quarterly and yearly numbers. it will average it out over the year.

It will also tell you your delta, or how much "leeway" you have in your budget for savings, or spendings, or whatever you want to do with your money, I don't care (unless you want to give me some of your money, in which case, send me HIVE!)

The expense analysis will also break down every entry you put into your expenses into the different frequencies. It will also tell you for each row, how much of your total expenses that item is (as a percentage of it) - and how much of a percentage that expense is of your income, too.

Then, there's my favourite tab, the...

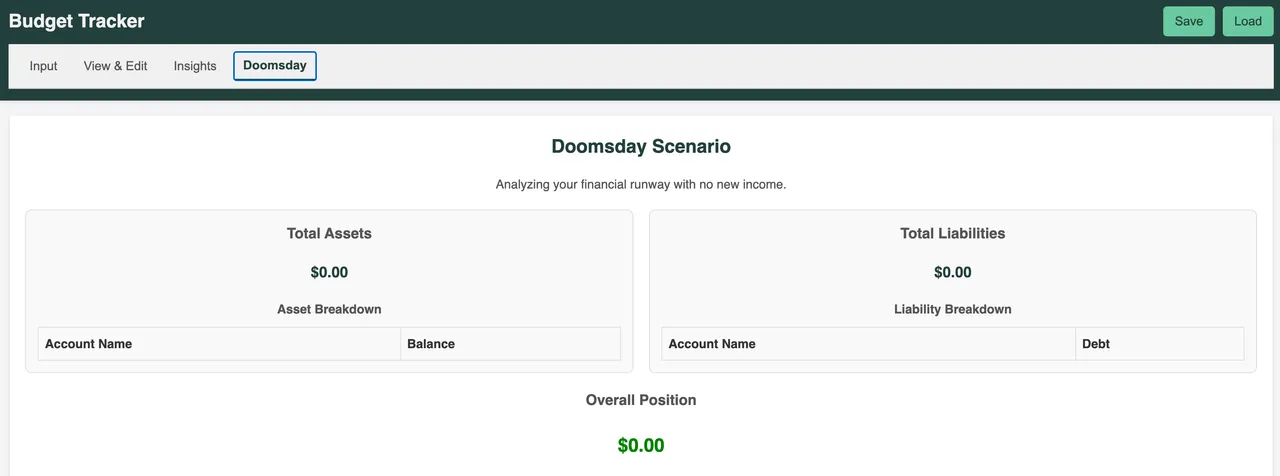

Page 4: Doomsday

The doomsday tab will aggregate your inputs, and present you with two tables. One table will show your assets, the other will show your liabilities.

Then, it will tell you if you're positive, or negative.

This is where you get the tissues out, or pop the champagne.

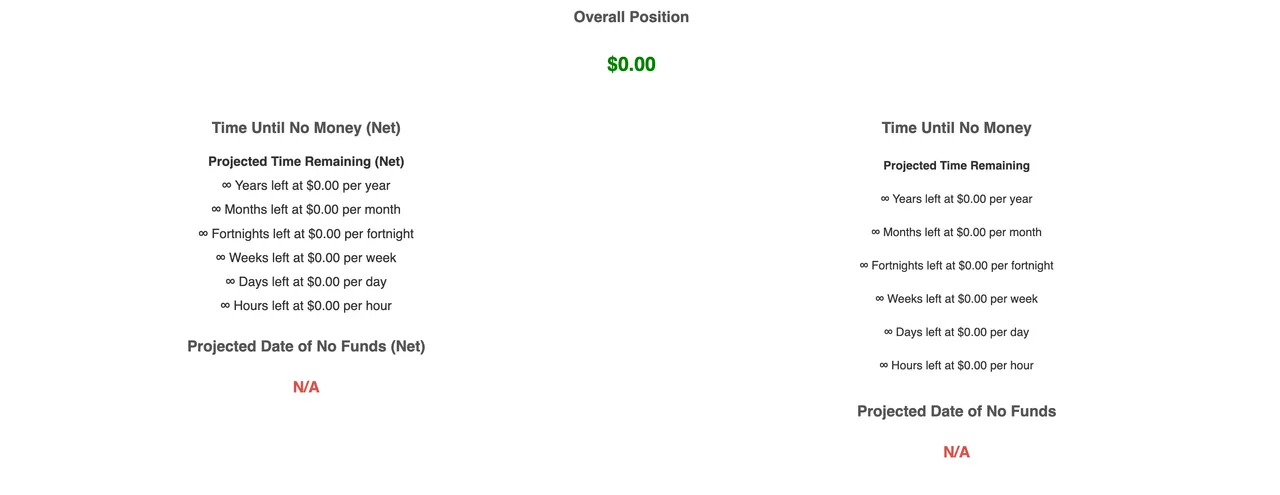

Because it will also show you something else that no other budget tracker (that I've seen!) will do. It will tell you how long you have left to live, financially, or if you want to look at it in another light, how long you can say "Nah, I don't wanna make money anymore"

Based on your overall position (savings subtracted by debts) - it will tell you how long you have left, for each interval.

The one on the right, if you have a fully offset mortgage, will also tell you how long you'll last if you elect to dip into those funds, ie, not increasing your debt position.

I haven't tested this tracker with scenarios where the debt is greater than the assets. I recognise I'm in a privileged position at the moment, but I also know that without new work, I will run out of money (based on the time of writing) on August 5th!

Now that doesn't mean I'll have NO money left, it just means that I will need to redraw from my mortgage, which I would rather not do. So instead, I'm making many life-style compromises at the moment thanks to this tool, to keep me living as far below my means as possible.

WANT TO USE IT?

LINK TO BUDGET TRACKER

Some warnings:

Save your JSON file. (use those buttons in the top right hand corner) Make sure its saved before you close the tab or refresh the page. Nothing is stored. Nothing is tracked. Things are only saved when you save them, and only to your device. I don't want your data. I can't recover your data. I can't get your time back if you forget to save or forget where you saved the file.

I made this for me. It might not work for everyone. I'm not here to tell you how to manage your money, only to remind you that "You are what you measure" - if you don't measure something, you don't know how it is going.

I used a combination of my own Python skills (to write the logic) then used a myriad of LLMs to make it work in a browser without a server-side dependency, cookies, or any "Internet" nasties, because I don't want your data.

It hasn't had widespread testing. It might work for you, it might not. It's functioned for me fine on Brave, Firefox and Chrome, and has interface issues on mobile, because it could probably be more reactive. I cbf doing that, as I use it primarily on my laptop, but feel free to fork the github repo.

The code is pretty spaghetti, but it works.