With many blockchains in the crypto space, the need to easily swap or exchange assets across any of them arose. Hence, cross-chain bridges and protocols that are being built and developed to facilitate such transactions.

This is where MAYA Protocol comes in, allowing multi-chain swaps without requiring any central authority.

The Protocol

Maya Protocol is a decentralized liquidity protocol that facilitates fast, cheap and efficient exchange of cryptocurrencies across different chains without needing intermediaries, token wrapping or custodial bridging. In simple terms, it makes direct swapping BTC to ETH faster, easier without going through any other processes.

It was founded in 2021 and been on development for two years until it finally launched on its mainnet on the 7th of March 2023. It is a fork of THORChain (the very first permissionless, completely decentralized exchange to allow cross-chain swaps of native assets), hence, MAYA protocol runs on the same technologies that THORChain uses (ie: Cosmos SDK, AMM and Tendermint).

It is a Cosmos SDK-powered replicated state machine that coordinates asset movement, the process of transactions, stakes, and more, without the need for an oracle. Here you can exchange cryptocurrencies (from BTC to ETH, for example) instantly, cheaply, and without trusting a central authority. It is also open source, so it is in the hands of the community and protected by code.¹

Whilst it is thought to be a backup system for THORChain, it aims to do more and better, surpass its capabilities by "increasing the implied capital efficiency, by having more uses for its native currency, CACAO and by using the high security of Maya’s node infrastructure for other valuable functionalities."²

And while it continues to innovate, adding more functionalities to its own ecosystem, it is also making sure that it remains compatible to THORChain so it will benefit from the protocol's future upgrades.

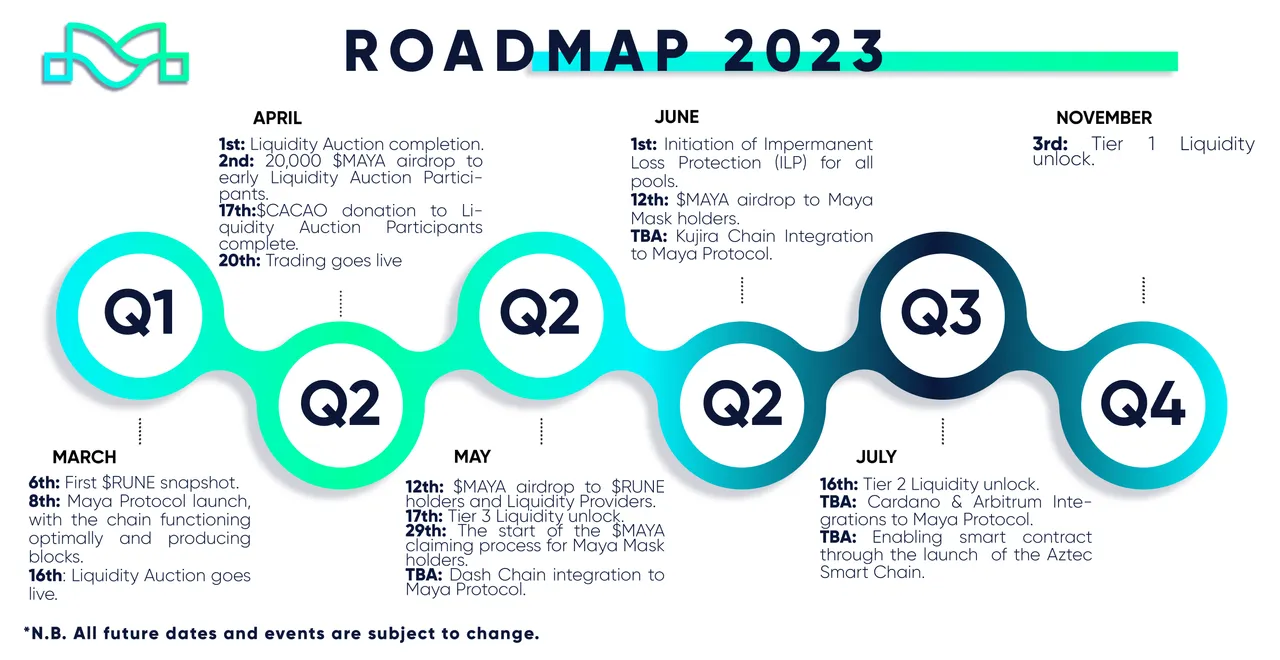

For an overview of how the protocol has been doing since its launching, here's how the preview from the roadmap for the year.

Components of MAYA Protocol

The protocol is comprised of MAYAChain and AZTECChain which give MAYA the "capability and advantage of both centralized and decentralized exchanges without inheriting the associated drawbacks."³

MAYAChain

This is an Automated Market Maker (AMM) similar to Uniswap but utilizes cross-chain liquidity. It allows easy and fast exchange of native assets in their respective blockchains. The chain enhances the security of the network, increases liquidity (TVL) and boosts volume.⁴

Here, users can do the following:

- Swap, buy or sell native cryptocurrencies without intermediaries.

- Provide liquidity and earn associated yields.

- Run a node or become a validator and be rewarded with incentives.

AZTEC Chain

This is a fork of Cosmos Hub. Development is still underway. It will provide the MAYA ecosystem with a smart contract chain that will enable the execution of programmable contracts within the protocol.

Accordingly, there will be algorithmic stablecoins, derivatives (Synths), order book trading similar to that of the Centralized Exchanges (CEX) among others.

The Tokens on the MAYA Ecosystem

💠CACAO

The protocol's primary or native token that powers the MAYA ecosystem. It incentivize node operators which in turn adds to the security of the network since a bond of CACAO is required to run MAYANodes.

In addition, it is used to create liquidity pools and used as incentives to liquidity providers. Each LP is paired with it (i.e: BTC:CACAO, ETH:CACAO etc). This token is utilized to pay for all transaction fees on both the Maya and Aztec Chains. Max supply is 100 million.

💠MAYA Token

This is a revenue share token. 10% of all swap and transaction fees on MAYAChain are distributed daily in the form of CACAO reward to holders of this token.⁵

The tokenomics are designed so as to "continuously incentivized holders of MAYA token so they will keep building the project. The incentive distribution ensures that the interest of all the participants on the ecosystem are economically aligned. Example: For every $9 that liquidity providers and node operators make, the holders of MAYA make $1. MAYA tokens will initially be held by participants of all levels, such as private investors, the development team, the project’s advisors, and the founders."⁶

💠AZTEC Token (Still on development)

This is the token of the AZTEC Smart Chain which is still under development. It is also a revenue share token and 10% of all swap and transaction fees on the AZTEC Chain will be paid to AZTEC holders.⁷

Summary (TL;DR)

Maya was forked from THORChain and is the second liquidity protocol for cross-chain swaps of native assets and it is developing to be more than just a backup. It continues to innovate and build new functionalities on its ecosystem to provide more services, better user experience and more earning opportunities.

It's core components are MAYAChain, where anyone can swap or trade native crypto assets to their respective chains without any custodial bridge. And the AZTECChain which is a smart contract chain, still being built and will have derivatives, CEX-like order book trading, derivatives, algorithmic stablecoins etc.

It has already two tradable tokens (CACAO and MAYA) and a third one is coming to the AZTEC Smart Chain. CACAO is the native token that powers up the ecosystem and used as a pairing asset to all of the liquidity pools. MAYA is a revenue share token, holders of which are rewarded with daily CACAO from the 10% of all swap and transaction fees on MAYAChain.

AZTEC token on the other hand, will be the token of AZTECChain, rewards scheme will be similar to that of MAYA tokens.

Info Sources: Maya Website / Documentation / Whitepaper / Medium

Lead image edited on canva. Logo from Maya Protocol. No copyright infringement intended. 19072023/09:30ph