Just do it!

It has been years since I began blabbering about joining a cooperative organization because of the many perks and privileges it provides to the members. Today, I've put my money where my mouth is and finally made this pipe dream into reality.

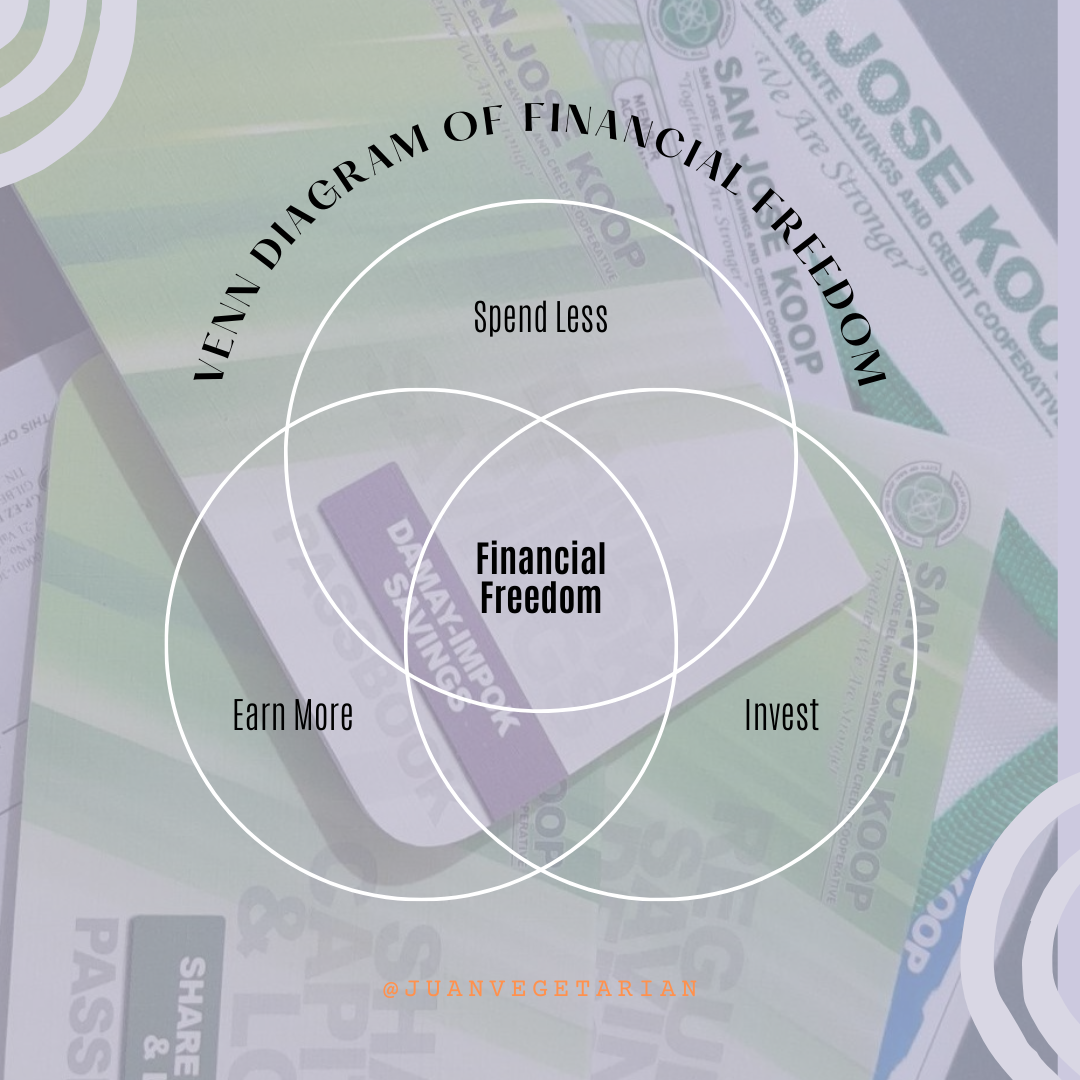

This venn diagram that I found on Canva above encapsulates what joining a cooperative is for me. I will be spending less because the money is "locked-in" in as share capital and it will require me to physically go to the branch and withdraw the money which has to be approved by the board if I want to get it. I can borrow against the share capital if I really need some money but I will have to make extra effort to gain access to liquid cash, thus preventing impulse buys and online shopping budol. The second part of this is to invest. Being a share holder in the cooperative means that I will be investing in it and will be a part-owner of the organization. Net surplus is distributed to cooperative members in the form of dividends so I will be eligible for this already when they distribute. The third part of the venn diagram is to earn more. The savings will earn but more than that, I will have access to opportunities that the cooperative provides via training, access to capital, networking, and other offerings that benefit members.

Perks and Privileges

To be transparent about it, this isn't my first rodeo. I was part of an employees cooperative and another multi-purpose cooperative in the area where we used to live. So I already know about the benefits, duties and responsibilities, and so on. The perks and privileges enjoyed by members far outweigh the disadvantages in my opinion. Aside from the more common financial benefits, such as the access to loans and savings, I was surprised to find out that members get 10% discount on room and 3% discount on diagnostic services in the hospital near our place. We already have an HMO to cover the expenses, but other people who do not have cards to cover hospital bills will really benefit from it. The other thing that surprised me is the partnership with the SM Mall with members enjoying a 10% discount on the first day of the 3-day sale on top of the discounts already associated with the sale event. These are the things that caught my eye while checking out the partners. I will be sure to browse again to hunt for good deals and bargains in the future.

Not Putting All Eggs in One Basket

Of course, this comes from the idea that if you have a basket full of eggs and you drop it, all of your eggs will break and you will have lost all of it. As opposed to having two, or more, baskets where you can carry your eggs thus the danger of losing all of it is lessened. The counter-argument for this is to hold on tightly to the basket so as not to drop it, but that is besides the point. LOL. Using "eggs in a basket" as a simile for one's financial portfolio makes sense. Treating an investment as something delicate that we should take care of because we can easily lose it paints a picture of what may happen if one becomes careless. Thinking about it, risk management is like this. It is all about mitigating risks and creating a scenario where your potential losses are reduced should be at the top of the list, or at least top five, of things an investor, trader, entrepreneur should have. Not putting all of your money in one savings account could be useful in case something happens and the bank closes, which happens quite often. A quick search said that 27 banks closed in the Philippines in the last five years, from 2019 to 2023. Wowzer! This is a surprise and might be a clue telling us not to put all of our hard-earned cash in one bank, right?

How much did I spend to become a Regular Member?

Php 7,730.00 (US$138.14 using the current exchange rate). Broken down into the following:

| Item | PhP |

|---|---|

| Share capital: | 5,000 |

| Damay-impok: | 2,000 |

| Membership fee: | 100 |

| Seminar fee: | 50 |

| Koop ID | 80 |

| Regular Savings | 500 |

Share capital is the equity, which gives the member voting rights and patronage refunds while Damay-impok is a savings account related to giving abuloy to members who died. Different savings account types earn anywhere from 1% to 2.5% APR, but the share capital will give around 10% APY. My strategy moving forward is to grow the share capital and savings and to eventually have a 30:70 ratio, where the bulk of the money is liquid for accessibility in case of business need, emergencies, or just for R&R.

Conclusion

To end, I'm really happy about my decision to join a cooperative. It's another step in the the path to financial freedom so it looks like 2024 will be an accumulation year for me personally; which basically means that I want to grow my personal wealth. I'm also planning to start a business this year so this will be really useful moving forward as the cooperative offers free training on accounting and how to start a business. They do offer free short courses to gain skills for those who don't know what business to start. That's a really good motivation for people to join. Anyways, I've said enough about it already. That's it for now.

Love and peace.

@juanvegetarian

Click here if you'd like to check out the Canva template I used for this post.