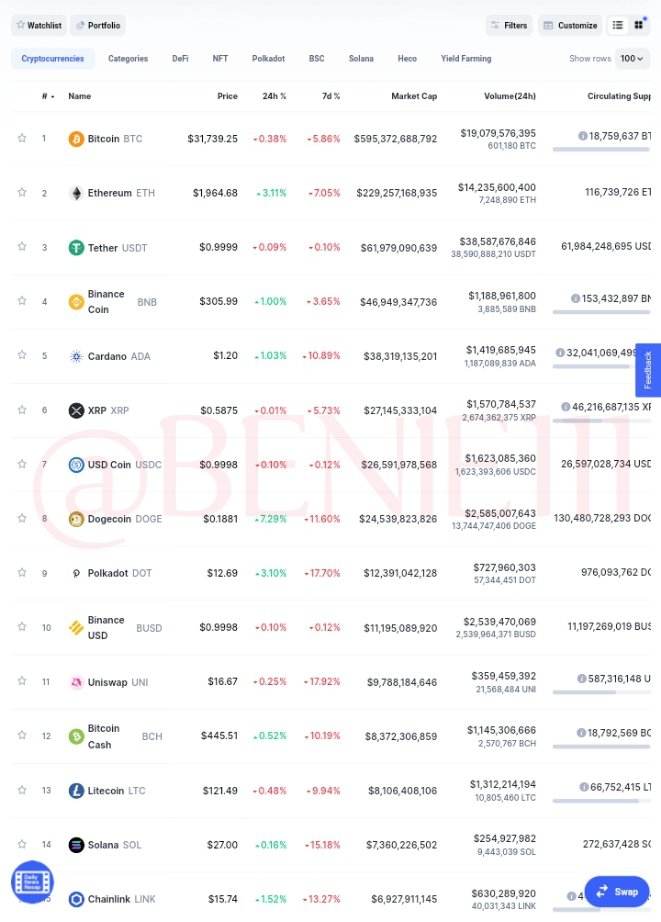

Large Capital:

The assets or companies that fall under this classification are those whose level of market capitalization is more than $10 billion, and also their ranking must be within the top 10 assets before they can be considered to be Large Capital.

Large capital investment carries a very low level of risk; therefore, it is considered the safest, though there is no guarantee of massive profit on investment due to the low level of risk involved. Thus, investing in such assets will possibly generate little profit even after a few years of investment (Maybe 2-3years)

Image screenshot by me from coinmarketcap

Mid Capital

The mode of investment with mid capital tends to be more profitable than that of Large capital because it carries a higher level of risk than that of Large Capital investments due to the level of their market capitalization, which falls between $1 to $10billion and there is the possibility of better future for it if there is an increase in capitalization.

The assets or companies that fall under this classification are those whose ranking level of asset is within 10 to 50.

Prices of exchange platforms influence the level of volatility in mid-capital investment and carry a higher level of risk because of crypto's unpredictable nature.

Small Capital

The mode of investment with small capital tends to be more profitable than that of Large capital and mid capital if everything goes well. Why?

The assets or companies that fall under this classification are those whose ranking level of asset is below 50, and also their market capitalization falls below $1 billion as well.

These features of Small capital make it more riskier than every other classification of assets. It is possible for small capital asset projects to fail due to any unbearable circumstances.

This is @benie111

I would like to hear from you. Do you have contribution or comment? Do well to drop them in the comment section.